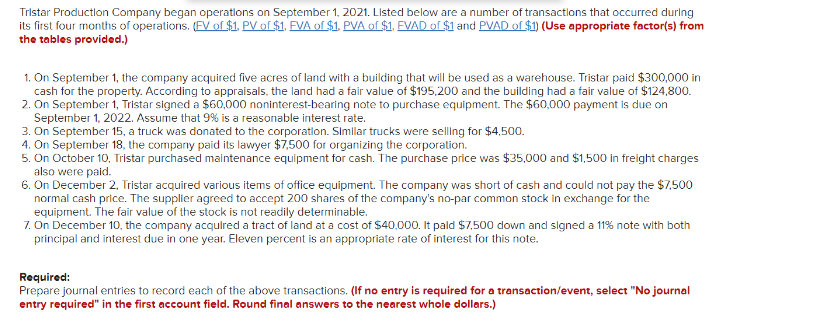

Tristar Production Company began operations on September 1, 2021. Listed below are a number of transactions that occurred during its first four months of operations. (EV of $1. PV of $1. EVA of $1 PVA of $1. EVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) 1. On September 1, the company acquired five acres of land with a building that will be used as a warehouse. Tristar paid $300,000 in cash for the property. According to appraisals, the land had a fair value of $195,200 and the building had a fair value of $124,800. 2. On September 1, Tristar signed a $60,000 noninterest-bearing note to purchase equipment. The $60,000 payment is due on September 1, 2022. Assume that 9% is a reasonable interest rate. 3. On September 15, a truck was donated to the corporation. Simlar trucks were selling for $4,500. 4. On September 18, the company paid its lawyer $7,500 for organizing the corporation. 5. On October 10. Tristar purchased maintenance equipment for cash. The purchase price was $35,000 and $1,500 in freight charges also were paid. 6. On December 2. Tristar acquired various items of office equipment. The company was short of cash and could not pay the $7,500 normal cash price. The supplier agreed to accept 200 shares of the company's no-par common stock in exchange for the equipment. The fair value of the stock is not readily determinable. 7. On December 10, the company acqulred a tract of land at a cost of $40.000. It pald S$7,500 down and signed a 11% note with both principal and interest due in one year. Eleven percent is an appropriate rate of interest for this note. Required: Prepare journal entries to record each of the above transactions. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round final answers to the nearest whole dollars.)

Tristar Production Company began operations on September 1, 2021. Listed below are a number of transactions that occurred during its first four months of operations. (EV of $1. PV of $1. EVA of $1 PVA of $1. EVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) 1. On September 1, the company acquired five acres of land with a building that will be used as a warehouse. Tristar paid $300,000 in cash for the property. According to appraisals, the land had a fair value of $195,200 and the building had a fair value of $124,800. 2. On September 1, Tristar signed a $60,000 noninterest-bearing note to purchase equipment. The $60,000 payment is due on September 1, 2022. Assume that 9% is a reasonable interest rate. 3. On September 15, a truck was donated to the corporation. Simlar trucks were selling for $4,500. 4. On September 18, the company paid its lawyer $7,500 for organizing the corporation. 5. On October 10. Tristar purchased maintenance equipment for cash. The purchase price was $35,000 and $1,500 in freight charges also were paid. 6. On December 2. Tristar acquired various items of office equipment. The company was short of cash and could not pay the $7,500 normal cash price. The supplier agreed to accept 200 shares of the company's no-par common stock in exchange for the equipment. The fair value of the stock is not readily determinable. 7. On December 10, the company acqulred a tract of land at a cost of $40.000. It pald S$7,500 down and signed a 11% note with both principal and interest due in one year. Eleven percent is an appropriate rate of interest for this note. Required: Prepare journal entries to record each of the above transactions. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round final answers to the nearest whole dollars.)

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 2EB: Johnson, Incorporated had the following transactions during the year: Purchased a building for...

Related questions

Topic Video

Question

Transcribed Image Text:Tristar Production Company began operatlons on September 1, 2021. Listed below are a number of transactions that occurred during

its first four months of operations. (EV of $1. PV of $1. EVA of $1. PVA of $1. EVAD of $1 and PVAD of $1) (Use appropriate factor(s) from

the tables provided.)

1. On September 1, the company acquired five acres of land with a building that will be used as a warehouse. Tristar paid $300,000 in

cash for the property. According to appraisals, the land had a fair value of $195,200 and the building had a fair value of $124,800.

2. On September 1, Tristar signed a $60,000 noninterest-bearing note to purchase equipment. The $60,000 payment is due on

September 1, 2022. Assume that 9% is a reasonable interest rate.

3. On September 15, a truck was donated to the corporation. Slmllar trucks were sellng for $4,500.

4. On September 18, the company paid its lawyer $7,500 for organizing the corporation.

5. On October 10, Tristar purchased maintenance equipment for cash. The purchase price was $35,000 and $1,500 in freight charges

also were paid.

6. On December 2. Tristar acquired various items of office equipment. The company was short of cash and could not pay the $7,500

normal cash price. The supplier agreed to accept 200 shares of the company's no-par common stock in exchange for the

equipment. The fair value of the stock is not readily determinable.

7. On December 10, the company acqulred a tract of land at a cost of $40.000. It pald $7,500 down and signed a 11% note with both

principal and interest due in one year. Eleven percent is an appropriate rate of interest for this note.

Required:

Prepare journal entries to record each of the above transactions. (If no entry is required for a transaction/event, select "No journal

entry required" in the first account field. Round final answers to the nearest whole dollars.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning