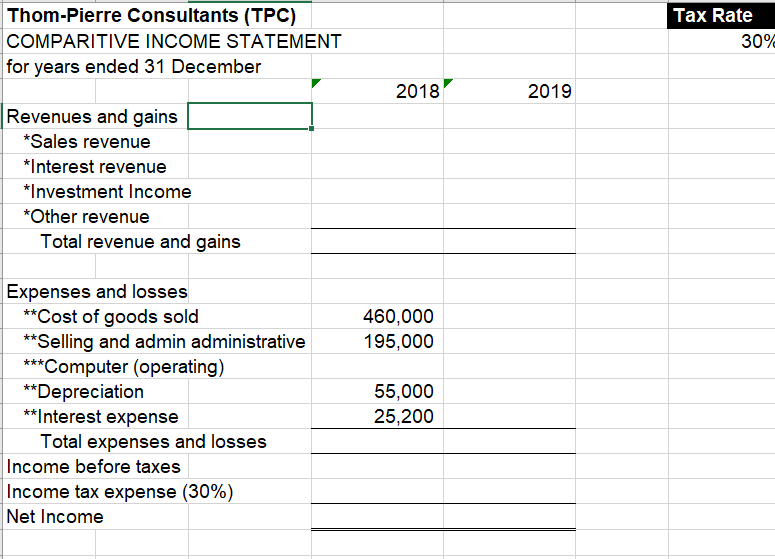

Thom-Pierre Consultants (TPC) Tax Rate COMPARITIVE INCOME STATEMENT 30% for years ended 31 December 2018 2019 Revenues and gains *Sales revenue *Interest revenue *Investment Income *Other revenue Total revenue and gains Expenses and losses **Cost of goods sold **Selling and admin administrative ***Computer (operating) **Depreciation **Interest expense 460,000 195,000 55,000 25,200 Total expenses and losses Income before taxes Income tax expense (30%) Net Income

Please see the attached screenshot and assist kindly.

1. Complete the formulas in cells provided for revenues* for 2019. 2019 revenues have increased by ¾ % over 2018

2. Using the correct function or formula calculate the total revenue and gains in the cells provided. Insert the comment, “Discuss with CEO and Consulting Team” in the cell containing the words “Total revenues and gains”.

3. Complete the formulas in cells provided for expenses for 2019. 2019 expenses** have increased by ¼% over 2018 values with the exception of computer expenses*** which should be used from the “Green Savings” worksheet.

4. Using the correct function or formula calculate the total expenses and losses in the cells

Step by step

Solved in 3 steps