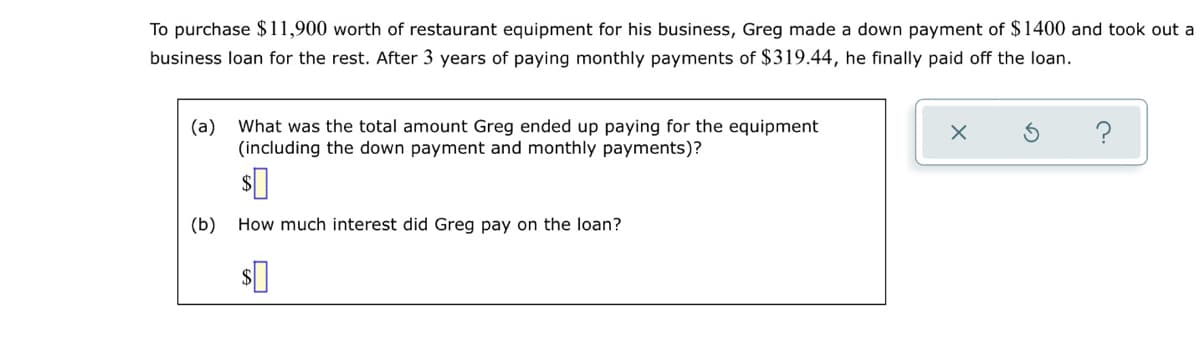

To purchase $ 11,900 worth of restaurant equipment for his business, Greg made a down payment of $1400 and took out a business loan for the rest. After 3 years of paying monthly payments of $319.44, he finally paid off the loan. (a) What was the total amount Greg ended up paying for the equipment (including the down payment and monthly payments)? (b) How much interest did Greg pay on the loan?

Q: nstruction: Show complete solution including the cash flow diagram if not given,Formula function, Fo...

A: The Equivalent Uniform Annual Cost is a term which defines the total cost of an asset which is incur...

Q: w much money will need to invest today e of 6 % and will be withdrawn in 3 year: 5425? 40775 45234 4...

A: Investment today required to achieve the future value would be the present value of future consideri...

Q: Find the term of the following ordinary general annuity. State your answer in years and months (from...

A: Future value (F) = $18,500 Interest rate (r) = 5.40% Number of compounding per year (m) = 4 Periodic...

Q: Preferred stock generally has a lower after-tax cost than debt to the corporation. True or False Tru...

A: Solution:- We know, preferred stock is hybrid form of common stock and debt. They get periodic divid...

Q: Which of the following supply and demand graphs for bonds issued by Company X represents what happen...

A: Default risk is the risk when the issuer of the bond is not able to make timely interest or coupon p...

Q: Find the future value of the following ordinary annuity. Payment Interval Periodic Term Interest Rat...

A: The future value of an ordinary annuity is the value we get after we have made periodic payments and...

Q: Compute the MIRR statistic for Project I if the appropriate cost of capital is 12 percent. (Do not r...

A: Cost of capital = 12% Time Cash flow 0 -11000 1 5330 2 4180 3 1520 4 2000

Q: ZYK company makes its policy that for every new equipment purchased, the annual depreciation should ...

A: When compared to other depreciation methods, double-declining-balance depreciation results in a grea...

Q: Find the term of the following ordinary general annuity. State your answer in years and months (from...

A: Future value of annuity = $18500 Annual payment (A) = $770 Compounding period is quarterly. Hence, ...

Q: Find the future value of the following ordinary annuity. Periodic Payment Payment Interval Term Inte...

A: Periodic payment (P) = $1450 Payment interval is 1 year, hence this payment is annual Interest rate ...

Q: four-year lease agreement requires payments of $20,000 at the beginning of every year. If the intere...

A: Present Value The present value is the value of cash flow stream or the fixed lump sum amount at ti...

Q: Bob Jones bought a new log cabin for $70,000 at 11% interest for 30 years. Prepare an amortization s...

A: The loan which are paid in installments as annuity follows the amortization process in which the pay...

Q: 1. The NPV for each projects 2. The ANPV for each investment projects 3. Payback period for all proj...

A: Net present value (NPV) of an alternative refers to the variance between the initial investment or p...

Q: Suppose a life insurance company sells a $250,000 one-year term life insurance policy to a 24-year-o...

A: Insurance Insurance is a legal agreement between an insurance company (insurer) and a person (insur...

Q: Calculate the project's cash payback period. (Round answer to 2 decimal places, eg. 15.25) Cash payb...

A: Payback period is the period within which the sum invested by the company in a project will be recei...

Q: Return on equity is: the rate of return that owners earn on their investment O the relationship of s...

A: Return on equity can be defined as the earning on the equity as hold by the equity shareholders of t...

Q: hassan has recently opened a margin account. He bought 200 shares of stock in the Abington Corporati...

A: Number of share bought = 200 Share Price = $80 Initial Margin = 70% Maintenance Margin = 30%

Q: Instruction: Solve the following problems on a piece of paper. Show your solution. 1. A man buys a t...

A: The present value of the loan is equal to the sum of the present values of all the future installmen...

Q: An annuity with a cash value of $14,000 earns 5% compounded semi-annually. End-of-period semi-annual...

A: Cash Value = $14,000 Interest Rate = 5% compounded semi annual

Q: The finance charge for this billing cycle is The account balance on the next billing is

A: A credit card is a type of payment card which is issued to the user by banks or financial institutio...

Q: 1. Discuss the issues encountered in Enron Scandal and how the Sarbanes Oxley Act addressed those is...

A: What was the WorldCom scandal? It was the major Accounting related scandal in history in 2002 at Wor...

Q: A contract can be fulfilled by making an immediate payment of $21,100 or equal payments at the end o...

A: As per the information given in the question Immediate payment= $21,100 Equal payment at the end of...

Q: r payoff be? What will your profit be?

A: Pay off refers to the gain or loss that buyers make from trading a stock option. There are three var...

Q: How long will it take to save $2581.00 by making deposits of $227.00 at the end of every month into ...

A: Amount to be saved is $2581.00 Interest rate is 7% compounded monthly Monthly deposit $227 To Find: ...

Q: Annette has just purchased a new home for $562758. She put 25% down and is paying the remainder off ...

A: The present value of the loan is equal to the sum of the present values of all future monthly instal...

Q: You are researching a bind with coupon payments of $90 per year and a face value of $1,000. If the y...

A: Solution:- Bond price is the present value of all the cash inflows receivable from bond discounted a...

Q: price! 13. Stock Valuation and PE Ratio The Blooming Flower Co. has earnings of $3.68 per share. The...

A: The PE ratio for the company can be used to estimate the value of the stock.

Q: George deposits $500 at the end of each quarter for 6 years, in an account paying 12 % compounded qu...

A: An annuity is a type of financial product offered by insurance companies and financial institutions....

Q: Q)You are given the future value of an annuity, A, the monthly payment, R, and the annual interest r...

A: Future Value of Ordinary Annuity means the concept which finds out the sum total of all the cash flo...

Q: City Bank limited is considering setting up an in-hose fintech lab. How do you think City Bank can t...

A: Before Answering this question we need to know the meaning of In-House fintech In-House fintech This...

Q: urance’s stock currently sells for $17.25 a share. It just paid a dividend of $2.42 a share (that is...

A: The prices of stock can be determined based on the constant growth model using constant growth of di...

Q: Anita put up a bank account with an initial deposit of 25, 000. After six months, she deposited thre...

A: Simple interest is applied directly on the principal amount. The formula for calculating simple inte...

Q: What is the amount of Return on Equity? (Round to the nearest 2 decimal places in percentage form)

A: ROE is a profitability ratio in finance. ROE = net income/shareholder's equity

Q: t has decided to build a bridge. that initial cost is estimated to be 60,000,000. the annual mainten...

A: Capitalized cost is present value of all cost that are going to occur in the future in the life of a...

Q: 2. Roman is considering taking out a P10,000 loan from Rolly. He guarantees Rolly P5000 in financial...

A: Stream of cash flows refer to the outflow and inflow of cash over a period of time. In order to calc...

Q: Find the future value of the following ordinary annuity. Periodic Payment Interest Rate Payment Inte...

A: The value of current payment or upcoming flow of payments at any future date when flow of payment te...

Q: A man paid 10% down payment of P1,500,000 for a house and lot this month of January. The rate of int...

A: The present value of the loan is equal to the sum of the present values of all the future installmen...

Q: deposited $10,000 today. He plans to withdraw S700 every year. For how long can she withdraw from th...

A: The present value of future payments will be amount withdrawn each year after deduction interest and...

Q: Which of these two companies is best for investment? Trend Probability Rate of Retrun (Company A) ...

A: We need to calculate expected return rate of return from investment by multiplying the probability w...

Q: te solution and box the fi

A: Since in this question, payments are not given, so we do by assuming it zero coupon discount bond.

Q: In the Heckscher-Ohlin model with intermediate goods in equilibrium international supply chains will...

A: Answer is True We have an Explanation for this Answer The Heckscher-Ohlin theorem implies that if t...

Q: What do you perceive as an immediate threat (or threats) to global corporate finance now? What do yo...

A: Corporate finance is actually concerned with how the businesses also used to fund their operations f...

Q: Expected Return: Discrete Distribution A stock's return has the following distribution: Demand for...

A: Scenario Probability Rate of Return Weak 10.00% -45.00% Below Average 20.00% -8.00% Average 40...

Q: Husband and Wife have two biological children and one adopted child. Now that the adoption is finali...

A: adoption is a process of getting non-biological child of someone else legally.

Q: An investor has two bonds in his portfolio that have a face value of $1,000 and pay an 11% annual co...

A: We need to calculate bond price by using excel PV function. The formula is =-PV(RATE,NPER,PMT,FV)

Q: Annual Percentage Rate 10% Compunding periods per year 12 Effective Annual Rate

A: As per Bartleby honor code, if multiple questions are asked, the expert is required only to solve th...

Q: Jack is considering purchasing a bond that is currently priced at 85.50. After performing a scenario...

A: Effective duration measures the sensitivity of the percentage change in price of a bond against the ...

Q: Compute the future value o

A: Future Value is defined as the amount that is accumulated at some upcoming period of time. The perio...

Q: Economic Profit (or Economic Value Added) is created

A: Economic profit shows the difference between the revenue generated from outputs after meeting all th...

Q: Suppose there are two possible states for the economy over the next year, boom or bust, and these tw...

A: Risk management is used to study the uncertainties in the market and to take corrective action to mi...

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Carlos opens a dry cleaning store during the year. He invests 30,000 of his own money and borrows 60,000 from a local bank. He uses 40,000 of the loan to buy a building and the remaining 20,000 for equipment. During the first year, the store has a loss of 24,000. How much of the loss can Carlos deduct if the loan from the bank is nonrecourse? How much does Carlos have at risk at the end of the first year?To purchase $14,300 worth of restaurant equipment for her business, Kala made a down payment of $1700 and took out a business loan for the rest. After 3 years of paying monthly payments of $383.33, she finally paid off the loan. 1. What was the total amount Kala ended up paying for the equipment (including the down payment and monthly payments)? 2. How much interest did Kala pay on the loan?Kristian purchased a new home for $200,000. He put down $50,000 in cash and took out a mortgage for the rest. At the time of closing, he also paid $1,000 for title insurance, $500 in recording fees, and the bank required that he place $2,500 in an escrow account for property taxes. What is the basis of the home?

- Matt purchased a car for 22,000 he paid 4400 as a down payment and financed the balance at 3.7% compounded monthly for 5 years, A. What is the size of payment made at the end of every month? B. What was the amount of interest for the entire loan?Peggy made a down payment of $400 toward the purchase of new furniture. To pay the balance of the purchase price, she has secured a loan from her bank at 6%/year compounded monthly. Under the terms of her finance agreement, she is required to make payments of $75.32 at the end of each month for 24 months. What was the purchase price of the furnitureGg Ali borrowed $21,500 at 5.00% p.a. from his parents to start a business. In 3 months he repaid $4,500 towards the loan, and in 10 months he repaid $4,200. How much would he have to repay his parents at the end of 15 months to clear the outstanding balance? Use the declining balance method to calculate the last payment.

- Marc has purchased a new car for $15,000. He paid $2,500 as down payment and he paid the balance by a loan from his hometown bank. The loan is to be paid on a monthly basis for two years charging 12 percent interest. How much are the monthly payments? Not excel pleaseTo pay for a $22,300 truck, Jina made a down payment of $4900 and took out a loan for the rest. On the loan, she paid monthly payments of $312.67 for 5 years. (a) What was the total amount Jina ended up paying for the truck (including the down payment and monthly payments)? $ (b) How much interest did Jina pay on the loan?In order to start a small business, Samy borrowed RM40, 000 from a bank. The loan is repaid by monthly installment for five years. The interest charged is 5% on the original balance. (a) Determine the monthly payment. (b) Immediately after paying for three years and six months, he decided to pay off the loan. Using the Rule of 78, calculate the amount he has to pay.

- On June 30, Jeff, who uses the cash method of accounting, borrowed $25,000 from a bank for use in his business Jeff was to repay the loan in one payment with interest on December 30 of the same year. On December 30, he renewed that loan plus the interest due. The new loan was for $27,000. What amount of interest expense can Jeff deduct for the current year?Shantel purchased a car for $22,000; she paid $2200 as a down payment and financed the balance amount at 2.9% compounded monthly for 4 years. a) What is the size of payment made at the end of every month to settle the loan? b) What was the amount of interest charged for the entire loan? c) If Shantel pays an additional $200 per month, how many periods will it take to payoff the load? d) If Shantel pays an additional $200 per month, how much interest will be saved?While buying a new car, Mitchell made a down payment of $1,000 and agreed to make month-end payments of $240 for the next 4 years and 9 months. He was charged an interest rate of 1% compounded semi-annually for the entire term. a. What was the purchase price of the car? b. What was the total amount of interest paid over the term?