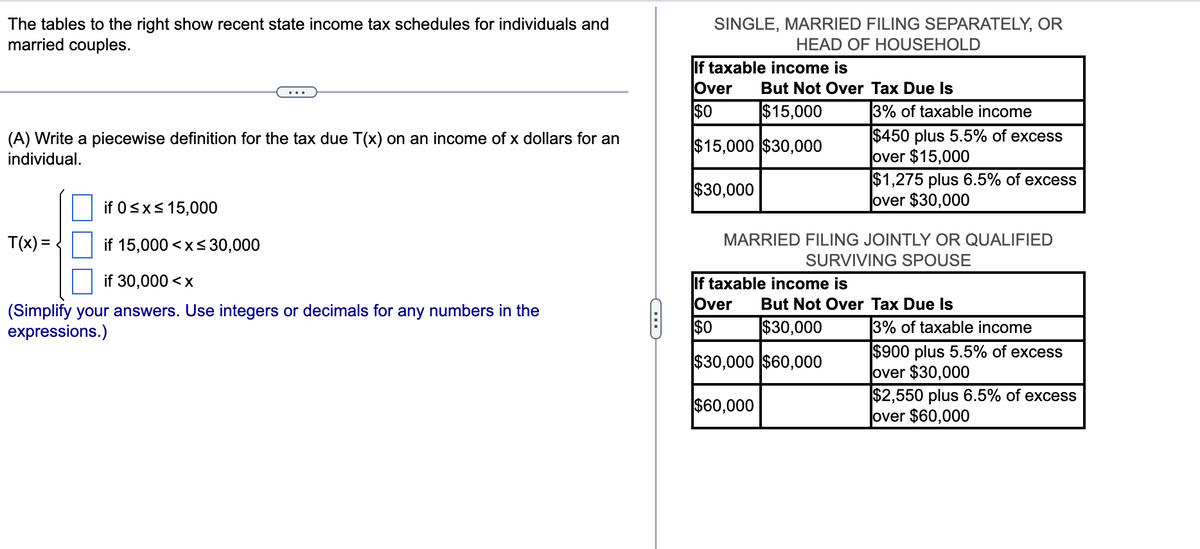

The tables to the right show recent state income tax schedules for individuals and married couples. SINGLE, MARRIED FILING SEPARATELY, OR HEAD OF HOUSEHOLD If taxable income is Over $0 But Not Over Tax Due Is $15,000 3% of taxable income $450 plus 5.5% of excess over $15,000 $1,275 plus 6.5% of excess over $30,000 (A) Write a piecewise definition for the tax due T(x) on an income of x dollars for an individual. $15,000 $30,000 $30,000 if 0sxs 15,000 T(x) = { if 15,000 < xs 30,000 MARRIED FILING JOINTLY OR QUALIFIED SURVIVING SPOUSE if 30,000

The tables to the right show recent state income tax schedules for individuals and married couples. SINGLE, MARRIED FILING SEPARATELY, OR HEAD OF HOUSEHOLD If taxable income is Over $0 But Not Over Tax Due Is $15,000 3% of taxable income $450 plus 5.5% of excess over $15,000 $1,275 plus 6.5% of excess over $30,000 (A) Write a piecewise definition for the tax due T(x) on an income of x dollars for an individual. $15,000 $30,000 $30,000 if 0sxs 15,000 T(x) = { if 15,000 < xs 30,000 MARRIED FILING JOINTLY OR QUALIFIED SURVIVING SPOUSE if 30,000

Algebra for College Students

10th Edition

ISBN:9781285195780

Author:Jerome E. Kaufmann, Karen L. Schwitters

Publisher:Jerome E. Kaufmann, Karen L. Schwitters

Chapter9: Polynomial And Rational Functions

Section9.4: Graphing Polynomial Functions

Problem 44PS: A company determines that its weekly profit from manufacturing and selling x units of a certain item...

Related questions

Question

25

Transcribed Image Text:The tables to the right show recent state income tax schedules for individuals and

married couples.

SINGLE, MARRIED FILING SEPARATELY, OR

HEAD OF HOUSEHOLD

If taxable income is

Over

$0

But Not Over Tax Due Is

$15,000

3% of taxable income

$450 plus 5.5% of excess

over $15,000

$1,275 plus 6.5% of excess

over $30,000

(A) Write a piecewise definition for the tax due T(x) on an income of x dollars for an

individual.

$15,000 $30,000

$30,000

if 0sxs 15,000

T(x) =

if 15,000 <x< 30,000

MARRIED FILING JOINTLY OR QUALIFIED

SURVIVING SPOUSE

if 30,000 <x

If taxable income is

Over

$0

But Not Over Tax Due Is

(Simplify your answers. Use integers or decimals for any numbers in the

expressions.)

$30,000

3% of taxable income

$900 plus 5.5% of excess

over $30,000

$2,550 plus 6.5% of excess

over $60,000

$30,000 $60,000

$60,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Algebra for College Students

Algebra

ISBN:

9781285195780

Author:

Jerome E. Kaufmann, Karen L. Schwitters

Publisher:

Cengage Learning

Algebra & Trigonometry with Analytic Geometry

Algebra

ISBN:

9781133382119

Author:

Swokowski

Publisher:

Cengage

Algebra for College Students

Algebra

ISBN:

9781285195780

Author:

Jerome E. Kaufmann, Karen L. Schwitters

Publisher:

Cengage Learning

Algebra & Trigonometry with Analytic Geometry

Algebra

ISBN:

9781133382119

Author:

Swokowski

Publisher:

Cengage