to X's defined benefit pension plan: The following Prepaid pension cost at the start of the year Current service cost Interest expense related to plan Actual income on plan assets Past service cost Current year contribution 3) In its current year Balance sheet, what amount should X report as P2,000 19,000 38,000 22,000 52,000 40,000 pension cost? a. 45,000 b. 49,000 C. 67,000 d. 87,000

to X's defined benefit pension plan: The following Prepaid pension cost at the start of the year Current service cost Interest expense related to plan Actual income on plan assets Past service cost Current year contribution 3) In its current year Balance sheet, what amount should X report as P2,000 19,000 38,000 22,000 52,000 40,000 pension cost? a. 45,000 b. 49,000 C. 67,000 d. 87,000

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter19: Accounting For Post Retirement Benefits

Section: Chapter Questions

Problem 9RE: Given the following information for Tyler Companys pension plan at the beginning of the year,...

Related questions

Question

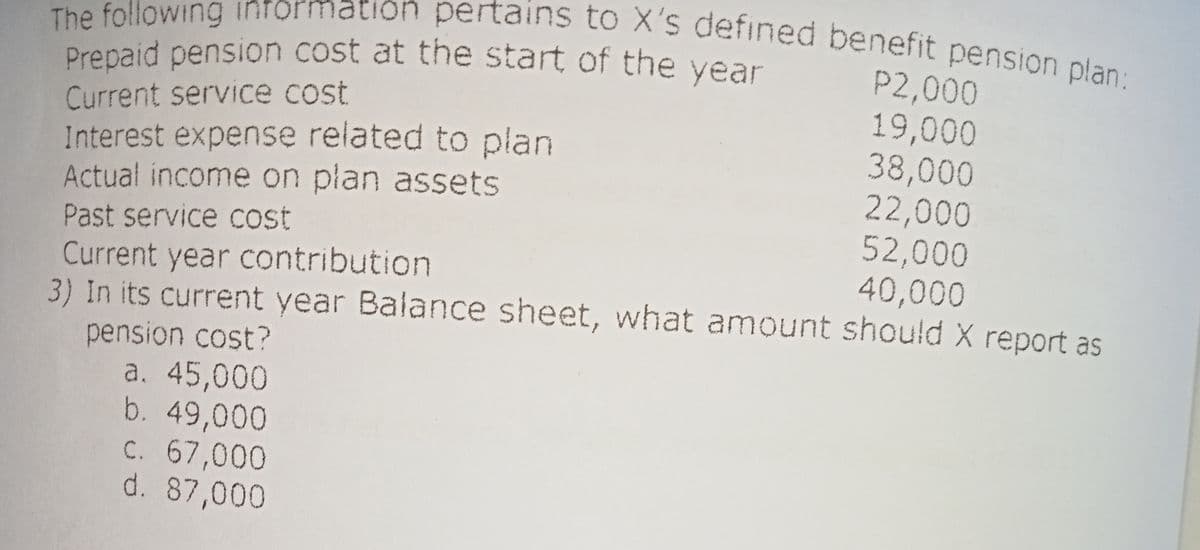

Transcribed Image Text:The following information pertains to X's defined benefit pension plan:

Prepaid pension cost at the start of the year

Current service cost

Interest expense related to plan

Actual income on plan assets

P2,000

19,000

38,000

22,000

52,000

40,000

Past service cost

Current year contribution

3) In its current year Balance sheet, what amount should X report as

pension cost?

a. 45,000

b. 49,000

C. 67,000

d. 87,000

Transcribed Image Text:5) How much benefit is attributed for services rendered by Mr. X?

No.2, Social Security System retirement benefit is an example of a

the period which the benefit is earned by the employee, rather than

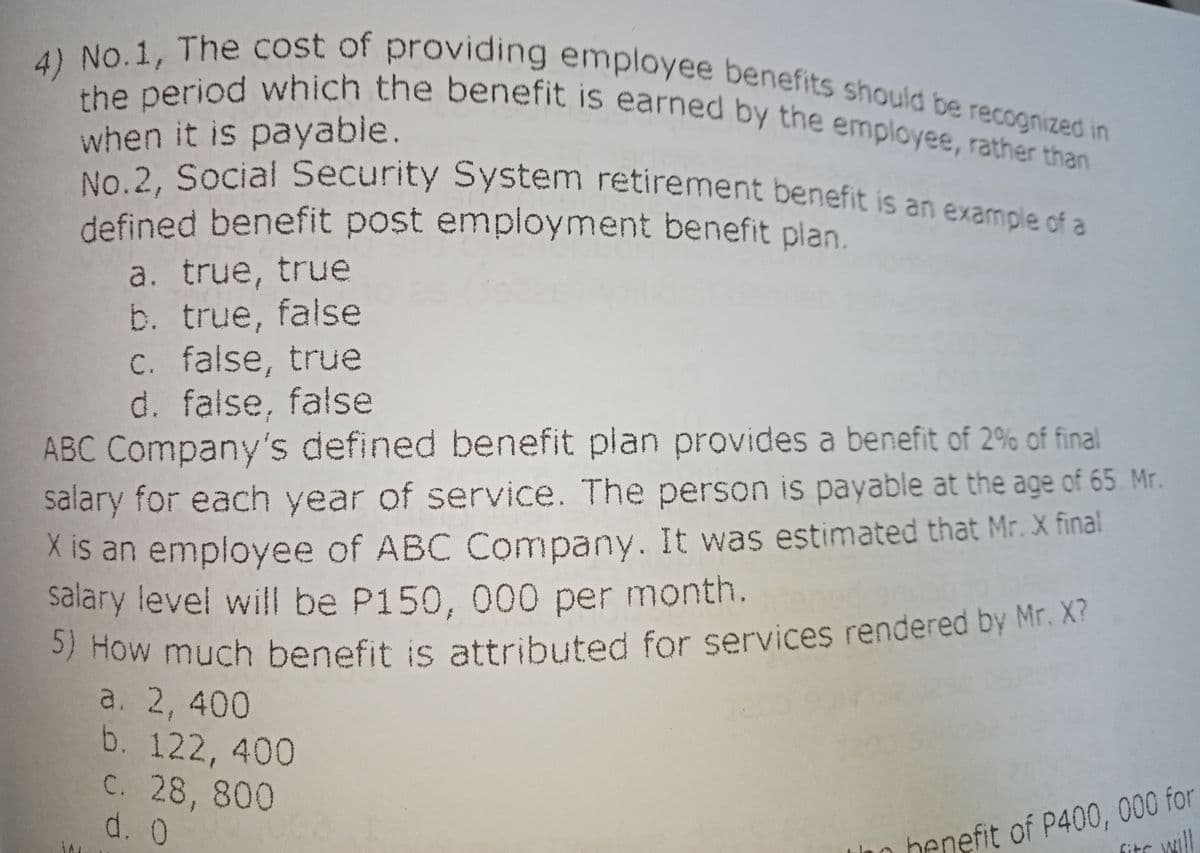

4) No.1, The cost of providing employee benefits should be recognized in

when it is payable.

No 2. Social Security System retirement benefit is an example of a

defined benefit post employment benefit plan.

a. true, true

b. true, false

c. false, true

d. false, false

ABC Company's defined benefit plan provides a benefit of 2% of final

salary for each year of service. The person is payable at the age of 65 Mr.

X is an employee of ABC Company. It was estimated that Mr. X final

salary level will be P150, 000 per month.

/ How much benefit is attributed for services rendered by Mr. X?

a. 2, 400

b. 122, 400

C. 28, 800

d. 0

benefit of P400, 000 for

fits

will

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT