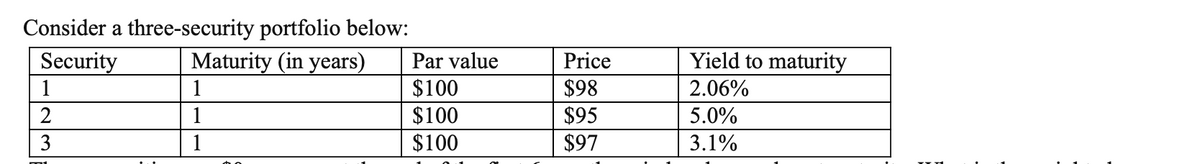

These securities pay $0 coupons at the end of the first 6-month period and par value at maturity. What is the weighted-average portfolio yield? What is the portfolio yield (i.e., portfolio internal rate of return)?

Q: Using the data generated in the graph, show what the information looks like in a spreadsheet. a)…

A: Security market line (SML) is a grapical representation of the Capital Asset Pricing Model. All the…

Q: Suppose instead of paying a dividend, Payout Corp. announces that it will repurchase stock with a…

A: Data given: No dividend is paid. Market price per share=$50 (computed in the main section) Market…

Q: Suppose you want to purchase a house. Your take-home pay is $4270 per month, and you wish to stay…

A: A loan is a financial arrangement in which one or more people, companies, or other entities lend…

Q: Consider the following information about the various states of economy and the returns of various…

A: The formula for calculating Mean, Standard deviation, and coefficient of variation with probability…

Q: Value of a putable bond is A. O value of callable bond -option cost B.O value of nonputable bond +…

A: Options are a derivative instrument which gives the investor the right but not the obligation to buy…

Q: The Wagner Company tries to follow a pure "residual" dividend policy. Earnings and dividends last…

A: We have to find the total amount of dividends Wagner should pay, under the pure "residual" dividend…

Q: QS 11-14 (Algo) Net present value of an annuity LO P3 Pena Company is considering an investment of…

A: Data given: Initial cost =$ 21,555 Net cash flow= $ 6800 n=4 years Required rate of return=8%…

Q: 1. A company issued 20-year bonds with par value $1,000 two years ago at a coupon rate of 5 percent.…

A: The price of bond is the present value of annual cash flow from the bonds and present value of face…

Q: If you deposit $500 at the end of each year for the next 5 years in a bank where it will earn 6%…

A: The amount that a present investment will gain in value over time when kept in a compound interest…

Q: The manufacturer of a product that has a variable cost of $2.40 per unit and total fixed cost of…

A: The concept of break-even analysis will be used here. Break-even point is that point at which total…

Q: You have just turned 23 years of age and accepted your first job. However, you would like to retire…

A: Current Age is 23 years The retirement age is 58 years Therefore; the Time period of the deposit is…

Q: You have just completed a $15,000 feasibility study for a new coffee shop in some retail space you…

A: Initial cashflow The cash that flows out of the business before starting the business is known as…

Q: Suppose a bank offers you a 10% interest rate on a 25-year mortgage to be paid back with monthly…

A:

Q: You want to be able to withdraw $50,000 each year for 20 years. Your account earns 5% interest

A: The amount of annual withdrawal of $50,000 each year is an annuity. We will have to determine the…

Q: Christina Sanders is concerned about the financing of a home. She saw a small Cape Cod–style house…

A: Here, Particulars Case (a) Case (b) Case (c) Case (d) Price of a house $ 90,000.00 $…

Q: earnings

A: from one data to other. The most practical ways of measuring average - mean, median, and mode, Take…

Q: Using single-period arithmetic returns, calculate the value after two periods for the realized…

A: The amount that a present investment will gain in value over time when kept in a compound interest…

Q: 2. Company A is expecting to sell 10,000 cases in July, 20,000 cases in August, and 30,000 in…

A: Data given: Description July August September Sales (Cases) 10,000 20,000 30,000 Selling…

Q: You purchased a commercial office building for $2,200,000 one year ago. The appraisal noted the…

A: As per the given information: Office building purchased - $2,200,000Value of the land -…

Q: Bliss Bar is a company that sells deluxe chocolate and candy bars based in Illinois. The company is…

A: The IRR of the project is a measure used to evaluate the actual return on the investment. The actual…

Q: Your 13-year old cousin comes to you again to ask more questions about the time value of money…

A: The concept of time value of money is one of the most important concepts in finance. When making…

Q: 1(A).Why did Lenders/Banks start to securitize mortgages (creating Collateralized Mortgages or Debt…

A: CMOs stand for collateralized mortgage obligations. CDOs stand for collateralized debt obligations.…

Q: Find the first month of the amortization schedule for a fixed-rate mortgage if 70,000 with an…

A: Loans are paid equal and fixed monthly payments and these payments carry the payment for loans and…

Q: Bliss Bar is a company that sells deluxe chocolate and candy bars based in Illinois. The company is…

A: Net present value is the technique used for making a decision about the investment to be done in a…

Q: You work for the CEO of a newly incorporated company that plans to acquire long-forgotten songs,…

A: Return on equity (ROE) refers to the return generated through shareholders' equity. This ratio is a…

Q: The First National Bank is offering a 4 year certificate of deposit (CD) at 4% interest compounded…

A: Compound Interest The interest received over the principal amount and the interest received from the…

Q: Net Sales = $88,122 Total Assets = $189,100 Calculate Asset Turnover ( Round to nearest hundredth…

A: When actual or intangible goods, services, or assets are traded for money and include two or more…

Q: Summer Tyme, Inc., is considering a new 3-year expansion project that requires an initial fixed…

A: After-tax salvage value The book value of an asset which is obtained after deducting all the…

Q: The company expects to invest approximately $1 million in three months in corporate bonds. The…

A: Given In this case, the company will buy treasury bonds to protect the portfolio against the…

Q: Question 1 Chief Medical, Inc. is a little-known producer of heart pacemakers. The earnings and…

A: Value of stock can be calculated as the present value of dividend and present value of growth…

Q: When computing the Free Cash Flow to the Firm (FCF), taxes are computed as EBIT multiplied by tax…

A: Capital investment is related to the acquisition of physical assets to attain long-term business…

Q: Assume AUD = 0.58 GBP and inflation is 3.5% pa in Australia and 7% pa in Great Britain. Estimate the…

A: Exchange rate depends on the inflation rate and changes based on the inflation in the home country…

Q: RiverRock Capital Geneva (B). Christoph Hoffeman of RiverRock Capital now believes the Swiss franc…

A: The exchange rate indicates the value of the currency of one country which is expressed in terms of…

Q: evaluate the sources of financial data which can be used to inform business strategy.

A: Financial Data: Quantitative information used by firms to make financial decisions is called…

Q: tock Price after Recapitalization e Manufacturing's value of operations is equal to $900 million…

A: With debt, the value of the firm is given as shown below. Value of firm=Market value of debt+Market…

Q: 5. If money is worth 10% compounded quarterly, calculate the present value of a deferred annuity on…

A:

Q: uy a truck for $25,200. You must also pay tax and license fees of $1,700. You borrow $23,000 at 9%…

A: Vehicles are purchased on the basis of monthly payments and these monthly payments carry the payment…

Q: II. Table Completion. Find the indicated value from the following ordinary annuity. Write your…

A: The periodic payment made at the end of each periodic interval is regarded as the ordinary annuity.…

Q: You are evaluating a project that costs $64,000 today. The project has an inflow of $138,000 in one…

A: The process via which an investor analyzes and evaluates any project or investment and decides…

Q: Use Exhibit 18-1 to determine Sales Tax in (K and Calculate the Total purchase price (in) for to…

A: Sales tax is the amount paid on the selling price and is included in the receipt. Selling price =…

Q: Review the following market information: Current Stock Market Return 11.25%…

A: The Capital Asset Pricing Model is a model that describes the relationship between the expected…

Q: Jen Logan bought a home in Iowa for $110,000. She put down 20% and obtained a mortgage for 30 years…

A: Here, Particulars Values Price of a house $ 110,000.00 Down payment (20%*$110,000) $…

Q: 21. A bond with a face value of $1000 and an 6% annual bond rate is redeemable at face value in 20…

A: Issue price of bonds would be present value of interest annuity & maturity amount at market rate…

Q: . If money is worth 12% compounded quarterly, calculate the pr eferred annuity of 185 every three…

A: When there is more compounding of interest than more is effective rate of interest and less is the…

Q: British Pound Futures, $=£1.00 (CME) Maturity Open High March 1.4246 1.4268 June 1.4164 1.4188 Low…

A: Honor Code: Since you have posted a question with multiple sub-parts, we will solve the first three…

Q: For an interest-bearing promissory notes, compute the sale proceeds, when the issue amount is…

A: Notes are secured investment and the a kind of deposits in which interest is paid on expiration but…

Q: ou invest $5000 at time t=0 and an additional $2000 at time t=1/2. At time t=1/2 you have $5300 in…

A: Time weighted rate of return Time weighted rate of return is calculated as shown below. Time…

Q: What is the accumulated sum of $12 a year for the next 8 years compounded annually at 10%?

A: The amount that a present investment will gain in value over time when kept in a compound interest…

Q: how economic currency exposure can affect an Australian based company with significant exports to…

A: Economic exposure affects the value of a firm. The firm's value is derived from its cash flows and…

Q: Suppose managers of a firm know that the company is approaching financial distress. Should the…

A: Financial distress The situation in which the company is not able to meet its obligation to…

These securities pay $0 coupons at the end of the first 6-month period and par value at maturity. What is the weighted-average portfolio yield? What is the portfolio yield (i.e., portfolio

Step by step

Solved in 4 steps

- What is the expected return for the following portfolio? (State your answer in percent with two decimal places.) Stock Expected returns Investment AAA 35% $500,000 BBB 29% $1,300,000 CCC 18% $1,200,000 DDD 7% $1,500,000 O.17.13% O.19.40% O.21.01% O.22.21% O.23.88%Consider a three-security portfolio below: Security Maturity (in years) Par value Price Yield to maturity 1 1 $100 $98 2.06% 2 1 $100 $95 5.0% 3 1 $100 $97 3.1% These securities pay $0 coupons at the end of the first 6-month period and par value at maturity. What is the weighted-average portfolio yield? A. 2.35% B. 4.34% C. 3.35% D. 5.34%Consider a three-security portfolio below: Security Maturity (in years) Par value Price Yield to maturity 1 1 $100 $98 2.06% 2 1 $100 $95 5.0% 3 1 $100 $97 3.1% These securities pay $0 coupons at the end of the first 6-month period and par value at maturity. What is the portfolio yield (i.e., portfolio internal rate of return)? A. 3.12% B. 3.42% C. 4.24% D. 5.24%

- In a bond portfolio, the following are the present values of all cash flows by annual period: Year PV Cash flows (millions) 1 14.3 2 13.2 3 15.3 4 10.5 5 18.4 What is the percentage contribution to duration of the year 3 cash flows? Enter answer in percents.Calculate the weighted average expected return of the portfolio. Stock Investment Expected ReturnA $20,000 15%B $4,000 10%C $26,000 12%Consider a portfolio comprise of three securities in the following proportion and with the indicated securities beta. Security Amount Invested Beta Expected return A 1.5million 1.0 12% B 1million 1.5 13.5% C 2million 0.8 9% Calculate the portfolio’s; Beta Expected return Determine whether this portfolio have more or less systematic risk than an average asset.

- If the T Bill rate is 1.1% and the market risk premium is 10.8%, what is the CAPM-implied expected return on a portfolio invested 50% in the risk-free asset and 50% in the market?Enter your answer as a percentage rounded to 2 decimal places.Assume that ASX 300 Index represents the risky portfolio. Calculate the annual return for the period 2011- 2020 for the risky portfolio using the data given for the ASX 300 Index. Year ASX 300 Index ASX 300 Dividend Yield (%) Return_risky portfolio 2010 4760.79 3.76 - 2011 4052.27 4.93 ??? 2012 4626.27 4.33 ??? 2013 5304.8 3.99 ??? 2014 5348.93 4.24 ??? 2015 5249.09 4.72 ??? 2016 5617.73 4.09 ??? 2017 6023.3 4.04 ??? 2018 5596.96 4.48 ??? 2019 6647.74 3.95 ??? 2020 6574.33 2.82 ??? Calculate the annual return for the period 2011-2020 for the risk-free asset using the data given for the risk-free asset Year Risk free rate (%) Return_risk-free asset 2011 5.03 2012 4.51 ??? 2013 3.11 ??? 2014 2.61 ??? 2015 2.75 ??? 2016 2.34 ??? 2017 1.78 ??? 2018 1.77 ??? 2019 2.02 ??? 2020…Below are the annual returns provided by TSCM. Calculate average annual return experienced by an investor over the last five years. Calculate the standard deviation of the portfolio return over this period. (See sheet "TSCM" in the attached Excel.) Period Return 2021 -51.0% 2020 43.0% 2019 61.0% 2018 -5.0% 2017 -19.0% In the year 2022, TSCM return is 21%. Calculate TSCM's Jensen's Alpha for the year period in annual terms. Use the below data. Beta = 2.3 Risk-free rate = 1% Expected Market Return = 8%

- For the upcoming year, the risk-free rate is 2 percent, and the expected return to the market is 7 percent. You are also given the following covariance matrix for Securities J,K, andL. \table[[Covariance,Security J,Security K,Security L],[Security J,0.0012532,0.0010344,0.0019711],[Security K,0.0010344,0.0023717,0.0013558],[Security L,0.0019711,0.0013558,0.0048442]] Also assume that you form a portfolio by putting 0 percent of your funds in Security J, 40 percent of your funds in Security K, and 60 percent of your funds in Security L. Based on this information, determine the standard deviation of the resulting portfolio. ◻ 6.47% 5.27% 4.98% 5.82% 4.77%N1 Consider a portfolio consisting of stocks and treasury bills. The expected return on the stocks is 25%, and the standard deviation is 30%. The expected return on the treasury bills is 1%, and treasury bills are risk free. All of these figures are annual. The portfolio's market value is $200 million and is allocated 90% to stocks and 10% to treasury bills. Determine the 1% annual VaR and the 1% weekly VaR using the analytical method.You observe the following prices for Treasury securities (per $100 of par value):Maturity Coupon Rate Price6 months 0 $99.011 year 3.5% $100.991.5 years 3.0% $100.30The 18-month theoretical spot rate implied by these price is A: 2.3% B: 2.5% C: 2.8% D: 3.1%