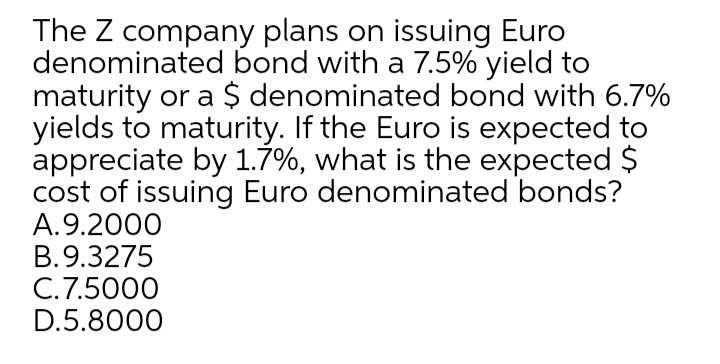

The Z company plans on issuing Euro denominated bond with a 7.5% yield to maturity or a $ denominated bond with 6.7% yields to maturity. If the Euro is expected to appreciate by 1.7%, what is the expected $ cost of issuing Euro denominated bonds? A.9.2000 B.9.3275 C.7.5000 D.5.8000

Q: Assume that Seminole, Inc., considers issuing a Singapore dollar–denominated bond at its present…

A: Here, Coupon Rate of Singapore dollar-denominated bond is 7% Coupon Rate of a US dollar-denominated…

Q: Multinational finance and investment Q2 e) Why do we say a coupon bond can be seen as a package…

A:

Q: Refer to Figure 2.3 and look at the Treasury bond maturing in May 2018. a. How much would you have…

A: Treasury bonds are a kind of debt financial component that is being used by companies and the…

Q: A BBB-rated corporate bond has a yield to maturity of 13.6%. A U.S. Treasury security has a yield to…

A: a. Let's assume the face value of the Treasury bond is $1. Determine the price of Treasury bond (as…

Q: Problem: You are given the following data for two bonds with semiannual payments (A and B) Bond…

A:

Q: Treasury notes and bonds. Use the information in the following table: Type Issue Date Price Coupon…

A: Data given:: Type Issue Date Price Coupon Rate Maturity Date YTM…

Q: The nominal annual interest rate on 6-month USD Treasury Bill is 4.50%. The spot rate of the Euro is…

A: Given: Spot rate = $3.8643 Forward rate=$3.8880 US interest rate=4.50%

Q: In the United States. The date is 26 July 2022. You decide that the market has under-estimated the…

A: Maturity on = 15 May 2052 Coupon Rate = 2.875% Price = 97.1340 Yield = 3.007%

Q: Two bonds, each with a face value of $16000, are redeemable at par in t-years and priced to yield y2…

A: Value of a bond is the price of the bond. It is the present value of future cash flows occurring…

Q: 2. A 6% German corporate bond is priced for settlement on 18 June 2015. The bond makes semiannual…

A: As per our guidelines, we are supposed to answer only 3 sub-parts (if there are multiple sub-parts…

Q: 2 What is the basis point spread (in Bips) between: + Years to Maturity Treasury Yield AA-Rated Bond…

A: The difference on the yield on the two bonds is spread and spread is expressed in the basis points…

Q: 3. Suppose the US government issued a 10 year, 10% semi-annual coupon bond on Jan 15, 2010. The face…

A: Bond is long term debt instrument which is issued by organization to raise long term debt from open…

Q: The table below lists the terms to maturity, the coupon rates, coupon payment dates and yields to…

A: Here, To Find: Accrued Interest =? Price =?

Q: The table below lists the terms to maturity, the coupon rates, coupon payment dates and yields to…

A: Date 07-01-2018 07-01-2018 07-01-2018 Maturity date 07-04-2022 20-08-2027 07-06-2035 Coupon…

Q: The nominal annual interest rate on 6-month USD Treasury Bill is 4.50%. The spot rate of the Euro is…

A: Interest rate parity is the fundamental equation that defines the relationship between interest…

Q: 1 Consider BOND AAA Coupon rate: 9,4% per year Yield to maturity: 10,6% per year Settlement…

A: All in Price: The bond price that includes accrued interest is known as All in price or full price…

Q: PIMCO gives the following example of an Inflation Linked Bond (ILB), called a Treasury Inflation…

A: Bonds are the debt instrument that is issued by the company in order to raise the finance for the…

Q: At 21 February 2018, the US Government could borrow at an annual 10-year yield of 2.89%. At that…

A: Since you have posted multiple questions, as per answering guidelines we shall be solving first…

Q: A 6% German corporate bond is priced for settlement on 18 June 2015. The bond makes semiannual…

A: Solution:- Full price means the price of bond inclusive of accrued interest, whereas clean price is…

Q: 1. Bond Delta was issued at a price of Php1,011.80 which carries a face value of Php1,000.00 and a…

A: Answer: b. The market rate of return must be lower than the coupon rate of 10%. Theory: Market…

Q: Assume that interest rate parity holds and that the 90-day risk-free securities yield is 5% in the…

A: The question is based on the concept of Foreign Exchange.

Q: Consider BOND AAA Coupon rate: 9,4% per year Yield to maturity: 10,6% per year Settlement date: 16…

A: Given,

Q: Bond X is a premium bond making semiannual payments. The bond has a coupon rate of 8.8 percent, a…

A: Given, Two bonds bond X and Bond Y Both have same time to maturity of 13 years.

Q: An Omani Government zero-coupon bond with a par value of $5,000 matures in 10 years. At what price…

A: To open the "PV function" window - MS-Excel --> Formulas --> Financials --> PV.

Q: A)A US corporate bond has a coupon rate of 4% and a face value of $1000 and will mature in 4 years.…

A: Bonds are generally long-term financial debt instruments raised by the company. Company periodically…

Q: Q15. The FIM bank has issued two bonds, the first bond is a 3-year coupon paying bond with 10% of…

A: Price of the bond of the current market value of the bond at which it can be sold or purchased.

Q: Treasury notes and bonds. Use the information in the following table Type Issue Date Price Coupon…

A: The price of bond is the sum of present value of coupon payment and present value of par value of…

Q: Pakistan bank issues a 10-year treasury bond at 12% coupon with the par value of 1000 Rupees. If the…

A: Yield to maturity(YTM)- It is the internal rate of return required for the present value of all the…

Q: IBM is considering having its German affiliate issue a 10- year, $100 million bond denominated in…

A: The cost is the burden or amount that has to be paid to other.

Q: Calculate the modified duration? Issue Price Yield to maturity US Treasury bond 15 4/5% maturing…

A: Face Value = 1000 Price = 1000 YTM = 15.80% Time Period = 5 years Coupon= Coupon Rate * Face Value =…

Q: and bonds. Ose the iniomiation in the following table: Wnat is the price in dollars of the February…

A: Price of bond is calculated by present value of periodic cash flows and present value of maturity…

Q: Treasury notes and bonds. Use the information in the following table: E Assume a $100,000 par value.…

A: YTM is the internal rate of return offered by the bond cash flow at given price. YTM is calculated…

Q: 13. If a bond has a face value of Euro 10,000 and a coupon rate of 10% what would the coupon payment…

A: Face value = Euro 10000 Coupon rate = 10%

Q: A BBB-rated corporate bond has a yield to maturity of 7.4%. A U.S. Treasury security has a yield to…

A: Here,

Q: The nominal annual interest rate on 6-month USD Treasury Bill is 4.50%. The spot rate of the Euro is…

A: The interest rate parity: The interest rate parity theory states that the returns earned by…

Q: Bond X is a premium bond making semiannual payments. The bond has a coupon rate of 8.8 percent, a…

A: we can calculate the price of the bond by applying the required formula

Q: Treasury notes and bonds. Use the information in the following table: . What is the price in…

A: Given information : Par value of bond = $1000 Coupon rate = 7.75% Yield to maturity (YTM) = 5.251%…

Q: you invested in a corporate bond that has a market price today of R983.87and a yield to maturity of…

A: A Bond refers to an instrument that represents the loan being made by the investor to the company…

Q: What are the prices of these bonds today? (Do not round intermediate calculations and round your…

A: Price of Bond: It is arrived at discounting the coupon payments and the principal payment. The bond…

Q: The current exchange rate is 0.8000 Swiss francs per dollar. A5-year U.S. government bond has a 3%…

A: Interest rate parity is a fundamental theory to establish relationship between interest rates…

Q: nominal annual interest rate on 6-month USD Treasury Bill is 4.50%. The spot rate of the Euro is…

A: If the interest parity hold than spot rate and forward must be in equilibrium with interest rates of…

Q: Pakistan bank issues a 10-year treasury bond at 12% coupon with the par value of 1000 Rupees. If the…

A: Coupon rate formula: coupon rate=couponpar×100 price of bond: price of bond=∑nc×1-11+rnr+par1+rn…

Q: The table below lists the terms to maturity, the coupon rates, coupon payment dates and yields to…

A: Periodic or semiannual coupon is calculated as shown below. Periodic coupon=Par…

Q: Bond with face value of 1000 EURO, 2 year's time to maturity and 10% coupon rate, makes semiannual…

A: Calculation of Price of bond , when the yield to maturity is 8% :

Q: Borrower Inc. is currently estimating the value of its bonded indebtedness with the following…

A: The price of a bond: The price of a bond in the secondary market is the discounted value of all cash…

Q: The Malawian government has issued a bond which is currently priced at K1,200 on the stock exchange.…

A: The interest and the bond price are inversely proportional to each other.

Step by step

Solved in 2 steps

- IBM is considering having its German affiliate issue a 10-year, $100 million bond denominated in euros and pricedto yield 7.5%. Alternatively, IBM’s German unit can issuea dollar-denominated bond of the same size and maturityand carrying an interest rate of 6.7%.a. If the euro is forecast to depreciate by 1.7% annually, what is the expected dollar cost of the eurodenominated bond? How does this compare to the costof the dollar bond?b. At what rate of euro depreciation will the dollar cost ofthe euro-denominated bond equal the dollar cost of thedollar-denominated bond?c. Suppose IBM’s German unit faces a 35% corporate taxrate. What is the expected after-tax dollar cost of theeuro-denominated bond?A European company issues a bond with a par value of $1,000, 13 years to maturity, and a coupon rate of 6 percent paid annually. If the yield to maturity is 11 percent, what is the current price of the bond? Group of answer choices $640.46 $622.56 $658.44 $662.51 $636.66Suppose you (U.S. investor) purchase a 5-year, AA-rated Euro bond for par that is paying an annual coupon at the rate equal to 8 percent. The bond has a face value of 1,000 Euros. The spot exchange rate at the time of purchase is USD1.15/EUR. At the end of the year 1, the bond is upgraded to AAA-rated and the yield changes to 7.5% per annum continuous compounding. In addition due to changes in macroeconomic environment, the exchange rate also changed to USD1.25/EUR. Assume that a U.S. investor holds this bond for one year and sells it in the market at the end of year 1. EUR is the abbreviation for Euro and USD is the abbreviation for U.S. dollar. What is the overall gain / loss in U.S. dollars for the U.S. investor at the end of year 1 (t = 1 year)? (Roundoff your answer to four decimal places, in order to get as accurate answer as possible on Canvas. If your answer is -$1.2345, loss of $1.2345, then type your answer as -1.2345.)

- Assume that the yield-to maturity on a straight € fixed-rate bond is 4%. A comparable risk five-year, 5.5 percent euro/dollar dual-currency bond pays $1,500 at maturity per €1,000 of face value. It sells for €1,250. What is the implied $/€ exchange rate at maturity?A BBB-rated corporate bond has a yield to maturity of 6.6%. A U.S. Treasury security has a yield to maturity of 5.0%. These yields are quoted as APRs with semiannual compounding. Both bonds pay semiannual coupons at an annual rate of 5.3% and have five years to maturity. a. What is the price (expressed as a percentage of the face value) of the Treasury bond? b. What is the price (expressed as a percentage of the face value) of the BBB-rated corporate bond? c. What is the credit spread on the BBB bonds?Bond with face value of 1000 EURO, 2 year's time to maturity and 10% coupon rate, makes semiannual coupon payments and provides 8% yield to maturity.calculate the price of the bond. If the yield-to-maturity would increase to 9% what will be the price of the bond? How this change in the yield-to-maturity would influence bond price

- General Maiter%u2019s outstanding bond issue has a coupon rate of 10.6%, and it sells at a yield to maturity of 8.70%. The firm wishes to issue additional bonds to the public at face value. What coupon rate must the new bonds offer in order to sell at face value? (Round your answer to 2 decimal places.) Coupon rate %A BBB-rated corporate bond has a yield to maturity of 10.8%. A U.S. Treasury security has a yield to maturity of 9.5%. These yields are quoted as APRs with semiannual compounding. Both bonds pay semiannual coupons at an annual rate of 10.2% and have five years to maturity. a. What is the price (expressed as a percentage of the face value) of the Treasury bond? b. What is the price (expressed as a percentage of the face value) of the BBB-rated corporate bond? c. What is the credit spread on the BBB bonds? a. What is the price (expressed as a percentage of the face value) of the Treasury bond? The price of the Treasury security as a percentage of face value is $________________ (Round to two decimal places.)On 31st March 2016 you saw the following information about bonds. Name of Security Face Value Maturity Date Coupon Rate Coupon Date(s) Zero Coupon 10,000 31st March 2026 N.A. N.A. t-Bill 1,00,000 24th June 2016 N.A. N.A. 10.71%GOTT 2026 100 31st March 2026 10.71 31st March 10%GOTT 2021 100 31st March 2021 10 31st March & 31st October 1B) What will be the annualized % yield of the treasury bill of face value which is currently traded at 98,000?

- Assume that Seminole, Inc., considers issuing a Singapore dollar–denominated bond at its present coupon rate of 7 percent, even though it has no incoming cash flows to cover the bond payments. It is attracted to the low financing rate because U.S. dollar–denominated bonds issued in the United States would have a coupon rate of 12 percent. Assume that either type of bond would have a four-year maturity and could be issued at par value. Semi-nole needs to borrow $10 million. Therefore, it will issue either U.S. dollar–denominated bonds with a par value of $10 million or bonds denominated in Singapore dollars with a par value of S$20 million. The spotrate of the Singapore dollar is $.50. Seminole has forecasted the Singapore dollar’s value at the end of each ofthe next four years, when coupon payments are to be paid. Determine the expected annual cost of financingwith Singapore dollars. Should Seminole, Inc., issue bonds denominated in U.S. dollars or Singapore dollars? Explain. END OF…In the bond market you are given the following information. All amounts are in the US dollar. CF stands for cash flows and all bonds mature in Year 3. One can buy or sell only integer quantity of bonds. Based on the no-arbitrage principle, what is the price of Bond C today? In other words, what is X? Price Today CF Year 1 CF Year 2 CF Year 3 Bond A 95.00 6 6 106 Bond B 107.00 11 11 111 Bond C X 7 7 107A BBB-rated corporate bond has a yield to maturity of 12.4%. A U.S. Treasury security has a yield to maturity of 10.6%. These yields are quoted as APRs with semiannual compounding. Both bonds pay semi-annual coupons at a rate of 11.1% and have 5 years to maturity. a. What is the price (expressed as a percentage of the face value) of the Treasury bond? b. What is the price (expressed as a percentage of the face value) of the BBB-rated corporate bond? c. What is the credit spread on the BBB bonds?