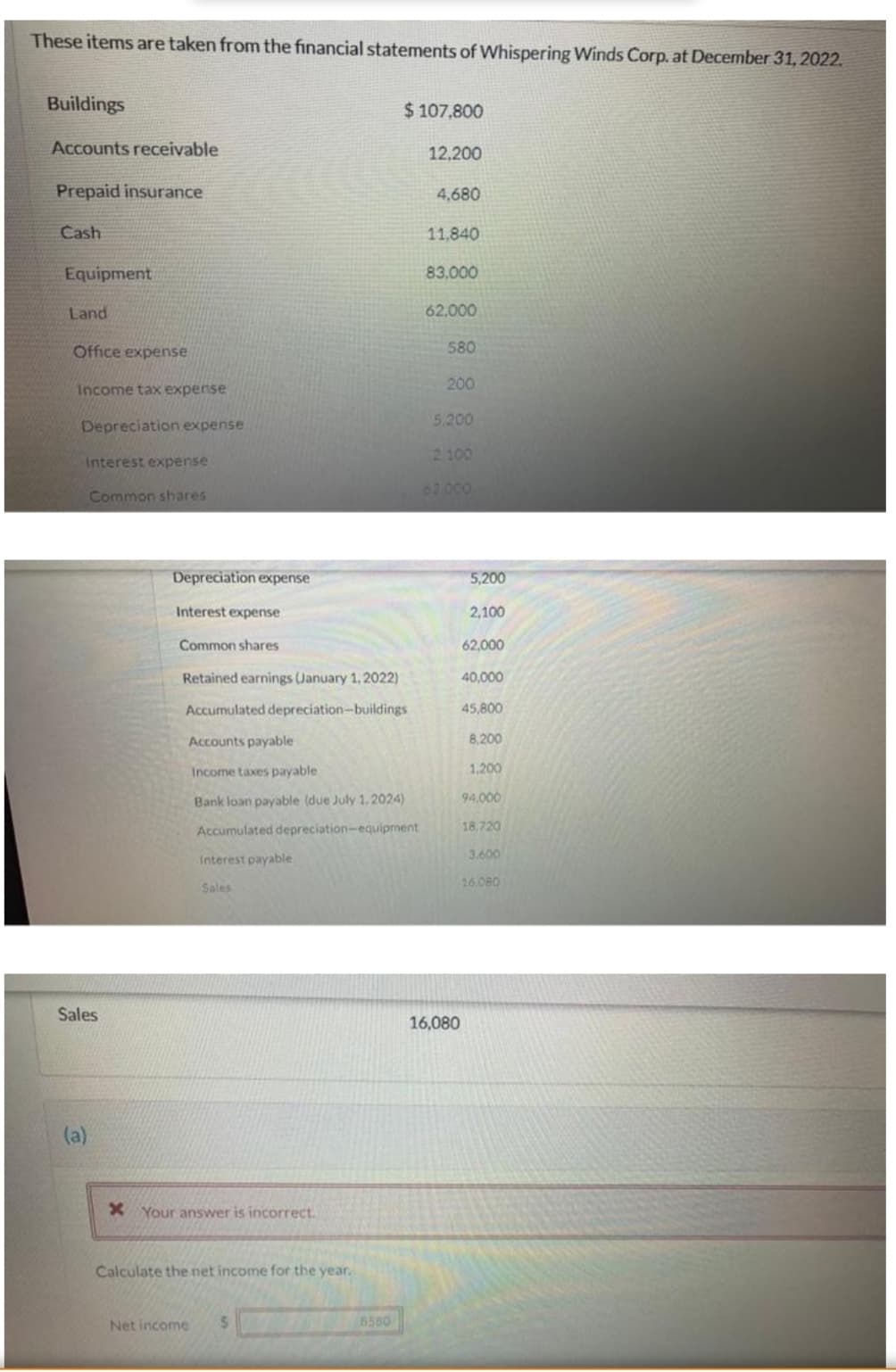

These items are taken from the financial statements of Whispering Winds Corp. at December 31, 2022. Buildings $ 107,800 Accounts receivable 12,200 Prepaid insurance 4,680 Cash 11,840 Equipment 83,000 Land 62.000 Office expense 580 Income tax expense 200 Depreciation expense 5.200 2100 Interest expense Common shares 62.000 Depreciation expense 5,200 Interest expense 2,100 Common shares 62,000 Retained earnings (January 1, 2022) 40,000 Accumulated depreciation-buildings 45,800 Accounts payable 8,200 Income taxes payable 1,200 Bank loan payable (due July 1.2024) 94,000 Accumulated depreciation-equipment 18,720 3.600 Interest payable 16.080 Sales Sales 16,080

These items are taken from the financial statements of Whispering Winds Corp. at December 31, 2022. Buildings $ 107,800 Accounts receivable 12,200 Prepaid insurance 4,680 Cash 11,840 Equipment 83,000 Land 62.000 Office expense 580 Income tax expense 200 Depreciation expense 5.200 2100 Interest expense Common shares 62.000 Depreciation expense 5,200 Interest expense 2,100 Common shares 62,000 Retained earnings (January 1, 2022) 40,000 Accumulated depreciation-buildings 45,800 Accounts payable 8,200 Income taxes payable 1,200 Bank loan payable (due July 1.2024) 94,000 Accumulated depreciation-equipment 18,720 3.600 Interest payable 16.080 Sales Sales 16,080

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter7: Operating Assets

Section: Chapter Questions

Problem 5MCQ: Refer to the information for Cox Inc. above. What amount would Cox record as depreciation expense at...

Related questions

Question

Transcribed Image Text:These items are taken from the financial statements of Whispering Winds Corp. at December 31, 2022.

Buildings

$107,800

Accounts receivable

12,200

Prepaid insurance

4,680

Cash

11,840

Equipment

83,000

Land

62.000

Office expense

580

Income tax expernse

200

Depreciation expense

5.200

2 100

Interest expense

62.000

Common shares

Depreciation expense

5,200

Interest expense

2,100

Common shares

62,000

Retained earnings (January 1,2022)

40,000

Accumulated depreciation-buildings

45,800

Accounts payable

8,200

Income taxes payable

1,200

Bank loan payable (due July 1.2024)

94,000

Accumulated depreciation-equipment

18,720

Interest payable

3.600

16.080

Sales

Sales

16,080

(a)

X Your answer is incorrect.

Calculate the net income for the year.

Net income

%24

8580

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning