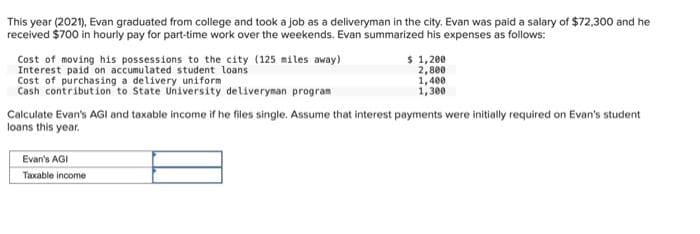

This year (2021), Evan graduated from college and took a job as a deliveryman in the city. Evan was paid a salary of $72,300 and he received $700 in hourly pay for part-time work over the weekends. Evan summarized his expenses as follows: Cost of moving his possessions to the city (125 miles away) Interest paid on accumulated student loans Cost of purchasing a delivery uniform Cash contribution to State University deliveryman program $ 1,200 2,800 1,400 1,300 Calculate Evan's AGI and taxable income if he files single. Assume that interest payments were initially required on Evan's student loans this year. Evan's AGI Taxable income

This year (2021), Evan graduated from college and took a job as a deliveryman in the city. Evan was paid a salary of $72,300 and he received $700 in hourly pay for part-time work over the weekends. Evan summarized his expenses as follows: Cost of moving his possessions to the city (125 miles away) Interest paid on accumulated student loans Cost of purchasing a delivery uniform Cash contribution to State University deliveryman program $ 1,200 2,800 1,400 1,300 Calculate Evan's AGI and taxable income if he files single. Assume that interest payments were initially required on Evan's student loans this year. Evan's AGI Taxable income

Chapter5: Gross Income: Exclusions

Section: Chapter Questions

Problem 34P

Related questions

Question

V19

Transcribed Image Text:This year (2021), Evan graduated from college and took a job as a deliveryman in the city. Evan was paid a salary of $72,300 and he

received $700 in hourly pay for part-time work over the weekends. Evan summarized his expenses as follows:

Cost of moving his possessions to the city (125 miles away)

Interest paid on accumulated student loans

Cost of purchasing a delivery uniform

Cash contribution to State University deliveryman program

$ 1,200

2,800

1,400

1,300

Calculate Evan's AGI and taxable income if he files single. Assume that interest payments were initially required on Evan's student

loans this year.

Evan's AGI

Taxable income

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT