The Treasury bill rate is 4%, and the expected return on the market portfolio is 14%. According to the capital asset pricing model: a. What is the risk premium on the market? 6. What is the required return on an investment with a beta of 1.5? (Do not round intermediate calculations. Enter your answer as a percent rounded to 1 decimal place.) c. If an investment with a beta of 0.7 offers an expected return of 9.5%, does it have a positive or negative NPV? d. If the market expects a return of 11.8% from stock X, what is its beta? (Do not round intermediate calculations. Round your answer to 2 decimal places.) a. Market risk premium % b. Return on investment % NPV с. d. Beta

The Treasury bill rate is 4%, and the expected return on the market portfolio is 14%. According to the capital asset pricing model: a. What is the risk premium on the market? 6. What is the required return on an investment with a beta of 1.5? (Do not round intermediate calculations. Enter your answer as a percent rounded to 1 decimal place.) c. If an investment with a beta of 0.7 offers an expected return of 9.5%, does it have a positive or negative NPV? d. If the market expects a return of 11.8% from stock X, what is its beta? (Do not round intermediate calculations. Round your answer to 2 decimal places.) a. Market risk premium % b. Return on investment % NPV с. d. Beta

Chapter8: Analysis Of Risk And Return

Section: Chapter Questions

Problem 13P

Related questions

Question

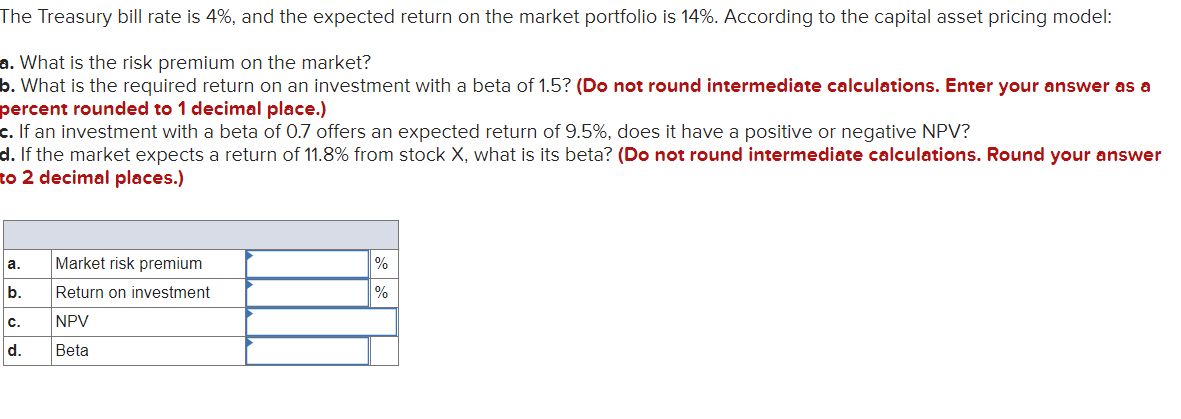

Transcribed Image Text:The Treasury bill rate is 4%, and the expected return on the market portfolio is 14%. According to the capital asset pricing model:

a. What is the risk premium on the market?

b. What is the required return on an investment with a beta of 1.5? (Do not round intermediate calculations. Enter your answer as a

percent rounded to 1 decimal place.)

c. If an investment with a beta of 0.7 offers an expected return of 9.5%, does it have a positive or negative NPV?

d. If the market expects a return of 11.8% from stock X, what is its beta? (Do not round intermediate calculations. Round your answer

to 2 decimal places.)

a.

Market risk premium

%

b.

Return on investment

%

c.

NPV

d.

Beta

Expert Solution

Step 1 Introduction

Dear Student as per Bartleby's answering guideline we can not answer more than three sub-parts. to obtaining the answer of the remaining sub-parts please repost the question with the remaining sub-parts.

As per the capital asset pricing model, the expected or required rate of return is calculated as follows:

The required rate of return = Risk-free rate of return + ( Beta * Market risk premium )

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning