tra lech, a phone accessories manufacturer, has presented you with the following financial information for the y ending March 31, 2023: Office salaries Provision for unrealised profits Debtors Purchases of other finished goods 54,300 107,150 82,450 8,100

tra lech, a phone accessories manufacturer, has presented you with the following financial information for the y ending March 31, 2023: Office salaries Provision for unrealised profits Debtors Purchases of other finished goods 54,300 107,150 82,450 8,100

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter10: Accounting Systems For Manufacturing Operations

Section: Chapter Questions

Problem 10.3E: Classifying costs as factory overhead Which of the following items are properly classified as part...

Related questions

Question

make the manufacturing account and statement of profit or loss

Do not give solution in image format

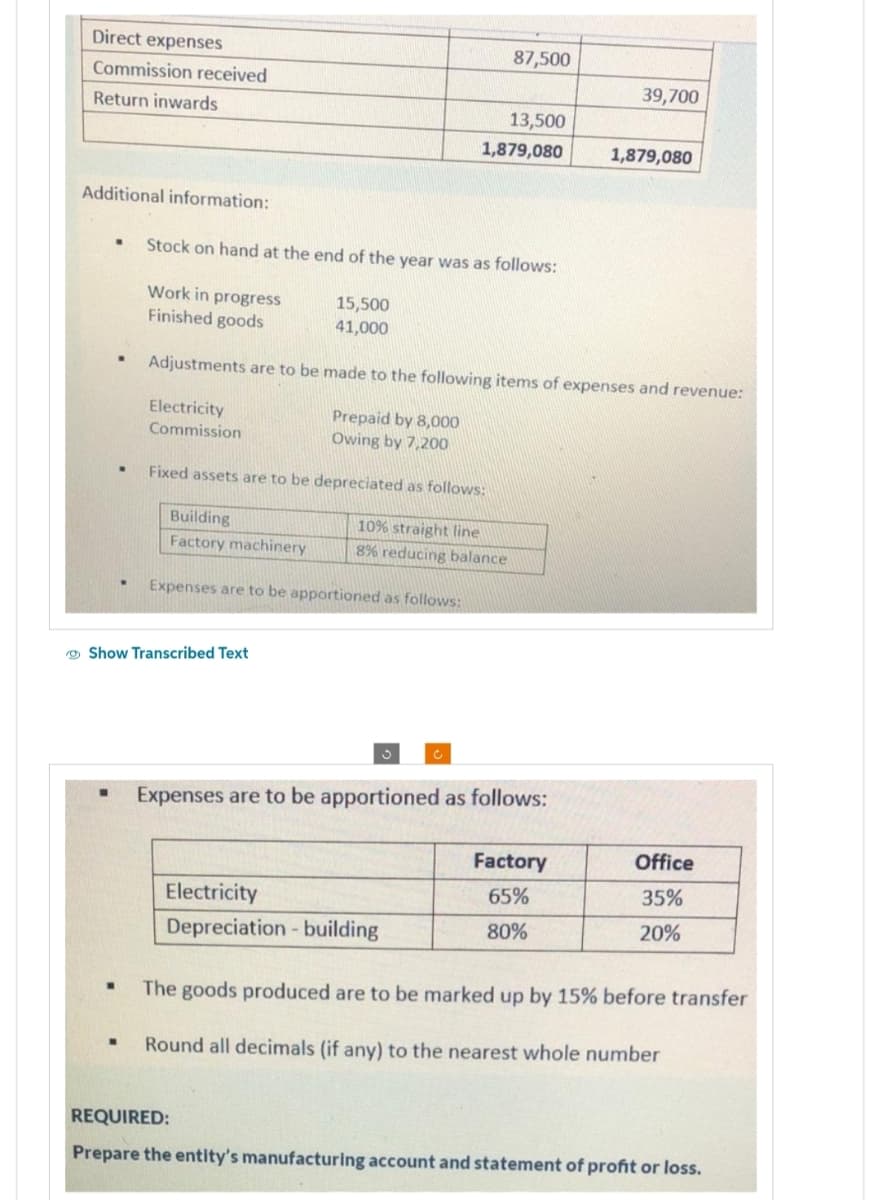

Transcribed Image Text:Direct expenses

Commission received

Return inwards

Additional information:

W

.

.

Work in progress

Finished goods

Stock on hand at the end of the year was as follows:

Show Transcribed Text

15,500

41,000

Building

Factory machinery

Expenses are to be apportioned as follows:

87,500

13,500

1,879,080

Adjustments are to be made to the following items of expenses and revenue:

Electricity

Prepaid by 8,000

Commission

Owing by 7,200

Fixed assets are to be depreciated as follows:

10% straight line

8% reducing balance

Electricity

Depreciation - building

Expenses are to be apportioned as follows:

39,700

Factory

65%

80%

1,879,080

Office

35%

20%

The goods produced are to be marked up by 15% before transfer

Round all decimals (if any) to the nearest whole number

REQUIRED:

Prepare the entity's manufacturing account and statement of profit or loss.

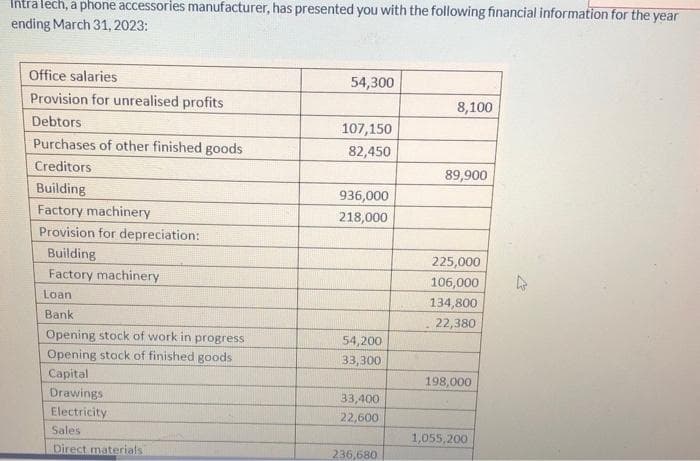

Transcribed Image Text:Intra lech, a phone accessories manufacturer, has presented you with the following financial information for the year

ending March 31, 2023:

Office salaries

Provision for unrealised profits

Debtors

Purchases of other finished goods

Creditors

Building

Factory machinery

Provision for depreciation:

Building

Factory machinery

Loan

Bank

Opening stock of work in progress

Opening stock of finished goods

Capital

Drawings

Electricity

Sales

Direct materials

54,300

107,150

82,450

936,000

218,000

54,200

33,300

33,400

22,600

236,680

8,100

89,900

225,000

106,000

134,800

22,380

198,000

1,055,200

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning