To what extent does "Coverage A2 - Loss Assessment" in a Condominium Unit Owners Comprehensive policy cover an assessment against a unit owner? Any covered assessment made by the Condominium Corporation, as additional insurance up to the limit specified on Unit Improvements and Betterments. Any assessment made by the Condominium Corporation as a contribution to cover the deductible in the Condominium Corporation's insurance. Any covered assessment made by the dominium Corporation up to $10,000 or the limit specified in the Unit Owners policy declarations. Any assessment not exceeding $25,000, made in respect of any losses sustained by the Condominium Corporation.

To what extent does "Coverage A2 - Loss Assessment" in a Condominium Unit Owners Comprehensive policy cover an assessment against a unit owner? Any covered assessment made by the Condominium Corporation, as additional insurance up to the limit specified on Unit Improvements and Betterments. Any assessment made by the Condominium Corporation as a contribution to cover the deductible in the Condominium Corporation's insurance. Any covered assessment made by the dominium Corporation up to $10,000 or the limit specified in the Unit Owners policy declarations. Any assessment not exceeding $25,000, made in respect of any losses sustained by the Condominium Corporation.

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter4: Gross Income

Section: Chapter Questions

Problem 1RP

Related questions

Question

Pls help ASAP

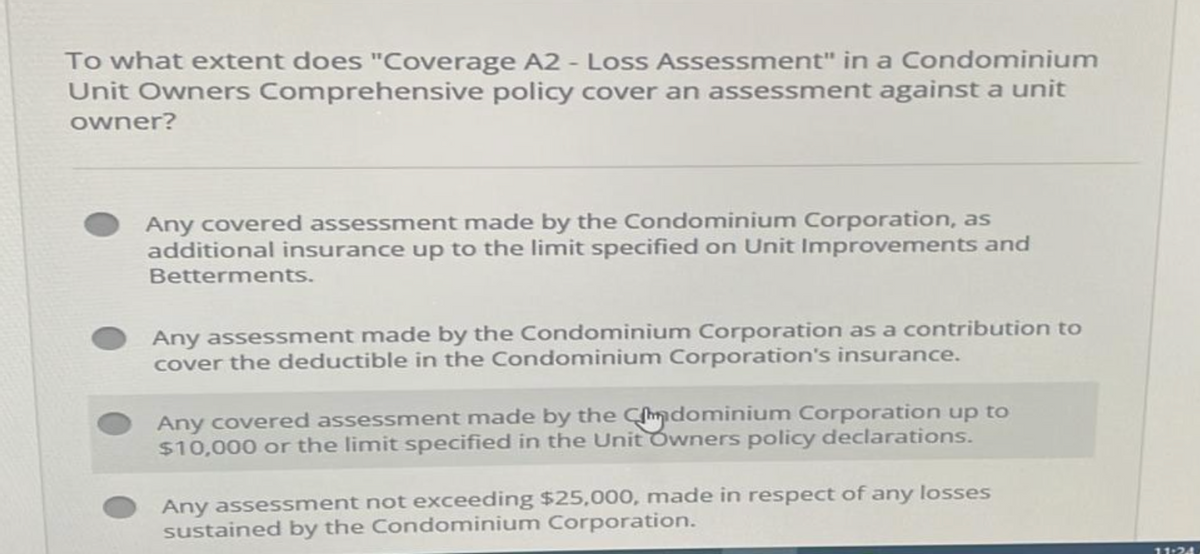

Transcribed Image Text:To what extent does "Coverage A2 - Loss Assessment" in a Condominium

Unit Owners Comprehensive policy cover an assessment against a unit

owner?

Any covered assessment made by the Condominium Corporation, as

additional insurance up to the limit specified on Unit Improvements and

Betterments.

Any assessment made by the Condominium Corporation as a contribution to

cover the deductible in the Condominium Corporation's insurance.

Any covered assessment made by the Cdominium Corporation up to

$10,000 or the limit specified in the Unit Owners policy declarations.

Any assessment not exceeding $25,000, made in respect of any losses

sustained by the Condominium Corporation.

11:24

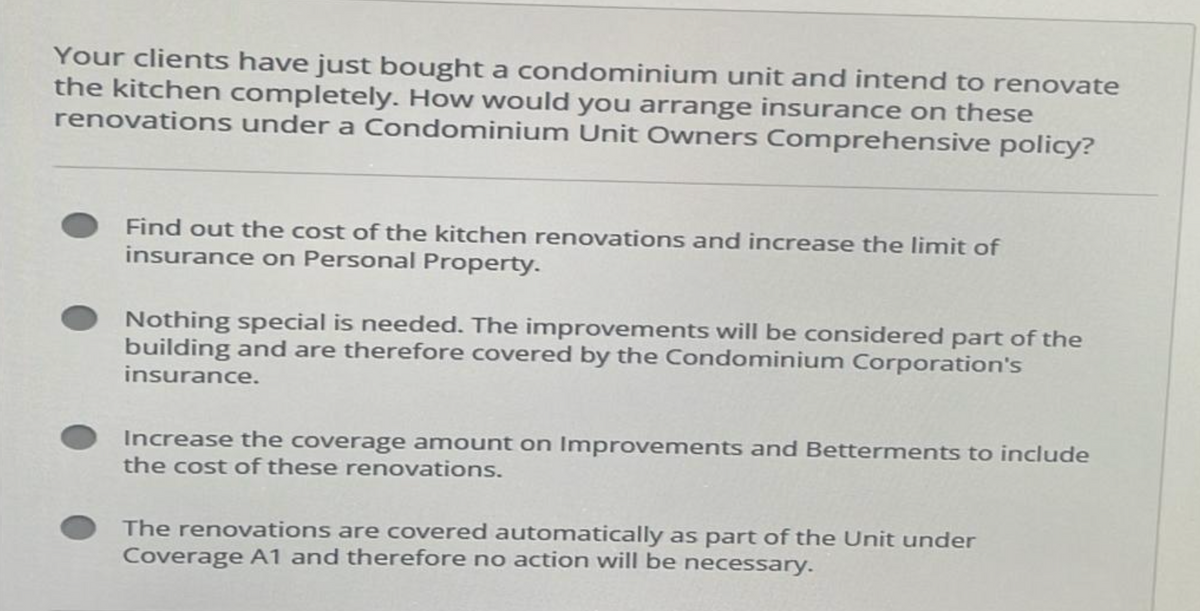

Transcribed Image Text:Your clients have just bought a condominium unit and intend to renovate

the kitchen completely. How would you arrange insurance on these

renovations under a Condominium Unit Owners Comprehensive policy?

Find out the cost of the kitchen renovations and increase the limit of

insurance on Personal Property.

Nothing special is needed. The improvements will be considered part of the

building and are therefore covered by the Condominium Corporation's

insurance.

Increase the coverage amount on Improvements and Betterments to include

the cost of these renovations.

The renovations are covered automatically as part of the Unit under

Coverage A1 and therefore no action will be necessary.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you