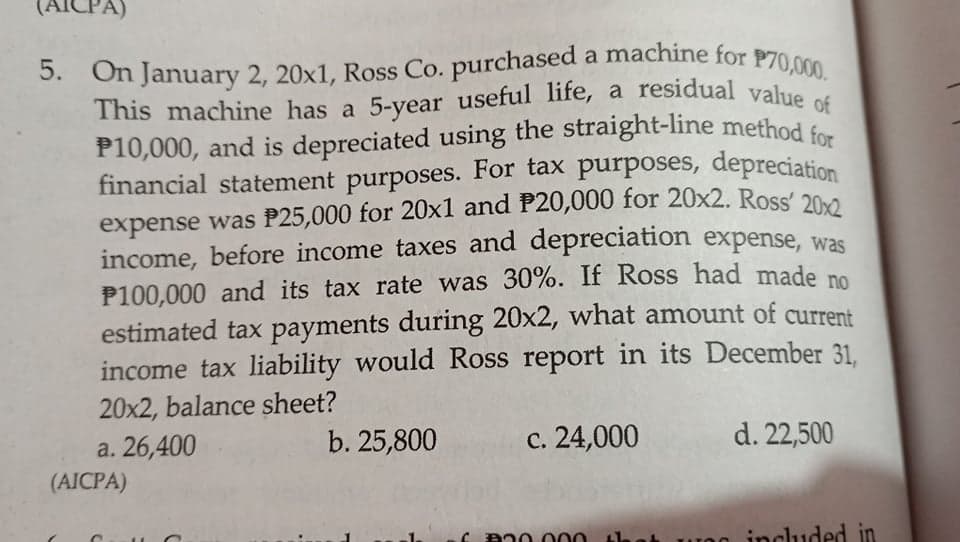

This machine has a 5-year useful life, a residual value of P10,000, and is depreciated using the straight-line method for financial statement purposes. For tax purposes, depreciation expense was P25,000 for 20x1 and P20,000 for 20x2. Ross' 20x2 0,000. 5. On January 2, 20x1, Ross Co. purchas financial statement purposes. For tax purposes, depreciation expense was P25,000 for 20x1 and P20,000 for 20x2. Ross' 20 income, before income taxes and depreciation expense, was P100,000 and its tax rate was 30%. If Ross had made no estimated tax payments during 20x2, what amount of current income tax liability would Ross report in its December 31. 20x2, balance sheet? a. 26,400 b. 25,800 с. 24,000 d. 22,500 (AICPA)

This machine has a 5-year useful life, a residual value of P10,000, and is depreciated using the straight-line method for financial statement purposes. For tax purposes, depreciation expense was P25,000 for 20x1 and P20,000 for 20x2. Ross' 20x2 0,000. 5. On January 2, 20x1, Ross Co. purchas financial statement purposes. For tax purposes, depreciation expense was P25,000 for 20x1 and P20,000 for 20x2. Ross' 20 income, before income taxes and depreciation expense, was P100,000 and its tax rate was 30%. If Ross had made no estimated tax payments during 20x2, what amount of current income tax liability would Ross report in its December 31. 20x2, balance sheet? a. 26,400 b. 25,800 с. 24,000 d. 22,500 (AICPA)

Chapter8: Depreciation, Cost Recovery, Amortization, And Depletion

Section: Chapter Questions

Problem 2BCRQ

Related questions

Question

Transcribed Image Text:P10,000, and is depreciated using the straight-line method for

financial statement purposes. For tax purposes, depreciation

5. On January 2, 20x1, Ross Co. purchased a machine for P70,000.

This machine has a 5-year useful life, a residual value of

(AICPA)

5. On January 2, 20x1, Ross Co. purchased a machine for P70.000

financial statement purposes. For tax purposes, depreciation

expense was P25,000 for 20x1 and P20,000 for 20x2. Ross' 20

income, before income taxes and depreciation expense, was

P100,000 and its tax rate was 30%. If Ross had made no

estimated tax payments during 20x2, what amount of current

income tax liability would Ross report in its December 31.

20x2, balance sheet?

a. 26,400

(AICPA)

b. 25,800

с. 24,000

d. 22,500

a00 000

UO0 included in

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning