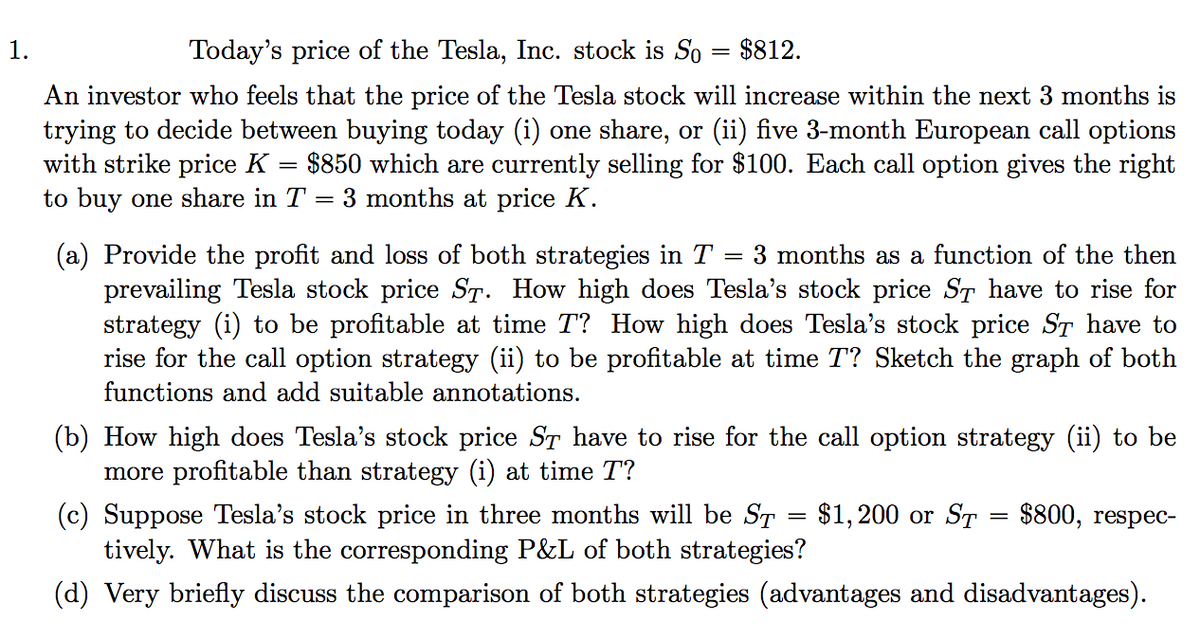

Today's price of the Tesla, Inc. stock is So = $812. An investor who feels that the price of the Tesla stock will increase within the next 3 months is trying to decide between buying today (i) one share, or (ii) five 3-month European call options with strike price K to buy one share in T = 3 months at price K. $850 which are currently selling for $100. Each call option gives the right (a) Provide the profit and loss of both strategies in T = prevailing Tesla stock price ST. How high does Tesla's stock price ST have to rise for strategy (i) to be profitable at time T? How high does Tesla's stock price ST have to rise for the call option strategy (ii) to be profitable at time T? Sketch the graph of both 3 months as a function of the then functions and add suitable annotations. (b) How high does Tesla's stock price ST have to rise for the call option strategy (ii) to be more profitable than strategy (i) at time T? (c) Suppose Tesla's stock price in three months will be ST = $1,200 or ST = $800, respec- tively. What is the corresponding P&L of both strategies? (d) Very briefly discuss the comparison of both strategies (advantages and disadvantages).

Today's price of the Tesla, Inc. stock is So = $812. An investor who feels that the price of the Tesla stock will increase within the next 3 months is trying to decide between buying today (i) one share, or (ii) five 3-month European call options with strike price K to buy one share in T = 3 months at price K. $850 which are currently selling for $100. Each call option gives the right (a) Provide the profit and loss of both strategies in T = prevailing Tesla stock price ST. How high does Tesla's stock price ST have to rise for strategy (i) to be profitable at time T? How high does Tesla's stock price ST have to rise for the call option strategy (ii) to be profitable at time T? Sketch the graph of both 3 months as a function of the then functions and add suitable annotations. (b) How high does Tesla's stock price ST have to rise for the call option strategy (ii) to be more profitable than strategy (i) at time T? (c) Suppose Tesla's stock price in three months will be ST = $1,200 or ST = $800, respec- tively. What is the corresponding P&L of both strategies? (d) Very briefly discuss the comparison of both strategies (advantages and disadvantages).

Chapter7: Common Stock: Characteristics, Valuation, And Issuance

Section: Chapter Questions

Problem 23P

Related questions

Question

Only Part C

Transcribed Image Text:1.

Today's price of the Tesla, Inc. stock is So

$812.

An investor who feels that the price of the Tesla stock will increase within the next 3 months is

trying to decide between buying today (i) one share, or (ii) five 3-month European call options

with strike price K

to buy one share in T = 3 months at price K.

$850 which are currently selling for $100. Each call option gives the right

(a) Provide the profit and loss of both strategies in T

prevailing Tesla stock price ST. How high does Tesla's stock price ST have to rise for

strategy (i) to be profitable at time T? How high does Tesla's stock price ST have to

rise for the call option strategy (ii) to be profitable at time T? Sketch the graph of both

3 months as a function of the then

functions and add suitable annotations.

(b) How

more profitable than strategy (i) at time T?

(c) Suppose Tesla's stock price in three months will be ST

tively. What is the corresponding P&L of both strategies?

igh does Tesla's stock price ST have to rise for the call option strategy (ii) to be

$1, 200 or ST

$800, respec-

(d) Very briefly discuss the comparison of both strategies (advantages and disadvantages).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning