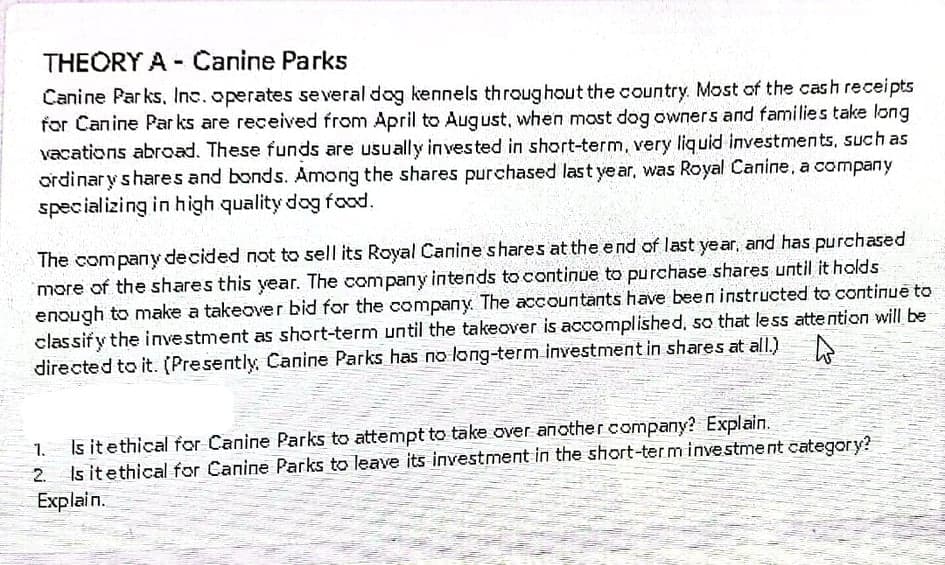

THEORY A - Canine Parks Canine Parks, Inc. operates several dog kennels throughout the country. Most of the cash receipts for Canine Par ks are received from April to August, when most dog owners and families take long vacations abroad. These funds are usually invested in short-term, very liquid investments, such as ordinary shares and bonds. Among the shares purchased last ye ar, was Royal Canine, a company specializing in high quality dog food. The company decided not to sell its Royal Canine shares at the end of last year, and has purchased more of the shares this year. The company intends to continue to purchase shares until it holds enough to make a takeover bid for the company. The accountants have been instructed to continue to classify the investment as short-term until the takeover is accomplished, so that less attention will be directed to it. (Presently, Canine Parks has no long-term .investment in shares at all.)

THEORY A - Canine Parks Canine Parks, Inc. operates several dog kennels throughout the country. Most of the cash receipts for Canine Par ks are received from April to August, when most dog owners and families take long vacations abroad. These funds are usually invested in short-term, very liquid investments, such as ordinary shares and bonds. Among the shares purchased last ye ar, was Royal Canine, a company specializing in high quality dog food. The company decided not to sell its Royal Canine shares at the end of last year, and has purchased more of the shares this year. The company intends to continue to purchase shares until it holds enough to make a takeover bid for the company. The accountants have been instructed to continue to classify the investment as short-term until the takeover is accomplished, so that less attention will be directed to it. (Presently, Canine Parks has no long-term .investment in shares at all.)

Chapter1: Multinational Financial Management: An Overview

Section: Chapter Questions

Problem 37QA

Related questions

Question

Transcribed Image Text:THEORY A -Canine Parks

Canine Parks, Inc.operates se veral dog kennels throughout the country. Most of the cash receipts

for Canine Par ks are received from April to August, when mast dog owners and families take long

vacations abroad. These funds are usually in vested in short-term, very liquid investments, such as

ordinary shares and bonds. Among the shares purchased last ye ar, was Royal Canine, a company

specializing in high quality dog food.

The company decided not to sell its Royal Canine shares at the end of last year, and has purchased

more of the shares this year. The company intends to continue to purchase shares until it holds

enough to make a takeover bid for the company. The accountants have been instructed to continue to

classify the investment as short-term until the takeover is accomplished, so that less attention will be

directed to it. (Presently, Canine Parks has no long-term investment in shares at allI.)

Is itethical for Canine Parks to attempt to take over another company? Explain.

Is itethical for Canine Parks to leave its investment in the short-ter m investment category?

Explain.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning