This is the second time I am asking for help for the following. The first answer I received was not thorough or detailed enough to explain each transaction that needed to be taken and what that transaction/method was. Also there were tons of typos, which made it even more difficult to make sense of the answer I was given. Your thoroughness and a tad better typing skills than the first individual to answer my question would be great!!1) Revenues for 2008= $8,000Dividends declared 2008= $1,000Expenses 2008= $3,000January 1 Retained Earnings= $5,000December 31 Retained Earnings= Unknown2) Revenues for 2008= $3,000Dividends for 2008= $2,000Expenses for 2008= $1,0001/1 Retained Earnings= unknown12/31 Retained Earnings= $6,0003) Revenue 2008= $5,000Dividends 2008= UnknownExpenses 2008= $1,0001/1 Retained Earnings $8,0001231Retained Earnings $3,0004) Revenue 2008= $6,000Dividends 2008=0Expenses 2008= Unknown1/1 Retained Earnings= $12,00012/31 Retained Earnings= $8,0005) Revenue 2008= UnknownDividends 2008= $3,000Expenses 2008= $6,0001/1 Retained Earnings= $8,00012/31 Retained Earnings= $9,000

This is the second time I am asking for help for the following. The first answer I received was not thorough or detailed enough to explain each transaction that needed to be taken and what that transaction/method was. Also there were tons of typos, which made it even more difficult to make sense of the answer I was given. Your thoroughness and a tad better typing skills than the first individual to answer my question would be great!!

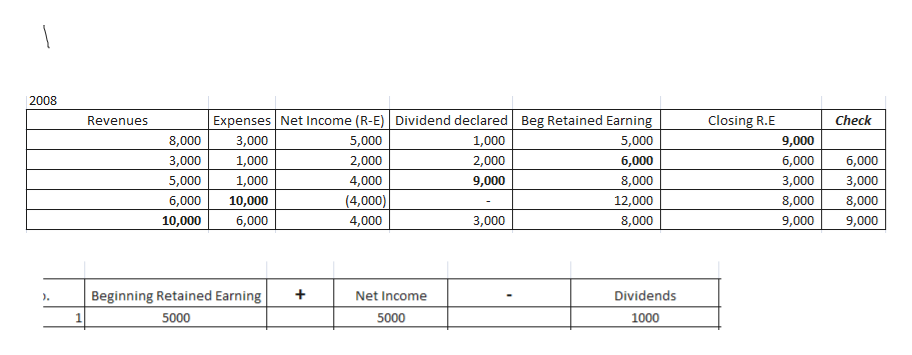

1) Revenues for 2008= $8,000

Dividends declared 2008= $1,000

Expenses 2008= $3,000

January 1

December 31 Retained Earnings= Unknown

2) Revenues for 2008= $3,000

Dividends for 2008= $2,000

Expenses for 2008= $1,000

1/1 Retained Earnings= unknown

12/31 Retained Earnings= $6,000

3) Revenue 2008= $5,000

Dividends 2008= Unknown

Expenses 2008= $1,000

1/1 Retained Earnings $8,000

1231Retained Earnings $3,000

4) Revenue 2008= $6,000

Dividends 2008=0

Expenses 2008= Unknown

1/1 Retained Earnings= $12,000

12/31 Retained Earnings= $8,000

5) Revenue 2008= Unknown

Dividends 2008= $3,000

Expenses 2008= $6,000

1/1 Retained Earnings= $8,000

12/31 Retained Earnings= $9,000

Closing entries in a financial process transfer the balances of all temporary accounts (revenue, expenses and dividends) to the balance of the retained earnings account. Retained Earning is a permanent account representing the accumulation of all revenues, expenses and dividends over the life of the company. Closing entries increase the retained earning by the amount of revenues and decrease retained earning by the amount of expenses and dividends.

Hence: Beginning Retained Earning + Net Income - Dividend = Closing Retained Earnings Equation can be used to solve these parts of the question. Please be mindful of the fact, closing retained earnings become the beginning retained earnings for next year however in this question, we are given subparts to solve for the same year (2008).

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images