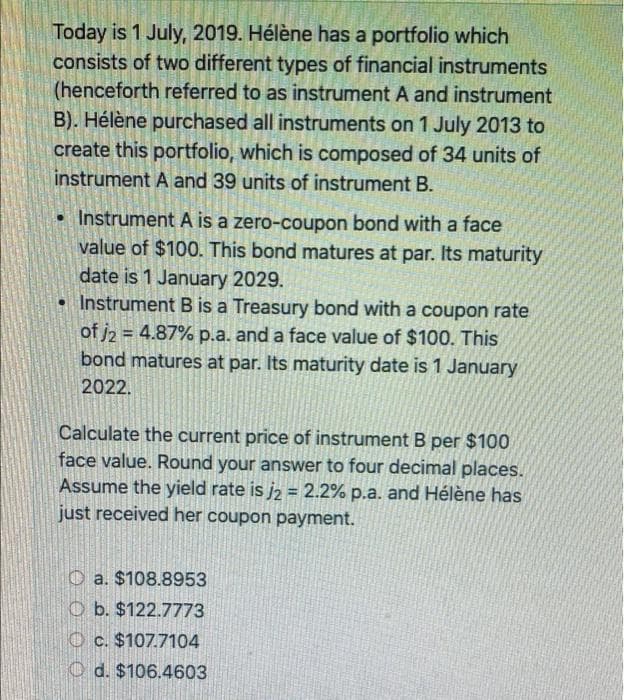

Today is 1 July, 2019. Hélène has a portfolio which consists of two different types of financial instruments (henceforth referred to as instrument A and instrument B). Hélène purchased all instruments on 1 July 2013 to create this portfolio, which is composed of 34 units of instrument A and 39 units of instrument B. • Instrument A is a zero-coupon bond with a face value of $100. This bond matures at par. Its maturity date is 1 January 2029. • Instrument B is a Treasury bond with a coupon rate of j2 = 4.87% p.a. and a face value of $100. This bond matures at par. Its maturity date is 1 January %3D 2022. Calculate the current price of instrument B per $100 face value. Round your answer to four decimal places. Assume the yield rate is j2 = 2.2% p.a. and Hélène has just received her coupon payment. %3D O a. $108.8953 Ob. $122.7773 O c. $107.7104 O d. $106.4603

Today is 1 July, 2019. Hélène has a portfolio which consists of two different types of financial instruments (henceforth referred to as instrument A and instrument B). Hélène purchased all instruments on 1 July 2013 to create this portfolio, which is composed of 34 units of instrument A and 39 units of instrument B. • Instrument A is a zero-coupon bond with a face value of $100. This bond matures at par. Its maturity date is 1 January 2029. • Instrument B is a Treasury bond with a coupon rate of j2 = 4.87% p.a. and a face value of $100. This bond matures at par. Its maturity date is 1 January %3D 2022. Calculate the current price of instrument B per $100 face value. Round your answer to four decimal places. Assume the yield rate is j2 = 2.2% p.a. and Hélène has just received her coupon payment. %3D O a. $108.8953 Ob. $122.7773 O c. $107.7104 O d. $106.4603

Chapter6: Fixed-income Securities: Characteristics And Valuation

Section: Chapter Questions

Problem 9P

Related questions

Question

Transcribed Image Text:Today is 1 July, 2019. Hélène has a portfolio which

consists of two different types of financial instruments

(henceforth referred to as instrument A and instrument

B). Hélène purchased all instruments on 1 July 2013 to

create this portfolio, which is composed of 34 units of

instrument A and 39 units of instrument B.

• Instrument A is a zero-coupon bond with a face

value of $100. This bond matures at par. Its maturity

date is 1 January 2029.

• Instrument B is a Treasury bond with a coupon rate

of j2 = 4.87% p.a. and a face value of $100. This

bond matures at par. Its maturity date is 1 January

2022.

Calculate the current price of instrument B per $100

face value. Round your answer to four decimal places.

Assume the yield rate is j2 = 2.2% p.a. and Hélène has

just received her coupon payment.

O a. $108.8953

O b. $122.7773

O c. $107.7104

O d. $106.4603

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT