to replace the van. What amount should be reported as gain on disposal of the van in the income statement?

to replace the van. What amount should be reported as gain on disposal of the van in the income statement?

Chapter12: Nonrecognition Transactions

Section: Chapter Questions

Problem 47IIP

Related questions

Question

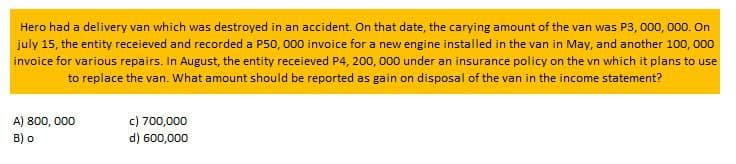

Transcribed Image Text:Hero had a delivery van which was destroyed in an accident. On that date, the carying amount of the van was P3, 000, 000. On

july 15, the entity receieved and recorded a P50, 000 invoice for a new engine installed in the van in May, and another 100, 000

invoice for various repairs. In August, the entity receieved P4, 200, 000 under an insurance policy on the vn which it plans to use

to replace the van. What amount should be reported as gain on disposal of the van in the income statement?

A) 800,000

B) o

c) 700,000

d) 600,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT