Chapter3: Evaluation Of Financial Performance

Section: Chapter Questions

Problem 8P

Related questions

Question

100%

This is an example prioblem. I need help understanding the math that is being done?

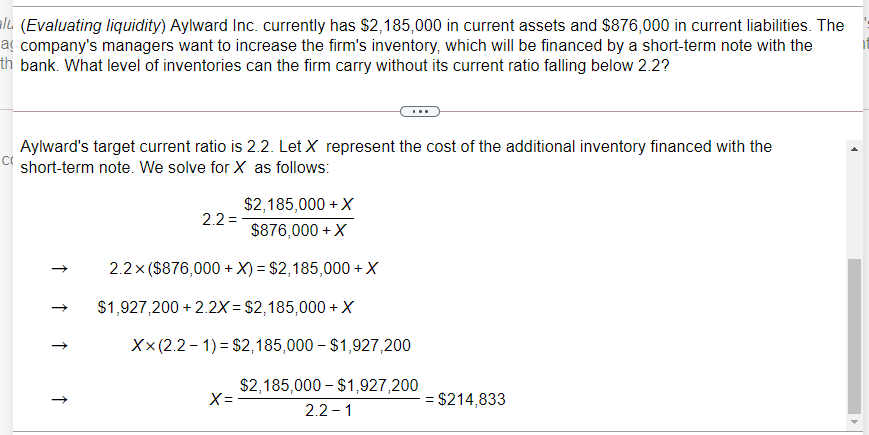

Transcribed Image Text:ale (Evaluating liquidity) Aylward Inc. currently has $2,185,000 in current assets and $876,000 in current liabilities. The

a company's managers want to increase the firm's inventory, which will be financed by a short-term note with the

th bank. What level of inventories can the firm carry without its current ratio falling below 2.2?

Aylward's target current ratio is 2.2. Let X represent the cost of the additional inventory financed with the

short-term note. We solve for X as follows:

$2,185,000 + X

2.2 =

$876,000 + X

2.2x ($876,000 +X) = $2,185,000 +X

$1,927,200 + 2.2X = $2,185,000 +X

X x(2.2 - 1) = $2,185,000 – $1,927,200

$2,185,000 – $1,927,200

X= -

= $214,833

2.2 - 1

↑

↑

Transcribed Image Text:IL (Evaluating liquidity) Aylward Inc. currently has $2,185,000 in current assets and $876,000 in current liabilities. The

aç company's managers want to increase the firm's inventory, which will be financed by a short-term note with the

th bank. What level of inventories can the firm carry without its current ratio falling below 2.2?

« STEP 1: FORMULATE A SOLUTION STRATEGY

Current ratio is defined as:

current assets

Current ratio

current liabilities

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning