Tina, Lou and Lena are partners sharing profits and losses in the ratio of 2:2:1 and hae capital balances of P400,000, P400,000 and P200,000, respectively. The following independent situations are given to you: a) Rod purchases half of Lena's interest, paying her directly for an amount that eamet for her a profit of P50,000. b) Rod pays P240,000 directly to the partners for a one-fourth share of the partnership. c) Rod pays P100,000 directly to Tina for one third of her share in the partnership Partners agree that it is time to revalue the assets of the partnership using as a basis the amount Rod is willing to pay. Direction: a. How much did Rod pay Lena in situation a? Record the admission of Rod. b. How much is the gain or loss of the partners in situation b? Record Rod's admission. c. How much should the asset revaluation be in situation c? Make two entries and prepare a revised partners' equity.

Tina, Lou and Lena are partners sharing profits and losses in the ratio of 2:2:1 and hae capital balances of P400,000, P400,000 and P200,000, respectively. The following independent situations are given to you: a) Rod purchases half of Lena's interest, paying her directly for an amount that eamet for her a profit of P50,000. b) Rod pays P240,000 directly to the partners for a one-fourth share of the partnership. c) Rod pays P100,000 directly to Tina for one third of her share in the partnership Partners agree that it is time to revalue the assets of the partnership using as a basis the amount Rod is willing to pay. Direction: a. How much did Rod pay Lena in situation a? Record the admission of Rod. b. How much is the gain or loss of the partners in situation b? Record Rod's admission. c. How much should the asset revaluation be in situation c? Make two entries and prepare a revised partners' equity.

Chapter11: Partnerships: Distributions, Transfer Of Interests, And Terminations

Section: Chapter Questions

Problem 39P

Related questions

Question

2. Tina, Lou and Lena are partners sharing

The following independent situations are given to you:

(see attached image for the given. please answer it based on your knowledge. thank you so much)

Direction:

a. How much did Rod pay Lena in situation a? Record the admission of Rod.

b. How much is the gain or loss of the partners in situation b? Record Rod's admission

c. How much should the asset revaluation be in situation c? Make two entries and prepare a revised partners equity.

Transcribed Image Text:agréemen

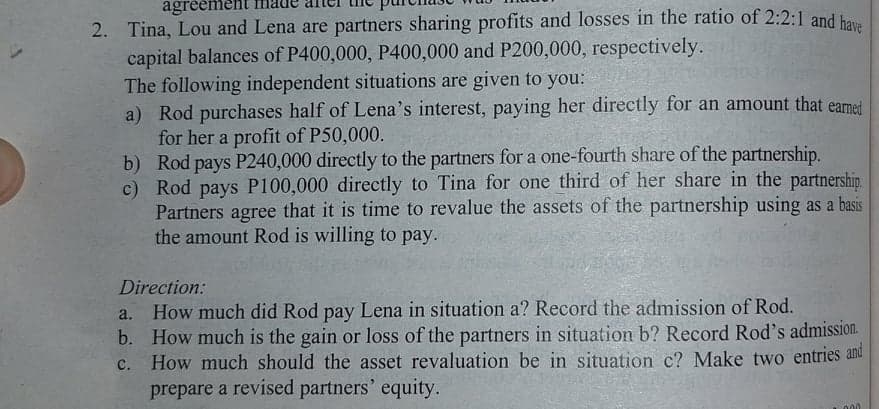

2. Tina, Lou and Lena are partners sharing profits and losses in the ratio of 2:2:1 and ha

capital balances of P400,000, P400,000 and P200,000, respectively.

The following independent situations are given to you:

a) Rod purchases half of Lena's interest, paying her directly for an amount that earmet

for her a profit of P50,000.

b) Rod pays P240,000 directly to the partners for a one-fourth share of the partnership.

c) Rod pays P100,000 directly to Tina for one third of her share in the partnershin.

Partners agree that it is time to revalue the assets of the partnership using as a basis

the amount Rod is willing to pay.

Direction:

How much did Rod pay Lena in situation a? Record the admission of Rod.

b. How much is the gain or loss of the partners in situation b? Record Rod's admission.

How much should the asset revaluation be in situation c? Make two entries and

prepare a revised partners' equity.

a.

C.

000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 8 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT