Totals Dirt Bikes Mountain Bikes Racing Bikes Sales Variable manufacturing and selling expenses Contribution margin (loss) Traceable fixed expenses: Advertising, traceable Depreciation of special equipment Salaries of the product line managers Total traceable fixed expenses Product line segment margin (loss) Common fixed expenses Net operating income (loss) 0 $ 이 $ olo %24

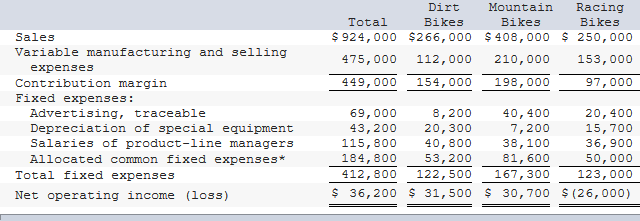

The Regal Cycle Company manufactures three types of bicycles: a dirt bike, a mountain bike, and a racing bike.

Management is concerned about the continued losses shown by the racing bikes and wants a recommendation as to whether or not the line should be discontinued. The special equipment used to produce racing bikes has no resale value and does not wear out.

Required:

1. What is the financial advantage (disadvantage) per quarter of discontinuing the Racing Bikes?

2. Should the production and sale of racing bikes be discontinued?

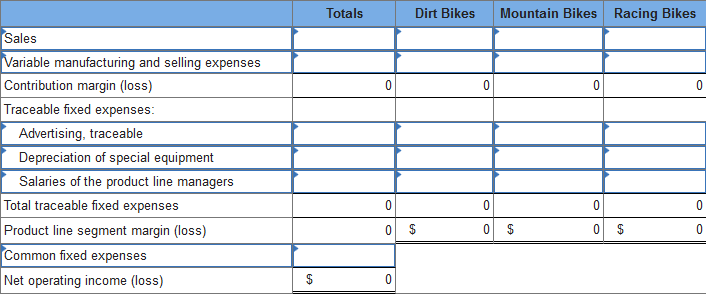

3. Prepare a properly formatted segmented income statement that would be more useful to management in assessing the long-run profitability of the various product lines.

Trending now

This is a popular solution!

Step by step

Solved in 6 steps