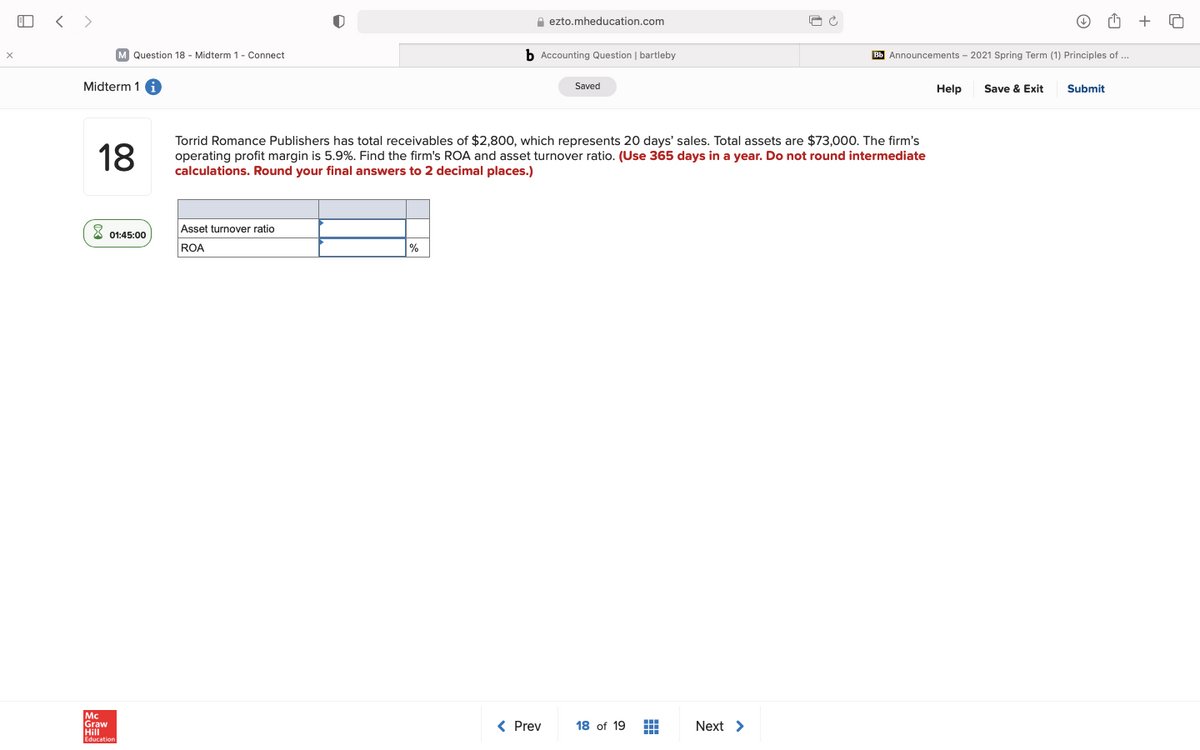

Torrid Romance Publishers has total receivables of $2,800, which represents 20 days' sales. Total assets are $73,000. The firm's operating profit margin is 5.9%. Find the firm's ROA and asset turnover ratio. (Use 365 days in a year. Do not round intermediate calculations. Round your final answers to 2 decimal places.)

Torrid Romance Publishers has total receivables of $2,800, which represents 20 days' sales. Total assets are $73,000. The firm's operating profit margin is 5.9%. Find the firm's ROA and asset turnover ratio. (Use 365 days in a year. Do not round intermediate calculations. Round your final answers to 2 decimal places.)

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter1: Accounting And The Financial Statements

Section: Chapter Questions

Problem 46E: OBJECTIVE 6 Exercise 1-46 Income Statement ERS Inc. maintains and repairs office equipment. ERS had...

Related questions

Question

Transcribed Image Text:< >

A ezto.mheducation.com

M Question 18 - Midterm 1- Connect

b Accounting Question | bartleby

Bb Announcements - 2021 Spring Term (1) Principles of ..

Midterm 1

Saved

Help

Save & Exit

Submit

18

Torrid Romance Publishers has total receivables of $2,800, which represents 20 days' sales. Total assets are $73,000. The firm's

operating profit margin is 5.9%. Find the firm's ROA and asset turnover ratio. (Use 365 days in a year. Do not round intermediate

calculations. Round your final answers to 2 decimal places.)

X 01:45:00

Asset turnover ratio

ROA

%

Mc

Graw

Hill

< Prev

18 of 19

Next >

Education

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub