through downturns in business cycles. Temporary current assets fluctuate seasonally or with business cycles. Each firm must devise a financing strategy that best fits its business situation and best manages its risk. In the following table identify the different current asset financing policies. Financing Policy Description All fxed assets, the permanent portion of current assets, and a portion of the temporary component of current assets are covered by long-term debt. The remaining portion of temporary current assets is Aggressive approach covered by short-term financing. Aggressive approach Conservative approach Long-term capital finances al permanent assets, but short-term debt finances temporary current assets Maturity matching approach Some portion of foxed assets and the permanent portion of current assets are financed with long-term capital, and all temporary needs of current assets and the remaining portion of faxed assets are fnanged with short-term loans

through downturns in business cycles. Temporary current assets fluctuate seasonally or with business cycles. Each firm must devise a financing strategy that best fits its business situation and best manages its risk. In the following table identify the different current asset financing policies. Financing Policy Description All fxed assets, the permanent portion of current assets, and a portion of the temporary component of current assets are covered by long-term debt. The remaining portion of temporary current assets is Aggressive approach covered by short-term financing. Aggressive approach Conservative approach Long-term capital finances al permanent assets, but short-term debt finances temporary current assets Maturity matching approach Some portion of foxed assets and the permanent portion of current assets are financed with long-term capital, and all temporary needs of current assets and the remaining portion of faxed assets are fnanged with short-term loans

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter2: Asset And Liability Valuation And Income Recognition

Section: Chapter Questions

Problem 8QE

Related questions

Question

Which usually costs less short term or long term debt?

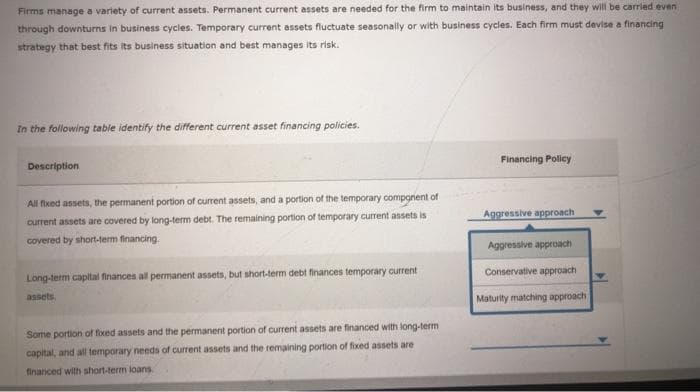

Transcribed Image Text:Firms manage a variety of current assets. Permanent current assets are needed for the ffirm to maintain its business, and they will be carried even

through downturns in business cycles. Temporary current assets fluctuate seasonally or with business cycles. Each firm must devise a financing

strategy that best fits its business situation and best manages its risk.

In the following table identify the different current asset financing policies.

Financing Policy

Description

All fixed assets, the permanent portion of current assets, and a portion of the temporary component of

Aggressive approach

current assets are covered by long-term debt. The remaining portion of temporary current assets is

covered by short-term financing.

Aggressive approach

Conservative approach

Long-term capital finances all permanent assets, but short-term debt finances temporary current

assets

Maturity matching approach

Some portion of fixed assets and the permanent portion of current assets are financed with long-term

capital, and all temporary needs of current assets and the remaining portion of fixed assets are

financed with short-term loans

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning