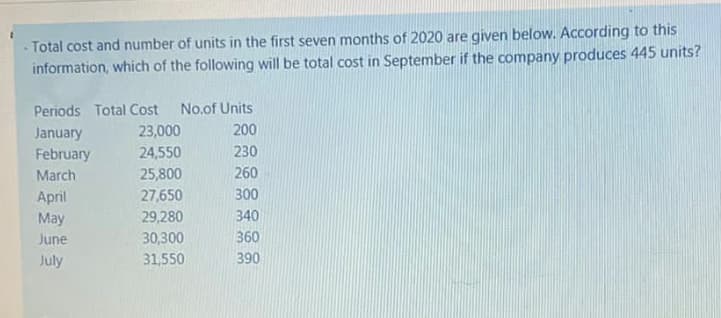

Total cost and number of units in the first seven months of 2020 are given below. According to this information, which of the following will be total cost in September if the company produces 445 units? Periods Total Cost No.of Units 23,000 200 January February 24,550 230 March 25,800 260 April 27,650 300 May 29,280 340 June 30,300 360 July 31,550 390

Total cost and number of units in the first seven months of 2020 are given below. According to this information, which of the following will be total cost in September if the company produces 445 units? Periods Total Cost No.of Units 23,000 200 January February 24,550 230 March 25,800 260 April 27,650 300 May 29,280 340 June 30,300 360 July 31,550 390

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.23E: Unusual income statement items Assume that the amount of each of the following items is material to...

Related questions

Question

Transcribed Image Text:Total cost and number of units in the first seven months of 2020 are given below. According to this

information, which of the following will be total cost in September if the company produces 445 units?

Periods Total Cost

No.of Units

23,000

200

January

February

24,550

230

March

25,800

260

April

27,650

300

29,280

30,300

May

340

June

360

July

31,550

390

Transcribed Image Text:if you have the following information

Sales

250,000

Cost of goods sold

260,000

Gross loss

(10000)

Operating expenses

80,000

Deprecation

20,000

Net loss

(110000)

The following accounts increase

Accounts receivable

22000

land

18000

Accounts payable

35000

building

47000

Long term investment

15000

The following accounts decrease :

bonds

24000

Rent payable

28000

Common stock

35000

The cash flows from investing activities is:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning