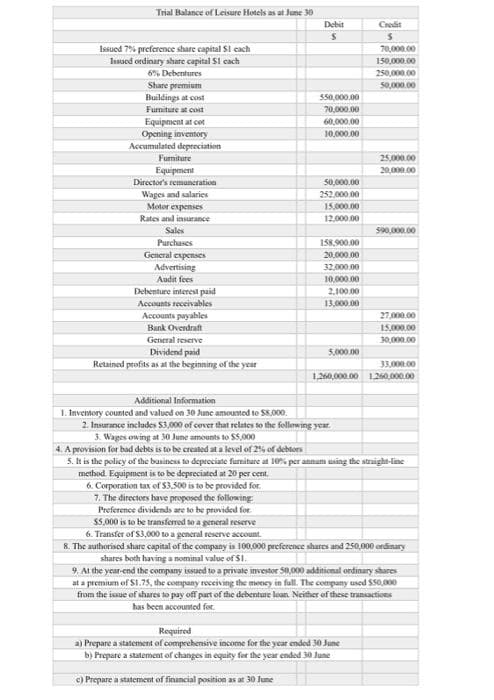

Tral Balance of Leisure Hotels as at June 30 Issued 7% preference share capital SI each Issued ordinary share capital S1 cach 6% Debentures Share premium Buildings at cost Furniture at cost Equipment at cot Opening inventory Accumulated depreciation Furniture Equipment Director's remuneration Wages and salaries Motor expenses Rates and insurance Sales Purchases General expenses Advertising Audit fees Debenture interest paid Accounts receivables Accounts payables Bank Overdraft General reserve Dividend paid Retained profits as at the beginning of the year Debit S 550,000.00 70,000.00 6. Corporation tax of $3.500 is to be provided for 7. The directors have proposed the following Preference dividends are to be provided for $5,000 is to be transferred to a general reserve 60,000.00 10,000.00 50,000.00 252,000.00 15,000.00 12,000.00 158,900.00 20,000.00 32,000.00 10,000.00 2.100.00 13,000.00 5,000.00 Additional Information 1. Inventory counted and valued on 30 June amounted to $8,000 2. Insurance includes $3,000 of cover that relates to the following year 3. Wages owing at 30 June amounts to $5,000 Credit S 70,000.00 150,000.00 250,000.00 50,000.00 25,000.00 20,000.00 590,000.00 33,000.00 1.260,000.00 1,260,000.00 Required a) Prepare a statement of comprehensive income for the year ended 30 June b) Prepare a statement of changes in equity for the year ended 30 June c) Prepare a statement of financial position as at 30 June 27,000.00 15,000.00 30,000.00 4. A provision for bad debts is to be created at a level of 2% of debtors 5. It is the policy of the business to depreciate furniture at 10% per annum using the straight-line method. Equipment is to be depreciated at 20 per cent. 6. Transfer of $3,000 to a general reserve account. 8. The authorised share capital of the company is 100,000 preference shares and 250,000 ordinary shares both having a nominal value of $1. 9. At the year-end the company issued to a private investor 50,000 additional ordinary shares at a premium of $1.75, the company receiving the money in fall. The company used $50,000 from the issue of shares to pay off part of the debenture loan. Neither of these transactions has been accounted for

Tral Balance of Leisure Hotels as at June 30 Issued 7% preference share capital SI each Issued ordinary share capital S1 cach 6% Debentures Share premium Buildings at cost Furniture at cost Equipment at cot Opening inventory Accumulated depreciation Furniture Equipment Director's remuneration Wages and salaries Motor expenses Rates and insurance Sales Purchases General expenses Advertising Audit fees Debenture interest paid Accounts receivables Accounts payables Bank Overdraft General reserve Dividend paid Retained profits as at the beginning of the year Debit S 550,000.00 70,000.00 6. Corporation tax of $3.500 is to be provided for 7. The directors have proposed the following Preference dividends are to be provided for $5,000 is to be transferred to a general reserve 60,000.00 10,000.00 50,000.00 252,000.00 15,000.00 12,000.00 158,900.00 20,000.00 32,000.00 10,000.00 2.100.00 13,000.00 5,000.00 Additional Information 1. Inventory counted and valued on 30 June amounted to $8,000 2. Insurance includes $3,000 of cover that relates to the following year 3. Wages owing at 30 June amounts to $5,000 Credit S 70,000.00 150,000.00 250,000.00 50,000.00 25,000.00 20,000.00 590,000.00 33,000.00 1.260,000.00 1,260,000.00 Required a) Prepare a statement of comprehensive income for the year ended 30 June b) Prepare a statement of changes in equity for the year ended 30 June c) Prepare a statement of financial position as at 30 June 27,000.00 15,000.00 30,000.00 4. A provision for bad debts is to be created at a level of 2% of debtors 5. It is the policy of the business to depreciate furniture at 10% per annum using the straight-line method. Equipment is to be depreciated at 20 per cent. 6. Transfer of $3,000 to a general reserve account. 8. The authorised share capital of the company is 100,000 preference shares and 250,000 ordinary shares both having a nominal value of $1. 9. At the year-end the company issued to a private investor 50,000 additional ordinary shares at a premium of $1.75, the company receiving the money in fall. The company used $50,000 from the issue of shares to pay off part of the debenture loan. Neither of these transactions has been accounted for

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter15: Contributed Capital

Section: Chapter Questions

Problem 17E

Related questions

Question

Transcribed Image Text:Trial Balance of Leisure Hotels as at June 30

Issued 7% preference share capital Sleach

Issued ordinary share capital S1 cach

6% Debentures

Share premium

Buildings at cost

Furniture at cost

Equipment at cot

Opening inventory

Accumulated depreciation

Furniture

Equipment

Director's remuneration

Wages and salaries

Motor expenses

Rates and insurance

Sales

Purchases

General expenses

Advertising

Audit fees

Debenture interest paid

Accounts receivables

Accounts payables

Bank Overdraft

General reserve

Dividend paid

Retained profits as at the beginning of the year

Debit

S

550,000.00

70,000.00

60,000.00

10,000.00

50,000.00

252,000.00

15,000.00

12,000,00

158,900.00

20,000.00

32,000.00

10,000.00

2,100.00

13,000.00

5,000.00

Additional Information

1. Inventory counted and valued on 30 June amounted to $8,000.

2. Insurance includes $3,000 of cover that relates to the following year.

3. Wages owing at 30 June amounts to $5,000

4. A provision for bad debts is to be created at a level of 2% of debtors

Credit

S

70,000.00

150,000.00

250,000.00

50,000.00

Required

a) Prepare a statement of comp

income for the year ended 30 June

b) Prepare a statement of changes in equity for the year ended 30 June

c) Prepare a statement of financial position as at 30 June

25,000.00

20,000.00

590,000.00

33,000.00

1,260,000.00 1.260,000.00

27,000.00

15,000.00

30,000.00

5. It is the policy of the business to depreciate furniture at 10% per annum using the straight-line

method. Equipment is to be depreciated at 20 per cent.

6. Corporation tax of $3.500 is to be provided for.

7. The directors have proposed the following:

Preference dividends are to be provided for

$5,000 is to be transferred to a general reserve

6. Transfer of $3,000 to a general reserve account.

8. The authorised share capital of the company is 100,000 preference shares and 250,000 ordinary

shares both having a nominal value of $1.

9. At the year-end the company issued to a private investor 50,000 additional ordinary shares

at a premium of $1.75, the company receiving the money in full. The company used $50,000

from the issue of shares to pay off part of the debenture loan. Neither of these transactions

has been accounted for

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning