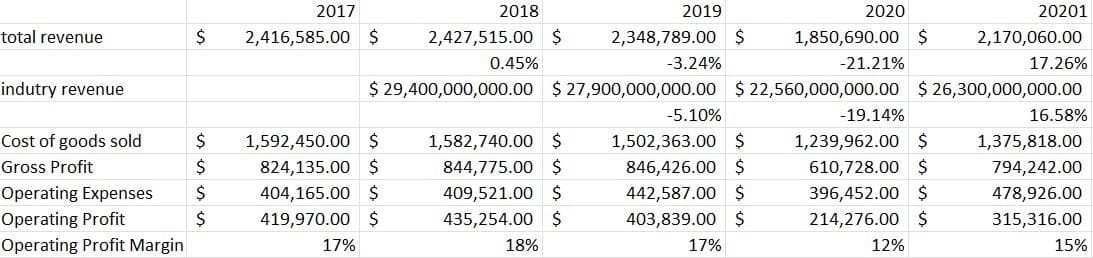

total revenue indutry revenue Cost of goods sold Gross Profit Operating Expenses Operating Profit Operating Profit Margin $ $ $ $ $ 2017 2,416,585.00 $ 1,592,450.00 $ 824,135.00 $ 404,165.00 $ 419,970.00 $ 17% 2018 2,427,515.00 $ 0.45% 2019 1,582,740.00 $ 844,775.00 $ 409,521.00 $ 435,254.00 $ 18% 2,348,789.00 $ -3.24% $ 29,400,000,000.00 $ 27,900,000,000.00 $ 22,560,000,000.00 $ 26,300,000,000.00 -5.10% 1,502,363.00 $ 846,426.00 $ 442,587.00 $ 403,839.00 $ 2020 17% 1,850,690.00 $ -21.21% -19.14% 1,239,962.00 $ 610,728.00 $ 396,452.00 $ 214,276.00 $ 20201 2,170,060.00 17.26% 12% 16.58% 1,375,818.00 794,242.00 478,926.00 315,316.00 15%

total revenue indutry revenue Cost of goods sold Gross Profit Operating Expenses Operating Profit Operating Profit Margin $ $ $ $ $ 2017 2,416,585.00 $ 1,592,450.00 $ 824,135.00 $ 404,165.00 $ 419,970.00 $ 17% 2018 2,427,515.00 $ 0.45% 2019 1,582,740.00 $ 844,775.00 $ 409,521.00 $ 435,254.00 $ 18% 2,348,789.00 $ -3.24% $ 29,400,000,000.00 $ 27,900,000,000.00 $ 22,560,000,000.00 $ 26,300,000,000.00 -5.10% 1,502,363.00 $ 846,426.00 $ 442,587.00 $ 403,839.00 $ 2020 17% 1,850,690.00 $ -21.21% -19.14% 1,239,962.00 $ 610,728.00 $ 396,452.00 $ 214,276.00 $ 20201 2,170,060.00 17.26% 12% 16.58% 1,375,818.00 794,242.00 478,926.00 315,316.00 15%

Chapter5: Operating Activities: Purchases And Cash Payments

Section: Chapter Questions

Problem 1.6C

Related questions

Question

Ma4.

Hello,

Please analyze this firm's performance if the revenue is increasing or decreasing compared to the industry average or if the profitability is stable or rising. Please include if the company needs to create or capture value or if they are creating or capturing value.

Transcribed Image Text:total revenue

indutry revenue

Cost of goods sold

Gross Profit

Operating Expenses

Operating Profit

Operating Profit Margin

$

$

$

$

Ś

2017

2,416,585.00 $

1,592,450.00 $

824,135.00 $

404,165.00 $

419,970.00 $

17%

2018

2,427,515.00 $ 2,348,789.00 $

-3.24%

0.45%

2019

1,582,740.00 $

844,775.00 $

409,521.00 $

435,254.00 $

18%

$ 29,400,000,000.00 $ 27,900,000,000.00 $ 22,560,000,000.00 $ 26,300,000,000.00

-5.10%

1,502,363.00 $

846,426.00 $

442,587.00 $

403,839.00 $

2020

17%

1,850,690.00 $ 2,170,060.00

-21.21%

17.26%

20201

-19.14%

1,239,962.00 $

610,728.00 $

396,452.00 $

214,276.00 $

12%

16.58%

1,375,818.00

794,242.00

478,926.00

315,316.00

15%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning