There are two projects under consideration by the Rainbow factory. Each of the projects will require an initial investment of $35,000 and is expected to generate the following cash flows: First Year Second Year Third Year Total Alpha Project $32,500 $23,000 $5,000 $60,500 Beta Project 7,500 24,000 28,500 60,000 (Click here to see present value and future value tables) A. If the discount rate is 10%, compute the NPV of each project. Round your present value factor to three decimal places and final answer to answer to 2 decimal places. Alpha Project $ Beta Project $ B. Which project should be recommended.

There are two projects under consideration by the Rainbow factory. Each of the projects will require an initial investment of $35,000 and is expected to generate the following cash flows: First Year Second Year Third Year Total Alpha Project $32,500 $23,000 $5,000 $60,500 Beta Project 7,500 24,000 28,500 60,000 (Click here to see present value and future value tables) A. If the discount rate is 10%, compute the NPV of each project. Round your present value factor to three decimal places and final answer to answer to 2 decimal places. Alpha Project $ Beta Project $ B. Which project should be recommended.

Chapter9: Capital Budgeting Techniques

Section: Chapter Questions

Problem 7PROB

Related questions

Question

Transcribed Image Text:Homework Assignment #13

Print Item

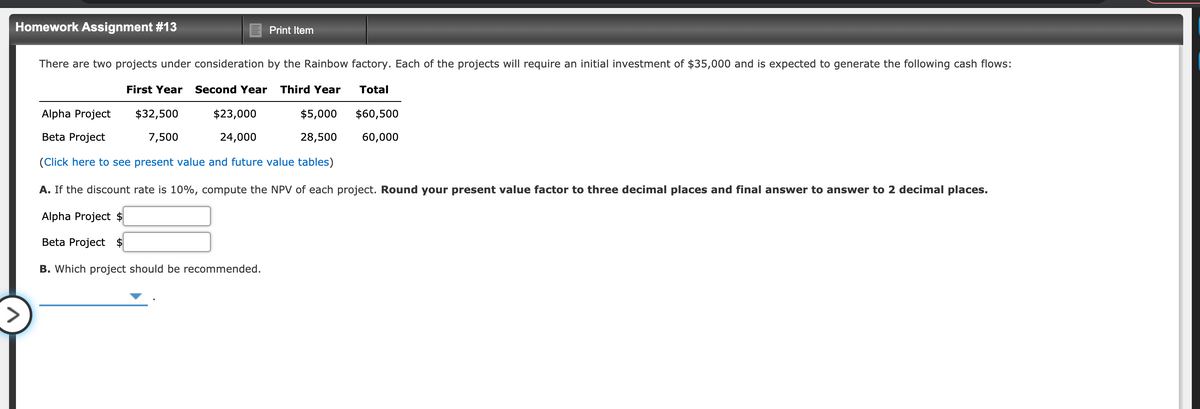

There are two projects under consideration by the Rainbow factory. Each of the projects will require an initial investment of $35,000 and is expected to generate the following cash flows:

First Year

Second Year

Third Year

Total

Alpha Project

$32,500

$23,000

$5,000

$60,500

Beta Project

7,500

24,000

28,500

60,000

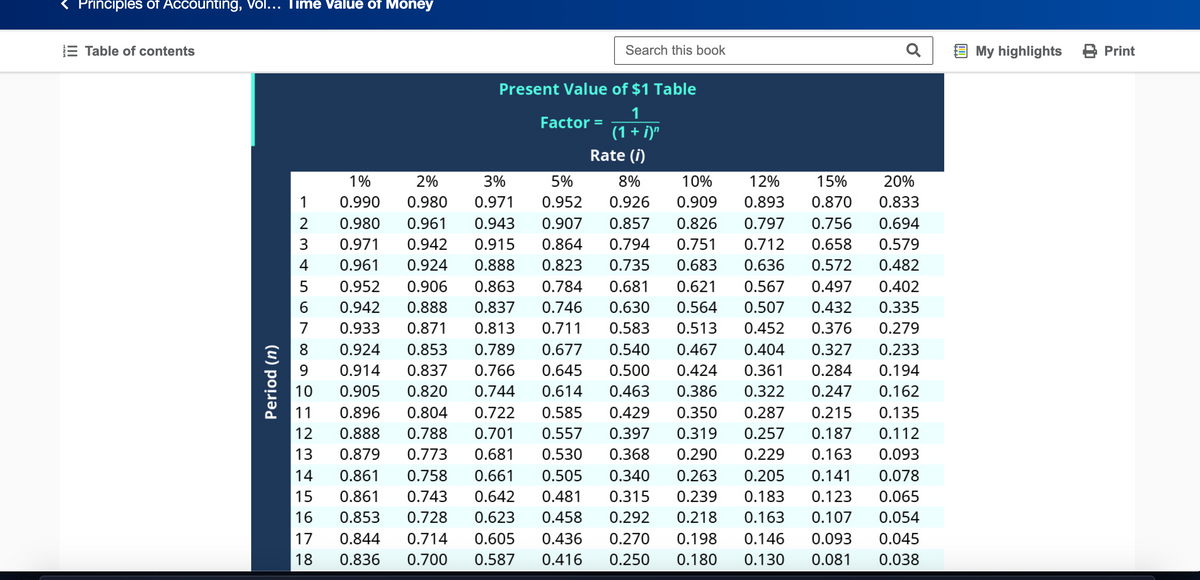

(Click here to see present value and future value tables)

A. If the discount rate is 10%, compute the NPV of each project. Round your present value factor to three decimal places and final answer to answer to 2 decimal places.

Alpha Project $

Beta Project $

B. Which project should be recommended.

Transcribed Image Text:< Principles of Accounting, Vol... T ime Value of Money

E Table of contents

Search this book

E My highlights

B Print

Present Value of $1 Table

1

Factor =

(1 + i)"

Rate (i)

1%

2%

3%

5%

8%

10%

12%

15%

20%

1

0.990

0.980

0.971

0.952

0.926

0.909

0.893

0.870

0.833

0.980

0.961

0.943

0.907

0.857

0.826

0.797

0.756

0.694

3

0.971

0.942

0.915

0.864

0.794

0.751

0.712

0.658

0.579

4

0.961

0.924

0.888

0.823

0.735

0.683

0.636

0.572

0.482

0.952

0.906

0.863

0.784

0.681

0.621

0.567

0.497

0.402

0.942

0.888

0.837

0.746

0.630

0.564

0.507

0.432

0.335

7

0.933

0.871

0.813

0.711

0.583

0.513

0.452

0.376

0.279

8

0.924

0.853

0.789

0.677

0.540

0.467

0.404

0.327

0.233

9

0.914

0.837

0.766

0.645

0.500

0.424

0.361

0.284

0.194

10

0.905

0.820

0.744

0.614

0.463

0.386

0.322

0.247

0.162

11

0.896

0.804

0.722

0.585

0.429

0.350

0.287

0.215

0.135

12

0.888

0.788

0.701

0.557

0.397

0.319

0.257

0.187

0.112

13

0.879

0.773

0.681

0.530

0.368

0.290

0.229

0.163

0.093

14

0.861

0.758

0.661

0.505

0.340

0.263

0.205

0.141

0.078

15

0.861

0.743

0.642

0.481

0.315

0.239

0.183

0.123

0.065

16

0.853

0.728

0.623

0.458

0.292

0.218

0.163

0.107

0.054

17

0.844

0.714

0.605

0.436

0.270

0.198

0.146

0.093

0.045

18

0.836

0.700

0.587

0.416

0.250

0.180

0.130

0.081

0.038

(u) poļua

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning