the VLN, expenditures after acquisition are either expensed or capitalized. The company spent money on improving their equipment and needs to capitalize the cost. To capitalize this cost means to Group of answer choices A. add the cost to maintenance expense and put it on the income statement. B. add the cost to the equipment account and put it on the balance sheet. C. add the cost to maintenance expense and put it on the balance sheet. D. add the cost to the equipment account and put it on the income statement.

the VLN, expenditures after acquisition are either expensed or capitalized. The company spent money on improving their equipment and needs to capitalize the cost. To capitalize this cost means to Group of answer choices A. add the cost to maintenance expense and put it on the income statement. B. add the cost to the equipment account and put it on the balance sheet. C. add the cost to maintenance expense and put it on the balance sheet. D. add the cost to the equipment account and put it on the income statement.

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 4MC: Which of the following statements about capitalizing costs is correct? A. Capitalizing costs refers...

Related questions

Question

From page 7-3 of the VLN, expenditures after acquisition are either expensed or capitalized. The company spent money on improving their equipment and needs to capitalize the cost. To capitalize this cost means to

Group of answer choices

A. add the cost to maintenance expense and put it on the income statement.

B. add the cost to the equipment account and put it on the balance sheet .

C. add the cost to maintenance expense and put it on the balance sheet.

D. add the cost to the equipment account and put it on the income statement.

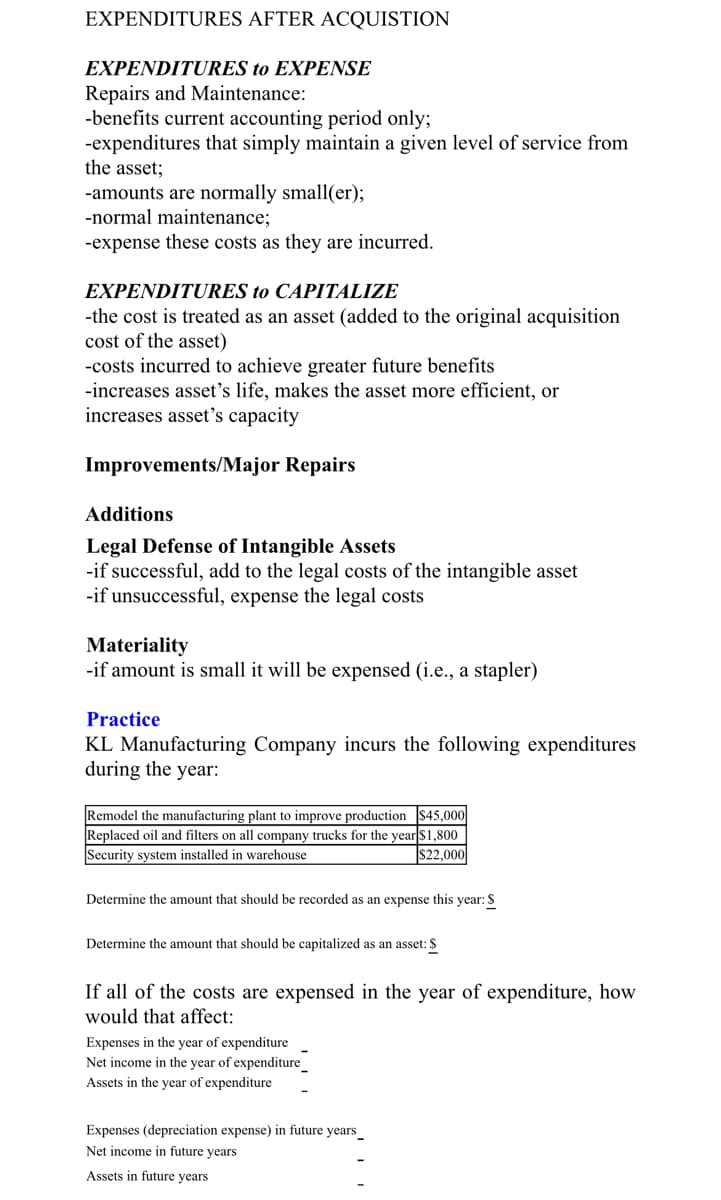

Transcribed Image Text:EXPENDITURES AFTER ACQUISTION

EXPENDITURES to EXPENSE

Repairs and Maintenance:

-benefits current accounting period only;

-expenditures that simply maintain a given level of service from

the asset;

-amounts are normally small(er);

-normal maintenance;

-expense these costs as they are incurred.

EXPENDITURES to CAPITALIZE

-the cost is treated as an asset (added to the original acquisition

cost of the asset)

-costs incurred to achieve greater future benefits

-increases asset's life, makes the asset more efficient, or

increases asset's capacity

Improvements/Major Repairs

Additions

Legal Defense of Intangible Assets

-if successful, add to the legal costs of the intangible asset

-if unsuccessful, expense the legal costs

Materiality

-if amount is small it will be expensed (i.e., a stapler)

Practice

KL Manufacturing Company incurs the following expenditures

during the year:

Remodel the manufacturing plant to improve production $45,000

Replaced oil and filters on all company trucks for the year $1,800

Security system installed in warehouse

$22,000

Determine the amount that should be recorded as an expense this year: $

Determine the amount that should be capitalized as an asset: $

If all of the costs are expensed in the year of expenditure, how

would that affect:

Expenses in the year of expenditure

Net income in the year of expenditure

Assets in the year of expenditure

Expenses (depreciation expense) in future years

Net income in future years

Assets in future years

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College