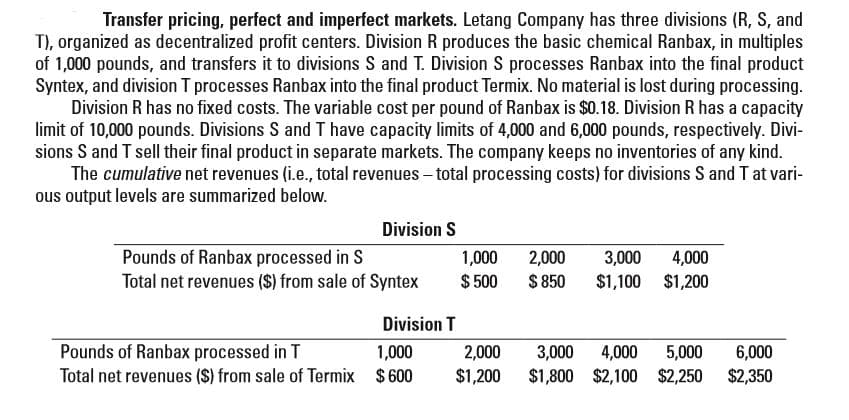

Transfer pricing, perfect and imperfect markets. Letang Company has three divisions (R, S, and T), organized as decentralized profit centers. Division R produces the basic chemical Ranbax, in multiples of 1,000 pounds, and transfers it to divisions S and T. Division S processes Ranbax into the final product Syntex, and division T processes Ranbax into the final product Termix. No material is lost during processing. Division R has no fixed costs. The variable cost per pound of Ranbax is $0.18. Division R has a capacity limit of 10,000 pounds. Divisions S and T have capacity limits of 4,000 and 6,000 pounds, respectively. Divi- sions S and T sell their final product in separate markets. The company keeps no inventories of any kind. The cumulative net revenues (i.e., total revenues – total processing costs) for divisions S and T at vari- ous output levels are summarized below. Division S Pounds of Ranbax processed in S Total net revenues ($) from sale of Syntex 4,000 $1,100 $1,200 1,000 2,000 3,000 $ 500 $ 850 Division T Pounds of Ranbax processed in T Total net revenues ($) from sale of Termix $600 6,000 $2,350 1,000 2,000 3,000 4,000 $1,800 $2,100 $2,250 5,000 $1,200

Transfer pricing, perfect and imperfect markets. Letang Company has three divisions (R, S, and T), organized as decentralized profit centers. Division R produces the basic chemical Ranbax, in multiples of 1,000 pounds, and transfers it to divisions S and T. Division S processes Ranbax into the final product Syntex, and division T processes Ranbax into the final product Termix. No material is lost during processing. Division R has no fixed costs. The variable cost per pound of Ranbax is $0.18. Division R has a capacity limit of 10,000 pounds. Divisions S and T have capacity limits of 4,000 and 6,000 pounds, respectively. Divi- sions S and T sell their final product in separate markets. The company keeps no inventories of any kind. The cumulative net revenues (i.e., total revenues – total processing costs) for divisions S and T at vari- ous output levels are summarized below. Division S Pounds of Ranbax processed in S Total net revenues ($) from sale of Syntex 4,000 $1,100 $1,200 1,000 2,000 3,000 $ 500 $ 850 Division T Pounds of Ranbax processed in T Total net revenues ($) from sale of Termix $600 6,000 $2,350 1,000 2,000 3,000 4,000 $1,800 $2,100 $2,250 5,000 $1,200

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter10: Evaluating Decentralized Operations

Section: Chapter Questions

Problem 4CMA: Morrisons Plastics Division, a profit center, sells its products to external customers as well as to...

Related questions

Question

What range of transfer prices will motivate divisions S and T to demand the quantities that maximize overall income , as well as motivate division R to produce the sum of those quantities?

Transcribed Image Text:Transfer pricing, perfect and imperfect markets. Letang Company has three divisions (R, S, and

T), organized as decentralized profit centers. Division R produces the basic chemical Ranbax, in multiples

of 1,000 pounds, and transfers it to divisions S and T. Division S processes Ranbax into the final product

Syntex, and division T processes Ranbax into the final product Termix. No material is lost during processing.

Division R has no fixed costs. The variable cost per pound of Ranbax is $0.18. Division R has a capacity

limit of 10,000 pounds. Divisions S and T have capacity limits of 4,000 and 6,000 pounds, respectively. Divi-

sions S and T sell their final product in separate markets. The company keeps no inventories of any kind.

The cumulative net revenues (i.e., total revenues – total processing costs) for divisions S and T at vari-

ous output levels are summarized below.

Division S

Pounds of Ranbax processed in S

Total net revenues ($) from sale of Syntex

4,000

$1,100 $1,200

1,000

2,000

3,000

$ 500

$ 850

Division T

Pounds of Ranbax processed in T

Total net revenues ($) from sale of Termix $600

6,000

$2,350

1,000

2,000

3,000 4,000

$1,800 $2,100 $2,250

5,000

$1,200

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,