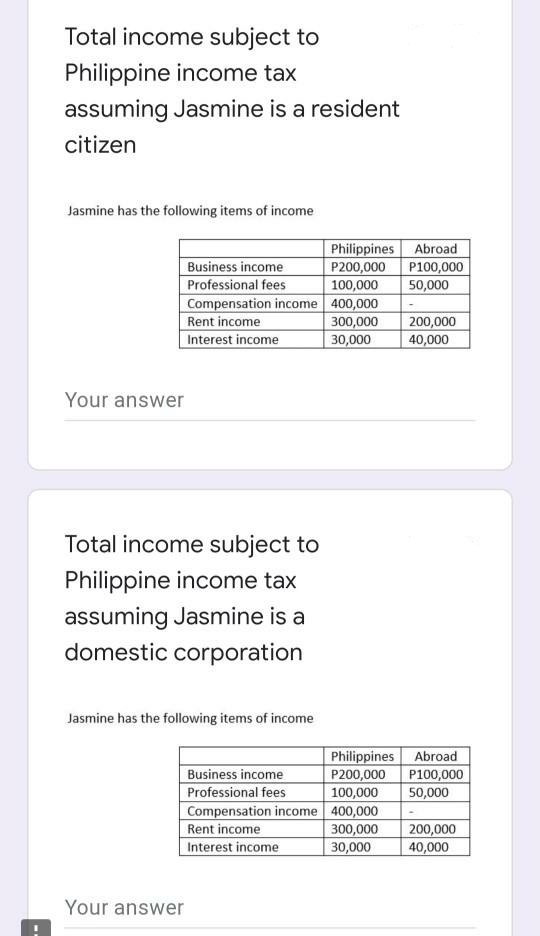

Total income subject to Philippine income tax assuming Jasmine is a resident citizen Jasmine has the following items of income Business income Professional fees Compensation income 400,000 Philippines Abroad P200,000 100,000 P100,000 50,000 Rent income Interest income 300,000 30,000 200,000 40,000

Total income subject to Philippine income tax assuming Jasmine is a resident citizen Jasmine has the following items of income Business income Professional fees Compensation income 400,000 Philippines Abroad P200,000 100,000 P100,000 50,000 Rent income Interest income 300,000 30,000 200,000 40,000

Chapter20: Corporations And Parterships

Section: Chapter Questions

Problem 6DQ

Related questions

Question

Transcribed Image Text:Total income subject to

Philippine income tax

assuming Jasmine is a resident

citizen

Jasmine has the following items of income

Philippines Abroad

P100,000

50,000

Business income

Professional fees

Compensation income 400,000

Rent income

Interest income

P200,000

100,000

300,000

30,000

200,000

40,000

Your answer

Total income subject to

Philippine income tax

assuming Jasmine is a

domestic corporation

Jasmine has the following items of income

Philippines Abroad

P100,000

50,000

Business income

Professional fees

Compensation income 400,000

Rent income

Interest income

P200,000

100,000

300,000

30,000

200,000

40,000

Your answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you