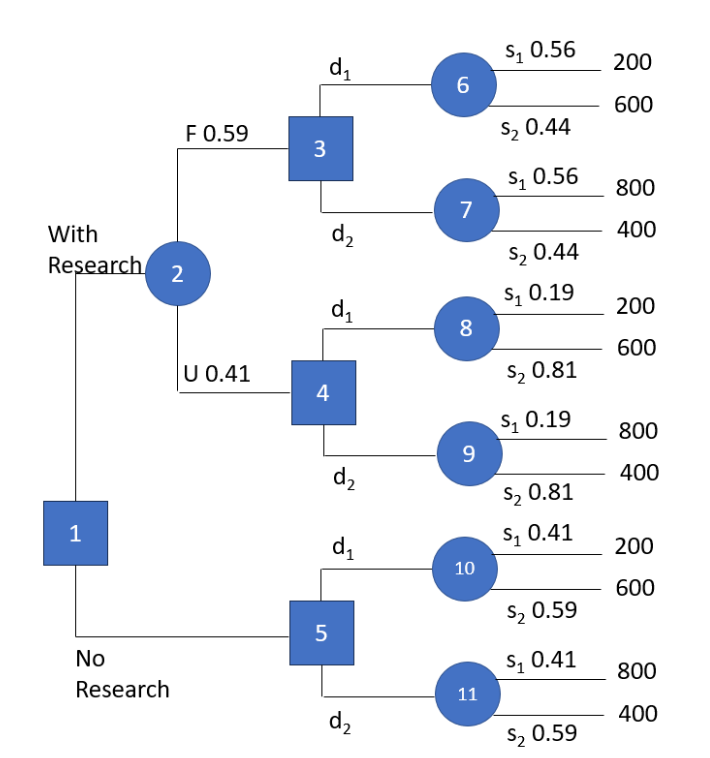

With Research 2 1 No Research F 0.59 U 0.41 d₁ 3 4 LO 5 d₂ d₁ d₂ d₁ d₂ 6 7 8 9 10 11 S₁ 0.56 $₂ 0.44 S₁0.56 $₂ 0.44 S₁ 0.19 $₂ 0.81 S₁ 0.19 $₂ 0.81 S₁ 0.41 $₂ 0.59 S₁ 0.41 $₂0.59 200 600 800 400 200 600 800 400 200 600 800 400

Use the following information to answer questions 1 to 5.

A development corporation purchased land that will be the site of a new luxury condominium complex. Management is considering a six month

1. Favorable report (F): A significant number of the individuals contacted express interest in purchasing a condominium.

2. Unfavorable report (U): Very few of the individuals contacted express interest in purchasing a condo- minium.

After deciding whether to conduct the market research study, they have the following two decision alternatives.

d1 = a small complex with 30 condominiums

d2 = a medium complex with 60 condominiums

Following this, a chance event concerning the demand for the condominiums has two states of nature. s1 = strong demand for the condominiums

s2 = weak demand for the condominiums

The payoffs, probabilities, and decision tree associated with this problem are given on the next page.

Note that payoffs are given in thousands of dollars.

The answer I got is $583,000 (B)

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

This is the question, included with this.

What is the expected profit for this project? (a) $624,000 (b) $583,000 (c) $564, 000 (d) $1,147,000 (e) $573, 500