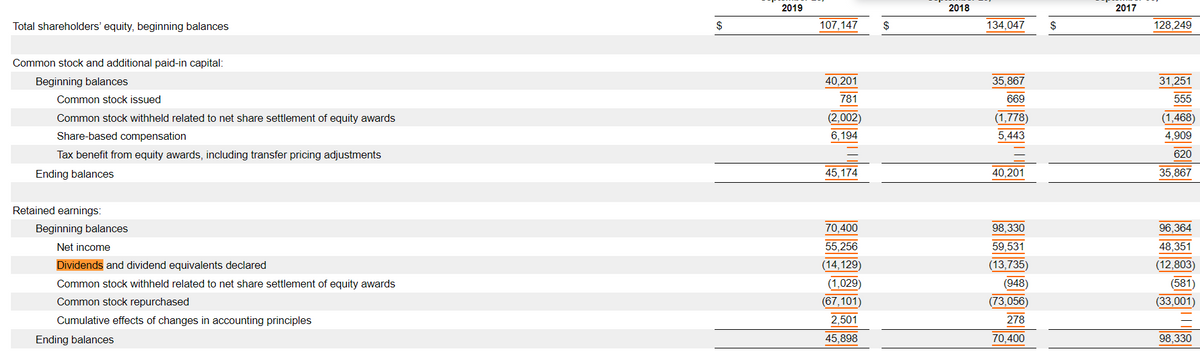

Total shareholders' equity, beginning balances Common stock and additional paid-in capital: Beginning balances Common stock issued Common stock withheld related to net share settlement of equity awards Share-based compensation. Tax benefit from equity awards, including transfer pricing adjustments Ending balances Retained earnings: Beginning balances Net income Dividends and dividend equivalents declared Common stock withheld related to net share settlement of equity awards Common stock repurchased Cumulative effects of changes in accounting principles Ending balances $ 2019 107,147 40,201 781 (2,002) 6,194 45,174 70,400 55,256 (14,129) (1,029) (67,101) 2,501 45,898 $ 2018 134,047 35,867 669 (1,778) 5,443 40,201 98,330 59,531 (13,735) (948) (73,056) 278 70,400 $ 2017 128,249 31,251 555 (1,468) 4,909 620 35,867 96,364 48,351 (12,803) (581) (33,001) 98,330

Total shareholders' equity, beginning balances Common stock and additional paid-in capital: Beginning balances Common stock issued Common stock withheld related to net share settlement of equity awards Share-based compensation. Tax benefit from equity awards, including transfer pricing adjustments Ending balances Retained earnings: Beginning balances Net income Dividends and dividend equivalents declared Common stock withheld related to net share settlement of equity awards Common stock repurchased Cumulative effects of changes in accounting principles Ending balances $ 2019 107,147 40,201 781 (2,002) 6,194 45,174 70,400 55,256 (14,129) (1,029) (67,101) 2,501 45,898 $ 2018 134,047 35,867 669 (1,778) 5,443 40,201 98,330 59,531 (13,735) (948) (73,056) 278 70,400 $ 2017 128,249 31,251 555 (1,468) 4,909 620 35,867 96,364 48,351 (12,803) (581) (33,001) 98,330

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter7: Financial Activities

Section: Chapter Questions

Problem 1QE

Related questions

Question

calculate the dividend payout?

Transcribed Image Text:Total shareholders' equity, beginning balances

Common stock and additional paid-in capital:

Beginning balances

Common stock issued

Common stock withheld related to net share settlement of equity awards

Share-based compensation

Tax benefit from equity awards, including transfer pricing adjustments

Ending balances

Retained earnings:

Beginning balances

Net income

Dividends and dividend equivalents declared

Common stock withheld related to net share settlement of equity awards

Common stock repurchased

Cumulative effects of changes in accounting principles

Ending balances

$

2019

107,147

40,201

781

(2,002)

6,194

45,174

70,400

55,256

(14,129)

(1,029)

(67,101)

2,501

45,898

$

2018

134,047

35,867

669

(1,778)

5,443

40,201

98,330

59,531

(13,735)

(948)

(73,056)

278

70,400

$

2017

128,249

31,251

555

(1,468)

4,909

620

35,867

96,364

48,351

(12,803)

(581)

(33,001)

98,330

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning