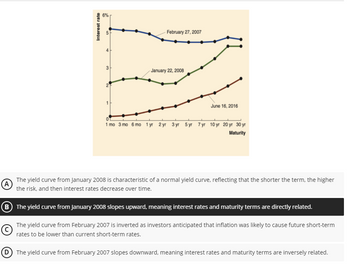

Interest rate 6% сл 3 1 February 27, 2007 January 22, 2008 June 16, 2016 1 mo 3 mo 6 mo 1 yr 2 yr 3 yr 5 yr 7 yr 10 yr 20 yr 30 yr Maturity The yield curve from January 2008 is characteristic of a normal yield curve, reflecting that the shorter the term, the higher (A) the risk, and then interest rates decrease over time. (B) The yield curve from January 2008 slopes upward, meaning interest rates and maturity terms are directly related. The yield curve from February 2007 is inverted as investors anticipated that inflation was likely to cause future short-term rates to be lower than current short-term rates. (D) The yield curve from February 2007 slopes downward, meaning interest rates and maturity terms are inversely related.

Interest rate 6% сл 3 1 February 27, 2007 January 22, 2008 June 16, 2016 1 mo 3 mo 6 mo 1 yr 2 yr 3 yr 5 yr 7 yr 10 yr 20 yr 30 yr Maturity The yield curve from January 2008 is characteristic of a normal yield curve, reflecting that the shorter the term, the higher (A) the risk, and then interest rates decrease over time. (B) The yield curve from January 2008 slopes upward, meaning interest rates and maturity terms are directly related. The yield curve from February 2007 is inverted as investors anticipated that inflation was likely to cause future short-term rates to be lower than current short-term rates. (D) The yield curve from February 2007 slopes downward, meaning interest rates and maturity terms are inversely related.

Oh no! Our experts couldn't answer your question.

Don't worry! We won't leave you hanging. Plus, we're giving you back one question for the inconvenience.

Submit your question and receive a step-by-step explanation from our experts in as fast as 30 minutes.

You have no more questions left.

Message from our expert:

Our experts need more information to provide you with a solution. The question is not complete. Please resubmit your question, making sure it's detailed and complete. We've credited a question to your account.

Your Question:

Transcribed Image Text:Interest rate

6%

сл

3

1

February 27, 2007

January 22, 2008

June 16, 2016

1 mo 3 mo 6 mo 1 yr 2 yr 3 yr 5 yr 7 yr 10 yr 20 yr 30 yr

Maturity

The yield curve from January 2008 is characteristic of a normal yield curve, reflecting that the shorter the term, the higher

(A)

the risk, and then interest rates decrease over time.

(B) The yield curve from January 2008 slopes upward, meaning interest rates and maturity terms are directly related.

The yield curve from February 2007 is inverted as investors anticipated that inflation was likely to cause future short-term

rates to be lower than current short-term rates.

(D) The yield curve from February 2007 slopes downward, meaning interest rates and maturity terms are inversely related.

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT