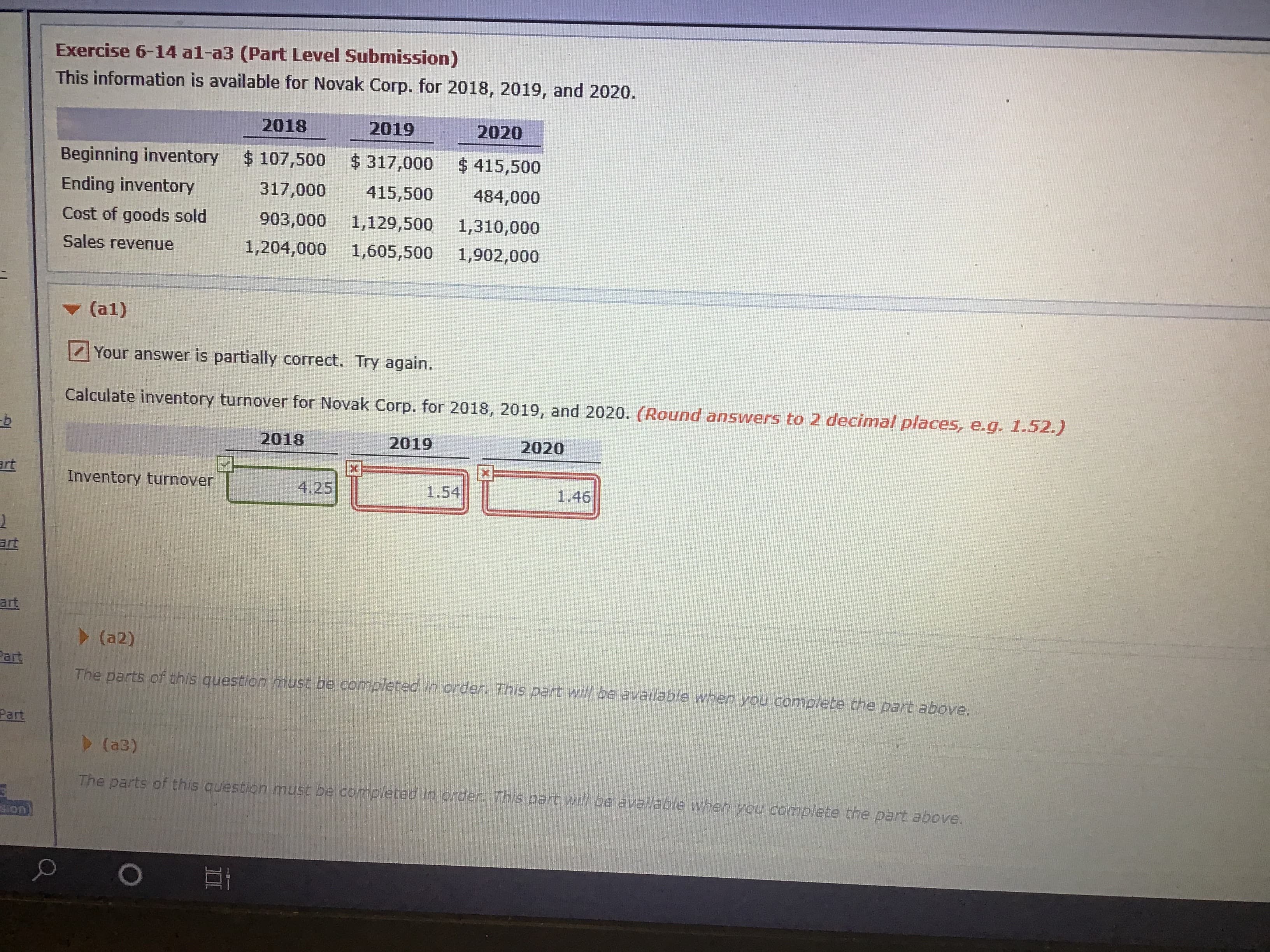

This information is available for Novak Corp. for 2018, 2019, and 2020. 2018 2019 2020 Beginning inventory $107,500 $ 317,000 $ 415,500 Ending inventory 317,000 415,500 484,000 Cost of goods sold 903,000 1,129,500 1,310,000 Sales revenue 1,204,000 1,605,500 1,902,000

Q: The Cadet Company shows the following information for 2020: conl th Cost Retail Beginning inventory…

A: The retail inventory method is used to estimate the value of ending inventory at cost with regards…

Q: The following balances were reported by ABC Co. at December 31, 2019 and 2020: 12/31/20 P2,600,000…

A: Cost of goods sold:- Cost of goods sold is defined as the cost which includes all direct costs that…

Q: Based on our understanding of inventcory cost fowis,and given the information listed below for the…

A: Cost of goods sold is calculated by subtracting gross profit from net sales. Note :- Net Sales is…

Q: Sheffield’s days in inventory in 2018 was

A: Information provided: Beginning inventory= $106,000 Ending inventory= $94,000 Cost of goods sold=…

Q: nko Inc. reported the following balances at the end of each year:…

A: >Accounts Payable are the balances of suppliers that have not yet been paid in cash for the…

Q: The following information was taken from the accounting records of Chicoutimi Ltée. and Jonquière…

A: Formula: Average inventory=Opening inventory+Closing inventory2

Q: Income Statement Calculations Taylor Company uses a periodic inventory system. The following is…

A: Since, Cost of goods sold = opening stock + Net purchases - closing stock

Q: The following balances were reported by ABC Co. at December 31, 2019 and 2020: 12/31/20 12/31/19…

A: The cost of goods sold refers to the cost of purchase or manufacturing of the goods which have been…

Q: At December 31, 2020, the following information was available from HIBISCUS Company's accounting…

A: We are provided with the cost and the retail price of the goods available for sale. Along with that,…

Q: Excerpts from Hulkster Company's December 31, 2021 and 2020, financial statements are presented…

A: RETURN ON ASSET : = NET INCOME / TOTAL AVERAGE ASSETS

Q: Taylor Company uses a periodic inventory system. The following is partial information from its…

A: The missing values are calculated using the accounting formulas. Sometimes single-entry books are…

Q: The records of Earthly Goods provided the following Information for the year ended December 31,…

A: The closing inventory represents the value of inventory that remains at the end of accounting…

Q: Assume the following are for Bubba Co. for 2019: Sales $980,000; Merchandise inventory January 1,…

A: Sales less Cost of goods sold is gross profit: Gross profit = Sales - Cost of goods sold. First,…

Q: Taylor Company uses a periodic inventory system. The following is partial information from its…

A: Beginning inventory = Ending inventory of previous year Cost of goods sold = Beginning inventory +…

Q: The following information is available for Splish Brothers Inc. for three recent fiscal years.…

A: Ratio analysis means where different ratio of various years of years companies has been compared and…

Q: Music, Inc. had the following beginning and ending values in its three inventory accounts:…

A:

Q: Skysong, Inc. reported these income statement data for a 2-year period. 2022 2021 Sales revenue…

A: Skysong Inco. Income Statement. 2021, 2022. Particulars 2022 2021 A Sales Revenue 255500…

Q: 3. Trump Incorporated reported the following data for the year 2019, 2020 and 2021 2019 2020 2021…

A:

Q: The following balances were reported by ABC Co. at December 31, 2020 and 2019: 12/31/20 Inventory…

A: Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: The following information is available for Miguel Company at December 31, 2020: beginning inventory…

A: Definition: Inventory turnover ratio: Inventory turnover ratio is used to determine the number of…

Q: Fischer, Inc. had the following inventory in fiscal 2019. The company uses the average cost method…

A: Average cost per unit = ((100 x $10) + (200 x $12))/ 300 units = $3,400 / 300 units = $11.3333

Q: The retail inventory method is used by Chuchi Inc. The records of inventory, purchases, and sales…

A: Perpetual inventory system: It is the inventory system that record each transaction of purchase…

Q: Data taken from the records of XYZ Co. revealed the following for 2020: Inventory - January 1…

A: Accounting is primarily concerned with identifying, recording, measuring, summarizing transactions…

Q: The following information is available for cullumber company for three recent fiscal years.…

A: Solution:- Calculation of Inventory turnover ratio as follows under:-

Q: On January 1, 2019, the merchandise inventory of Gulf, Inc. was $800,000. During 2019 Gulf purchased…

A: Since you have asked multiple question, we will solve the first question for you. If you want any…

Q: 10. On December 31, 2020, ABC Company provided the following information: Cost Retail Inventory,…

A: Under retail method of inventory, we need to calculate cost-to-retail ratio in order to compute the…

Q: PRETTY Co. has a recent gross profit history of 40% of net sales. These data are taken from the…

A: Gross profit=Net sale×Rate=P 4,500,000×40%=P 1,800,000

Q: Taylor Company uses a periodic inventory system. The following is partial information from its…

A: Beginning inventory = Cost of goods sold + Ending inventory - (Purchases - Purchase returns) Gross…

Q: This information is available for Kingbird, Inc. for 2017, 2018, and 2019. 2017 2018 2019 Beginning…

A: Sales revenue: It is the revenue earned by a business on selling the goods or providing services to…

Q: The following balances were reported by ABC Co. at December 31, 2020 and 2019: 12/31/20 Inventory…

A: First we need to find out purchase from account payable information and then we will calculate the…

Q: Company C had cost of goods sold in the year of sale 2019 of $1,500,000 and net sales was…

A: Inventory Turnover = Cost of Goods Sold/Average Inventory

Q: CAC Co. provided these information for 2020: Inventory - January 1 : P400,000; Freight in :…

A: The gross purchases are calculated by adding the ending inventory in the cost of sales and deducting…

Q: The following balances were reported by ABC Co. at December 31, 2020 and 2019: 12/31/20 P2,600,000…

A: The cost of goods sold is determined by adding the purchases to the beginning balance of inventory…

Q: Bandy’s Barbeque recorded the following financial results: Fiscal year 2020 Fiscal year 2019…

A: Both the raw materials used in production and the final commodities that are ready to sale are…

Q: The following information was available for Concord Company at December 31, 2020: beginning…

A: Inventory turnover = cost of goods sold/Average inventory

Q: ABC Corporation reports the following information for 2020. Based on these figures, what is ABC's…

A: Inventory turnover = Cost of goods sold / Average inventory where, Average inventory = (beginning…

Q: Selected financial statement data from Western Colorado Stores is shown below. 2021 2020 Net sales…

A: Gross profit ratio = Gross profit / sales

Q: Grotesque Company which employed the FIFO retail method provided the following inventory data: 2020…

A: The retail inventory method calculates the ending inventory by multiplying the retail closing stock…

Q: The following information is available for Cullumber Company for three recent fiscal years.…

A: Inventory Turnover Ratio: Inventory Turnover Ratio shows how effectively inventory is managed by…

Q: This information is available for Kingbird, Inc. for 2017, 2018, and 2019. 2017 2018 2019 Beginning…

A: Inventory turnover = cost of goods sold / Average inventory where, Average inventory = (beginning…

Q: Suppose this information is available for PepsiCo, Inc. for 2020, 2021, and 2022. (in millions)…

A: Inventory Turnover Ratio = Cost of goods sold/ Average Inventory Averag Inventory = (Beginning…

Q: The January 28, 2020 (fiscal year 2019) financial statements of Firm C reported the following…

A: Under the FIFO method, the inventory that is purchased first is sold first, hence the ending…

Q: The following information is available for Miguel Company at December 31, 2020: beginning inventory…

A: Ratio analysis is a method of measuring the financial position of the organization with different…

Q: Data taken from the records of XYZ Co. revealed the following for 2020: Inventory - January 1…

A: Gross sales are the sales which are computed by adding gross profit to the cost of goods sold. When…

Q: This information is available for Kingbird, Inc. for 2017, 2018, and 20 2017 2018 2019 Beginning…

A: SOLUTION- FORMULA OF INVENTORY TURNOVER RATIO = COST OF GOOD SOLD/AVERAGE STOCK AVERAGE STOCK =…

Q: acme company had the following records: 2022…

A: The average days in inventory is calculated as average inventory divided by cost of goods sold and…

Q: Emily Corporation reports the following beginning inventory and purchases for 2019 Beginning…

A: FIFO and LIFO are the cost methods used to manage inventories, where FIFO stands for…

Q: Lily Technologies Company reported the following income statement data for a 2-year period.…

A: The income statement is one of the essential part of financial statements used for reporting the…

Q: CAC Co. provided these information for 2020: Inventory - January 1 : P400,000; Freight in :…

A: Hello. Since your question has multiple parts, we will solve the first question for you. If you want…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

- The cost of the inventory on January 31, 2019, under the FIFO method is: a. 400 b. 2,700 c. 3,100 d. 3,200Goods in Transit Gravais Company made two purchases on December 29, 2019. One purchase for 3,000 was shipped FOB destination, and the second for 4,000 was shipped FOB shipping point. Neither purchase had been received nor paid for on December 31, 2019. Required: Which of these purchases, if either, does Gravais include in inventory on December 31, 2019? What is the cost?Inventory Write-Down The inventory records of Frost Company for the years 2019 and 2020 reveal the cost and market of the January 1, 2019, inventory to be 125,000. On December 31, 2019, the cost of inventory was 130,000, while the market value was only 128,000. The December 31, 2020, market value of inventory was 140,000, and the cost was only 135,000. Frost uses a perpetual inventory system. Required: 1. Assume the inventory that existed at the end of 2019 was sold in 2020. Prepare the journal entries at the end of 2019 and 2020 to record the lower of cost or net realizable value under the: a. allowance method b. direct method 2. Show the presentation of cost of goods sold and inventory of Frosts income statement and balance sheet for 2019 and 2020 under the: a. allowance method (assume the cost of goods sold prior to applying the lower of cost or net realizable value rule was 595,000 and 605,000 for 2019 and 2020, respectively) b. direct method

- ( Appendix 6B) Inventory Costing Methods Grencia Company uses a periodic inventory system. For 2018 and 2019, Grencia has the following data (assume all purchases and sales are for cash): Required: 1. Compute cost of goods sold, the cost of ending inventory, and gross margin for each year using FIFO. 2. Compute cost of goods sold, the cost of ending inventory, and gross margin for each year using LIFO. 3. Compute cost of goods sold, the cost of ending inventory, and gross margin for each year using the average cost method. ( Note: Use four decimal places for per unit calculations and round all other numbers to the nearest dollar.) 4. CONCEPTUAL CONNECTION Which method would result in the lowest amount paid for taxes? 5. CONCEPTUAL CONNECTION Which method produces the most realistic amount for income? For inventory? Explain your answer. 6. CONCEPTUAL CONNECTION What is the effect of purchases made later in the year on the gross margin when LIFO is employed? When FIFO is employed? Be sure to explain why any differences occur. 7. CONCEPTUAL CONNECTION If you worked Problem 6-68B, compare your answers. What are the differences? Be sure to explain why any differences occurred.(Appendix 8.1) Inventory Write-Down Frost Companys inventory records tor the years 2019 and 2020 reveal the cost and market of the January 1, 2019, inventory to be 125,000. On December 31, 2019, the cost of inventory was 130,000, while the market value was only 128,000. The December 31, 2020, market value of inventory was 140,000, and the cost was only 135,000. Frost uses a periodic inventory system. Purchases for 2019 were 100,000 and for 2020 were 110,000. Required: 1. Assume the inventory that existed at the end of 2019 was sold in 2020. Prepare the journal entries at the end of 2019 and 2020 to record the lower of cost or net realizable value under the (a) allowance method and (b) direct method. 2. Prepare the cost of goods sold section of the income statement and show how the company would record the inventory on its balance sheet for 2019 and 2020 under the (a) allowance method and (b) direct method. 3. Next Level Refer to your answer for P8-3. How does the use of a periodic inventory system versus a perpetual inventory system affect the valuation of inventory and the amount reported as income?Refer to RE22-2. Assume Heller Company had sales revenue of 510,000 in 2019 and 650,000 in 2020. Prepare Hellers partial income statements (through gross profit) for 2019 and 2020. RE22-2 Heller Company began operations in 2019 and used the LIFO method to compute its 300,000 cost of goods sold for that year. At the beginning of 2020, Heller changed to the FIFO method. Heller determined that its cost of goods sold under FIFO would have been 250,000 in 2019. For 2020, Hellers cost of goods sold under FIFO was 360,000, while it would have been 410,000 under LIFO. Heller is subject to a 21% income tax rate. Compute the cumulative effect of the retrospective adjustment on prior years income (net of taxes) that Heller would report on its retained earnings statement for 2020.

- Inventory Errors McLelland Inc. reported net income of $175,000 for 2019 and $210,000 for 2020. Early in 2020, McLelland discovers that the December 31, 2019 ending inventory was overstated by $20,000. For simplicity, ignore taxes. Required: 1. What is the correct net income for 2019? For 2020? 2. Assuming the error was not corrected, what is the effect on the balance sheet at December 31, 2019? At December 31, 2020?At December 31, 2019, the following information was available from Crisford Companys books: Sales for the year totaled 110,600; markdowns amounted to 1,400. Under the approximate lower of average cost or market retail method, Crisfords inventory at December 31, 2019, was: a. 30,800 b. 28.000 c. 21,560 d. 19,600Comprehensive The following information for 2019 is available for Marino Company: 1. The beginning inventory is 100,000. 2. Purchases returns of 4,000 were made. 3. Purchases of 300,000 were made on terms of 2/10, n/30. Eighty percent of the discounts were taken. 4. At December 31, purchases of 20,000 were in transit, FOB destination, on terms of 2/10, n/30. 5. The company made sales of 640,000. The gross selling price per unit is twice the net cost of each unit sold. 6. Sales allowances of 6,000 were made. 7. The company uses the LIFO periodic method and the gross method for purchase discounts. Required: 1. Compute the cost of the ending inventory before the physical inventory is taken. 2. Compute the amount of the cost of goods sold that came from the purchases of the period and the amount that came from the beginning inventory.

- Use the following information relating to Medinas Company to calculate the inventory turnover ratio, gross margin, and the number of days sales in inventory ratio, for years 2022 and 2023.(Appendix 8.1) Inventory Write-Down The inventories of Berry Company for the years 2019 and 2020 are as follows: Berry uses the periodic inventory method and the FIFO inventory cost flow assumption. Required: 1. Assume the inventory that existed at the end of 2019 was sold in 2020. Prepare the necessary journal entries at the end of each year to record the correct inventory valuation if Berry uses the: a. direct method b. allowance method 2. Next Level Refer to your answer for E8-6. How does the use of a periodic or perpetual inventory system affect the valuation of inventory?Use the following information relating to Clover Company to calculate the inventory turnover ratio, gross margin, and the number of days sales in inventory ratio, for years 2022 and 2023.