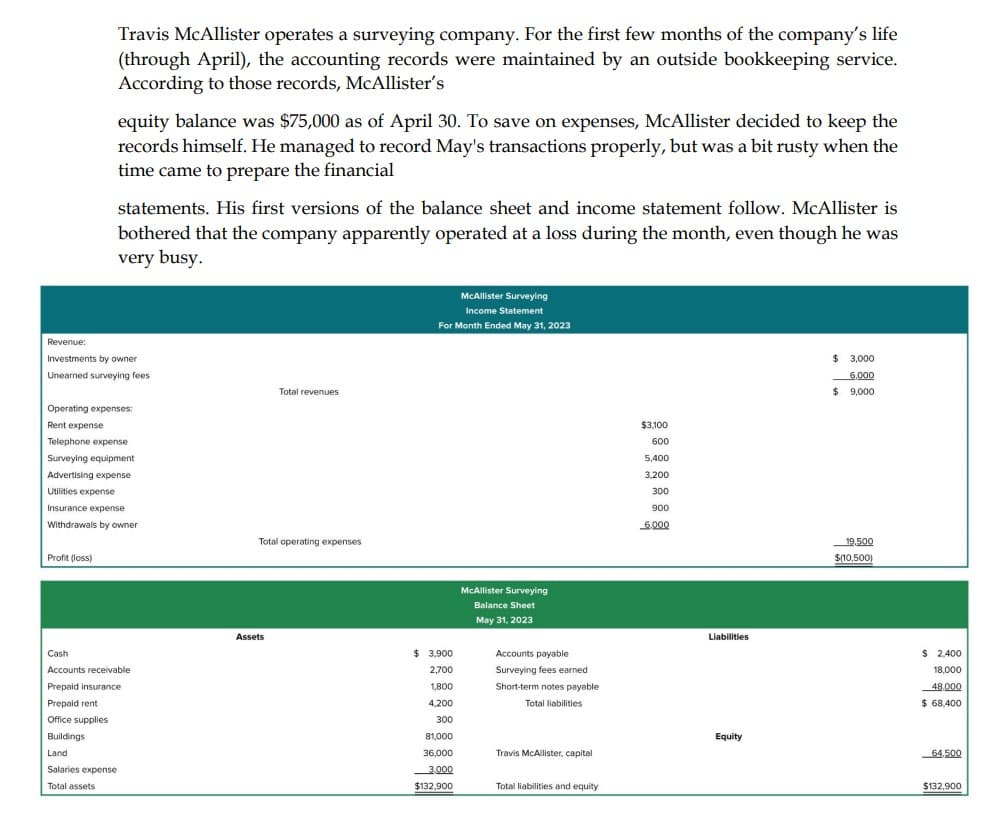

Travis McAllister operates a surveying company. For the first few months of the company's life (through April), the accounting records were maintained by an outside bookkeeping service. According to those records, McAllister's equity balance was $75,000 as of April 30. To save on expenses, McAllister decided to keep the records himself. He managed to record May's transactions properly, but was a bit rusty when the time came to prepare the financial statements. His first versions of the balance sheet and income statement follow. McAllister is bothered that the company apparently operated at a loss during the month, even though he was very busy. Revenue: Investments by owner Unearned surveying fees Profit (loss) Operating expenses: Rent expense Telephone expense Surveying equipment Advertising expense Utilities expense Insurance expense Withdrawals by owner Cash Accounts receivable Prepaid insurance Prepaid rent Office supplies Buildings Land Salaries expense Total assets Total revenues Total operating expenses Assets McAllister Surveying Income Statement For Month Ended May 31, 2023 $ 3,900 2,700 1,800 4,200 300 81,000 36,000 3,000 $132,900 McAllister Surveying Balance Sheet May 31, 2023 Accounts payable Surveying fees earned Short-term notes payable Total liabilities Travis McAllister, capital Total liabilities and equity $3,100 600 5,400 3,200 300 900 6,000 Liabilities Equity $3,000 6,000 $ 9,000 19,500 $(10.500) $ 2,400 18,000 48.000 $ 68,400 64.500 $132,900

Travis McAllister operates a surveying company. For the first few months of the company's life (through April), the accounting records were maintained by an outside bookkeeping service. According to those records, McAllister's equity balance was $75,000 as of April 30. To save on expenses, McAllister decided to keep the records himself. He managed to record May's transactions properly, but was a bit rusty when the time came to prepare the financial statements. His first versions of the balance sheet and income statement follow. McAllister is bothered that the company apparently operated at a loss during the month, even though he was very busy. Revenue: Investments by owner Unearned surveying fees Profit (loss) Operating expenses: Rent expense Telephone expense Surveying equipment Advertising expense Utilities expense Insurance expense Withdrawals by owner Cash Accounts receivable Prepaid insurance Prepaid rent Office supplies Buildings Land Salaries expense Total assets Total revenues Total operating expenses Assets McAllister Surveying Income Statement For Month Ended May 31, 2023 $ 3,900 2,700 1,800 4,200 300 81,000 36,000 3,000 $132,900 McAllister Surveying Balance Sheet May 31, 2023 Accounts payable Surveying fees earned Short-term notes payable Total liabilities Travis McAllister, capital Total liabilities and equity $3,100 600 5,400 3,200 300 900 6,000 Liabilities Equity $3,000 6,000 $ 9,000 19,500 $(10.500) $ 2,400 18,000 48.000 $ 68,400 64.500 $132,900

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter3: The Double-entry Framework

Section: Chapter Questions

Problem 1CP: Your friend Chris Stevick started a part-time business in June and has been keeping her own...

Related questions

Question

Required

Using the information contained in the original financial statements, prepare corrected

statements, including a statement of changes in equity, for the month of May

Transcribed Image Text:Travis McAllister operates a surveying company. For the first few months of the company's life

(through April), the accounting records were maintained by an outside bookkeeping service.

According to those records, McAllister's

equity balance was $75,000 as of April 30. To save on expenses, McAllister decided to keep the

records himself. He managed to record May's transactions properly, but was a bit rusty when the

time came to prepare the financial

statements. His first versions of the balance sheet and income statement follow. McAllister is

bothered that the company apparently operated at a loss during the month, even though he was

very busy.

Revenue:

Investments by owner

Unearned surveying fees

Profit (loss)

Operating expenses:

Rent expense

Telephone expense

Surveying equipment

Advertising expense

Utilities expense

Insurance expense

Withdrawals by owner

Cash

Accounts receivable

Prepaid insurance

Prepaid rent

Office supplies

Buildings

Land

Salaries expense

Total assets

Total revenues

Total operating expenses

Assets

McAllister Surveying

Income Statement

For Month Ended May 31, 2023

$3,900

2,700

1,800

4,200

300

81,000

36,000

3,000

$132,900

McAllister Surveying

Balance Sheet

May 31, 2023

Accounts payable

Surveying fees earned

Short-term notes payable

Total liabilities

Travis McAllister, capital

Total liabilities and equity

$3,100

600

5,400

3,200

300

900

6.000

Liabilities

Equity

$3,000

6,000

$ 9,000

19,500

$(10,500)

$ 2,400

18,000

48,000

$68,400

64,500

$132,900

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub