Time left 0:31 Which one of the following is correct regarding derivative securities? O a. Options obligate investors to buy/sell securities at a specified price over a fixed period. O b. The value of a stock option depends on the market price of the underlying stock. O c. Options are riskier than futures. O d. Calls and puts are the two common types of futures.

Time left 0:31 Which one of the following is correct regarding derivative securities? O a. Options obligate investors to buy/sell securities at a specified price over a fixed period. O b. The value of a stock option depends on the market price of the underlying stock. O c. Options are riskier than futures. O d. Calls and puts are the two common types of futures.

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

ChapterD: Investments

Section: Chapter Questions

Problem D.8EX

Related questions

Question

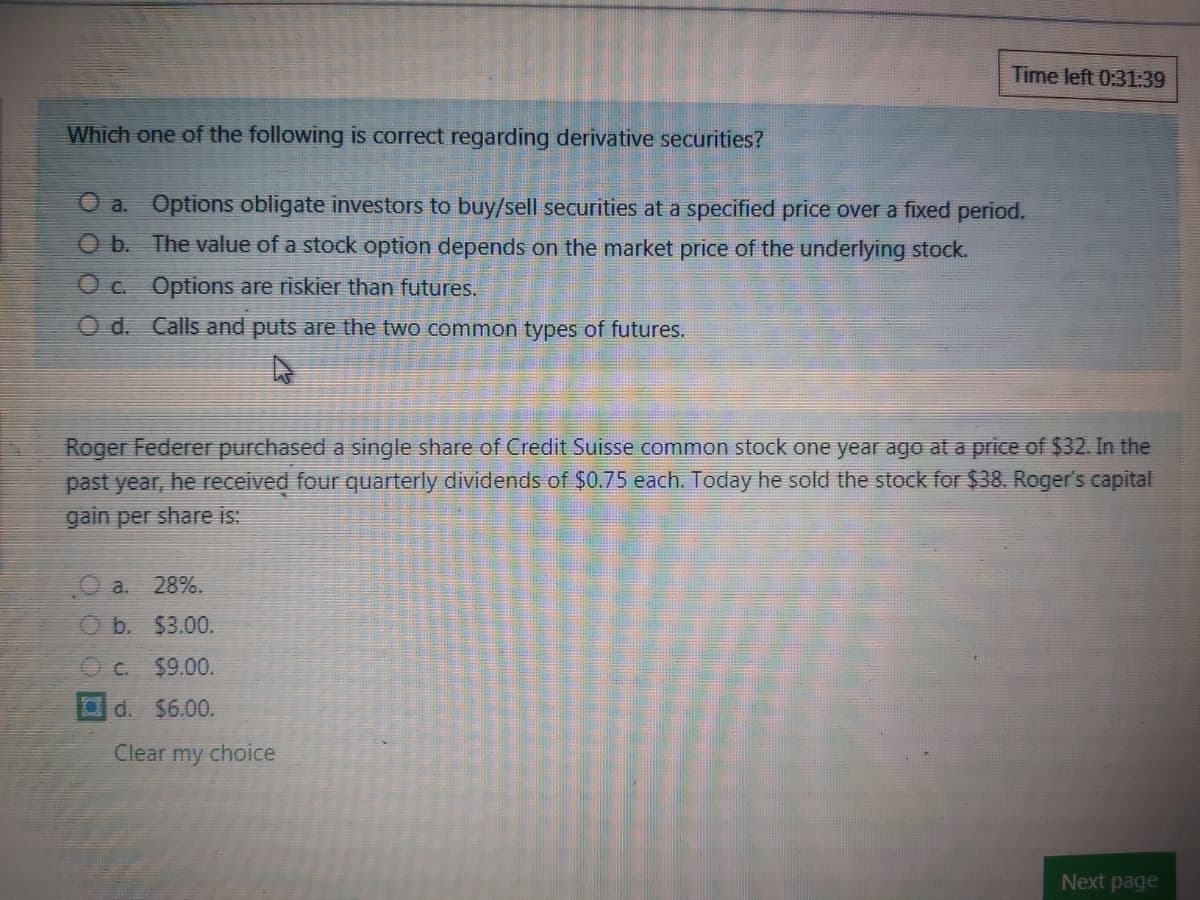

Transcribed Image Text:Time left 0:31:39

Which one of the following is correct regarding derivative securities?

O a. Options obligate investors to buy/sell securities at a specified price over a fixed period.

O b. The value of a stock option depends on the market price of the underlying stock.

O c. Options are riskier than futures.

O d. Calls and puts are the two common types of futures.

Roger Federer purchased a single share of Credit Suisse common stock one year ago at a price of $32. In the

past year, he received four quarterly dividends of $0.75 each. Today he sold the stock for $38. Roger's capital

gain per share is:

O a. 28%.

O b. $3.00.

C.

$9.00.

Od. $6.00.

Clear my choice

Next page

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning