Tropical Tours is considering an expansion of its operations, which will require the company to issue new debt and equity. Tropical’s investment banker provided the following information about the cost of issuing new debt: If Tropical’s capital structure consists of 60 percent debt, what WACC break points are associated with issuing new debt? Kindly answer with explanation.

Q: In 1998, Hepler Company's sales were $26 million and its total assets were $10 million. Current…

A: A company is expecting growth in sales driven by additional assets. We have to find the amount of…

Q: ) The forecasted demand for the week of October 12 using a 3-week moving average = ____ pints…

A: the final answer is 373.67 approx Approach used for the solution;- Under three period moving…

Q: For each of the following, compute the present value: (Do not round intermedia calculations and…

A: Present value is the present worth of the future cash stream. It is calculated by discounting the…

Q: You go short the soybean market 2 contracts on March 1 at a price of $11.58, on May 15 you offset…

A: Short position and long position are two situations in stock market or future contracts. Under short…

Q: Partial Income Statement of ABC Corp. In 2021 Sales revenue $350,200 Cost of goods sold $142,000…

A: Net income is the amount left from revenue after all the expenses and taxes.

Q: Question 17 Ferry's Furniture Outlet has an accounts receivable period of 50.15 days and an accounts…

A: the final answer is option a) 117.62 detailed explanation:- given information we have, Accounts…

Q: One of the limitations of Excel's Solver is that we cannot get additional information about a…

A: The solver of Excel is a tool to provide a solution or values of the decision variables based on the…

Q: A bond has a face value of $1000, a 10% coupon rate and four years to maturity. The bond makes…

A: We have the characteristics of the bond in the question. We have to find the yield to maturity (YTM)…

Q: Use up to 6 decimal places during solving for the answer. Write all numerical final answers round…

A: Solution: All numerical final answers round off up to TWO (2) decimal places.

Q: Solve Problem 20.17 using Excel.

A: Year (n) Cash flow (a) Discount factor (b = 1/(1+8%)^n) Present value of cash flow (a*b) 0 0…

Q: You and your friend are both 20 years of age. You decide to invest $200/month for 15 years in an…

A: The concept of TVM states that money inherently has an interest-earning capacity which makes the…

Q: YOU OWN A RENTAL BUILDING IN THE CITY AND ARE INTERESTED IN REPLACING THE HEATING SYSTEM. YOU ARE…

A: Given,

Q: annon's brewery currently boasts a customer base of 1,750 customers on 's current variable cost of…

A: Given: The Shannon's is customer 1.750 brewhouse twice per month The 50% sales buy the house The…

Q: If a customer purchases 10 Microsoft 365 Business Premium licenses at $22 each per month, for a full…

A: Your answer: The customer would be charged for 10 licenses for the first 6 months, and then 5…

Q: A couple want to buy a house that costs $542 000. They pay a 20% deposit and borrow the rest of the…

A: House value = $542,000 Loan amount (P) = House value * (1 - Down payment) Loan amount (P) = $542,000…

Q: a. What is Forever's current WACC? Round your answer to two decimal places. b. What is the current…

A: Information Provided: Debt weight = 35% Equity weight = 60% YTM = 9% Risk free rate = 6% Risk…

Q: 2. A loan earns an interest of 12% compounded- quarterly and should be paid within 6 yrs. How much…

A: TIme value of money concept sometimes uses the focal point to compare the sum of money including the…

Q: SDJ, Incorporated, has net working capital of $3,490, current liabilities of $4,950, and inventory…

A: Net working capital = $3,490 Current liabilities = $4,950 Inventory = $4,990 Current assets = ?…

Q: 3) How do you calculate (mathematically) the present value (PV) of a(n): (a) perpetuity (b) annuity…

A: The present value is the equivalent amount that is equivalent today considering the time and…

Q: a. What is the times-interest-earned ratio? Note: Round your answer to 2 decimal places. Times…

A: In finance we use financial ratios often. This is done to determine the financial position and…

Q: Problem 10. You have loaned Mr. Brown $1,000 on the condition that he repay you in ten equal annual…

A: Loan value= $1000 Interest rate = 4% Number of years = 10 Annual monthly payment = Loan…

Q: Tim makes four payments of 3000 at four year intervals starting today (annuity due). Interest is…

A: Number Of payment 4 Payment 3000 Interval 4 Years Nominal Interest Rate for 10 years 6%…

Q: Your have $15,000 that you want to invest. You expect your investment to yield 5% annual growth…

A: Future value = Present value×[1+Periodic interest rate]^n Where, N = Number of periods (years) = 15…

Q: paste

A: The company can expect a profit and should consider moving forward with the investment if NPV IS…

Q: 3-12 What sum of money now is equivalent to $8250 two year later a) if interest is 4 % per 6 month…

A: Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: (c) Hairul is considering to buy the ordinary shares of One Berhad and Two Berhad. The possible…

A: concept. 1 Expected return. In case the data is given with probabilities: The expected return of…

Q: Master Card and other credit card issuers must by law print the Annual Percentage Rate (APR) on…

A: The effective annual rate refers to the interest over the investment affecting the compounding…

Q: Joy is nearing retirement and is considering buying an annuity product from Wagon Financial.…

A: Annuity refers to the contract between the insurer and the insurance company for making the…

Q: What are the key differences between the certainty equivalent cash flow approach and the risk…

A: “Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: Perez Corporation has the following financial data for the years 20X1 and 20X2: Sales Cost of goods…

A: Inventory turnover ratio The ratio that represents the number of units sold and replaced by a…

Q: Find the value of each B if the interest rate is 12%. в в в M

A: Future value of the the amount includes the amount being deposited and amount of interest being…

Q: A loan for P50,000 is to be paid in 3 years at the amount of P65,000. What is the effective rate of…

A: In the given question we are given is loan amount (present value)=50000 number of years=3 Future…

Q: You have located a warehouse property to purchase at a price of $320,000. You plan to make a 20%…

A: Purchase price of warehouse is $320,000 Down payment is of $64,000 Term of loan is 10 year Fixed…

Q: Calculate the total cost, proceeds, and gain (or loss) (in $) for the stock market transaction.

A: Information Provided: Shares sold = 100 Purchase price = $45.20 Selling price = $54.06 Selling…

Q: What factors lead to the valuation of a company's worth compared to that of the financial…

A: Valuation of a company- There are a number of ways to value a company, and these are- i) Market…

Q: Situational Software Co. (SSC) is trying to establish its optimal capital structure. Its current…

A: Data given: Debt=30% Equity=70% Risk free rate=5% Market risk premium=7% Tax rate=40% Cost of…

Q: Jeff earned $84 on $1,200 invested in a high-yield money market account. He is taxed at 22 percent…

A: Earning = $84 Investment = $1200 Tax rate = 0.22 or 22% After tax yield = ? After tax yield is…

Q: Scenario 2 1.05 2.97 2.46 150,000 180,000 80,000 Sc 1.3 3.0 2.0 41 30 3C

A: we will solve this question using the solver option in excel. here we will add the maximizing…

Q: Last year Carson Industries issued a 10-year, 15% semiannual coupon bond at its par value of $1,000.…

A: Coupon rate is 15% Paid semi annually par Value is $1,000 Call price is 6 years Callable price is…

Q: Solve for the missing item in the following. Note: Do not round intermediate calculations. Round…

A: Data given: Interest rate = 5.25% =0.0525 Time =4 3/4 years = 4.75 years Simple interest = $ 390…

Q: You are given the following information for Ortiz Corporation: Decrease in inventory $ 610…

A: Given: Particulars Amount Decrease in inventory $610 Decrease in accounts payable $255…

Q: what are some risks of investing in investing in SAAS startups

A: SaaS stands for Software as a service. Saas delivers application over the internet i.e., user do not…

Q: how to calculate NPV of realized revenue in each history (realizations of states) in stochastic…

A: Your answer: There is no definitive answer to this question since it will depend on the specifics…

Q: Domenic is 20 years old and wishes to secure his future by saving $300 per week into an investment…

A: Savings per week is $300 Interest rate is 6.25% Compounded weekly Time deriod is 30 years To Find:…

Q: sfandairi Enterprises is considering a new 3-year expansion project that requires an initial fixed…

A: This is a capital budgeting problem. In problems like these we need to determine the cash flows for…

Q: The accumulation function for fund X is given by: ax(t) = 1 + 0.5t. The accumulation function for…

A: We have the accumulation function for two funds. At a given time T, they have the same force of…

Q: Should Eddie recommend that purchase of the robot?

A: Information Provided: Employee cost in Year 1 = $58,240 Annual Increase in employee cost = 6% Robot…

Q: profits of Telekom are R1000 000 and have not been paid as dividends. What is the value of Telkom…

A: Information Provided: Annual Growth rate = 3% Market interest rate = 6% Current profits = R…

Q: A factory costs $810,000. You reckon that it will produce an inflow after operating costs of…

A: Initial cost (I) = $810,000 Annual net cash inflow (C) = $171,000 Period (n) = 11 years Cost of…

Q: A company is evaluating a project with a useful life of 12 years that requires an investment of…

A: Useful Life of project is 12 years Required investment per year in the begining of year 1 to 4 is…

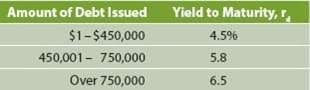

Tropical Tours is considering an expansion of its operations, which will require the company to issue new debt and equity. Tropical’s investment banker provided the following information about the cost of issuing new debt:

If Tropical’s capital structure consists of 60 percent debt, what WACC break points are associated with issuing new debt?

Kindly answer with explanation.

Step by step

Solved in 2 steps

- Klynveld Companys balance sheet shows total liabilities of 94,000,000, total stockholders equity of 75,000,000, and total assets of 169,000,000. Required: Note: Round answers to two decimal places. 1. Calculate the debt ratio. 2. Calculate the debt-to-equity ratio.Category Prior Year Current Year Accounts payable 3,123.00 5,969.00 Accounts receivable 6,987.00 8,940.00 Accruals 5,642.00 6,108.00 Additional paid in capital 19,885.00 13,325.00 Cash ??? ??? Common Stock 2,850 2,850 COGS 22,986.00 18,120.00 Current portion long-term debt 500 500 Depreciation expense 1,035.00 988.00 Interest expense 1,290.00 1,167.00 Inventories 3,006.00 6,743.00 Long-term debt 16,856.00 22,001.00 Net fixed assets 75,521.00 74,000.00 Notes payable 4,072.00 6,540.00 Operating expenses (excl. depr.) 19,950 20,000 Retained earnings 35,244.00 34,874.00 Sales 46,360 45,055.00 Taxes 350 920 What is the firm's cash flow from financing?Category Prior Year Current Year Accounts payable 3,147.00 5,976.00 Accounts receivable 6,925.00 8,910.00 Accruals 5,635.00 6,187.00 Additional paid in capital 19,527.00 13,950.00 Cash ??? ??? Common Stock 2,850 2,850 COGS 22,974.00 18,270.00 Current portion long-term debt 500 500 Depreciation expense 975.00 976.00 Interest expense 1,278.00 1,155.00 Inventories 3,048.00 6,717.00 Long-term debt 16,569.00 22,919.00 Net fixed assets 75,968.00 73,882.00 Notes payable 4,045.00 6,584.00 Operating expenses (excl. depr.) 19,950 20,000 Retained earnings 35,870.00 34,759.00 Sales 46,360 45,347.00 Taxes 350 920 What is the firm's cash flow from operations? What is the firm's dividend payment in the current year? What is the firm's net income in the current year?

- PROBLEM 8:Tomas Co. has the following balance sheet as of December 31, 2021.Current assets 180,000.00Fixed assets 120,000.00Total assets 300,000.00Accounts payable 40,000.00Accrued liabilities 20,000.00Notes payable 50,000.00Other Long-term debt 75,000.00Total Equity 115,000.00Total liabilities and equity 300,000.00 In 2021, Tomas Co. reported sales of P1,500,0000, net income of P30,000, and dividends of P18,000. The company expected its sales to increase by 20% by next year and its retention ratio will remain at 40%. Assume that Tomas Co. is operating at full capacity and it uses the AFN approach in determining the amount of external financing needed.How much is the sales for 2022? Using Problem 8, how much is the increase in retained earnings for the purpose of computing the AFN? Using Problem 8, how much external funds needed for the year 2022?Total Debt = 800,000; Income before Income Taxes and Interest Expense = 100,000; Total Assets = 1,000,000. How much is the Debt to Total Assets Ratio?BALANCE SHEETCash $ 140.0 Accounts payable $ 800 .0Accts. receivable 880 .0 Notes payable 600.0Inventories 1,320.0 Accruals 400 .0Total current assets $2,340.0 Total current liabilities $1,800.0Long-term bonds 1,000.0Total debt $2,800.0Common stock 200 .0Retained earnings 1,000.0Net plant & equip. 1,660.0 Total common equity $1,200.0Total assets $4.000.0 Total liabilities & equity $4.000.0lNCOME STATEMENTNet sales $6,000.0Operating costs 5,599.8Depreciation 100.2EBIT $ 300.0Less: Interest 96 .0EBT $ 204 .0Less: Taxes 81.6Net income $ 122.4OTHER DATAAnnual Principal and Lease Payments 0.00Shares outstanding (millions) 60 .00Common dividends (millions) $42.8Interest rate on NIP and long-term bonds 6.0 %Federal plus state income tax rate 40%Year-end stock price $30 .60 What is the firms ROE (Return on Equity)?Group of answer choices 9.45% 9.63% 9.84% 10.20%

- BALANCE SHEETCash $ 140.0 Accounts payable $ 800 .0Accts. receivable 880 .0 Notes payable 600.0Inventories 1,320.0 Accruals 400 .0Total current assets $2,340.0 Total current liabilities $1,800.0Long-term bonds 1,000.0Total debt $2,800.0Common stock 200 .0Retained earnings 1,000.0Net plant & equip. 1,660.0 Total common equity $1,200.0Total assets $4.000.0 Total liabilities & equity $4.000.0lNCOME STATEMENTNet sales $6,000.0Operating costs 5,599.8Depreciation 100.2EBIT $ 300.0Less: Interest 96 .0EBT $ 204 .0Less: Taxes 81.6Net income $ 122.4OTHER DATAAnnual Principal and Lease Payments 0.00Shares outstanding (millions) 60 .00Common dividends (millions) $42.8Interest rate on NIP and long-term bonds 6.0 %Federal plus state income tax rate 40%Year-end stock price $30 .60 Question 9 What is the firm's Debt Ratio? Group of answer choices 60.0% 65.0% 70.0% 75.0% Question 10 What is the firm's Inventory Turnover? 4.41 4.55 4.69 4.83 Question 11 What is the firm's DPS…BALANCE SHEETCash $ 140.0 Accounts payable $ 800 .0Accts. receivable 880 .0 Notes payable 600.0Inventories 1,320.0 Accruals 400 .0Total current assets $2,340.0 Total current liabilities $1,800.0Long-term bonds 1,000.0Total debt $2,800.0Common stock 200 .0Retained earnings 1,000.0Net plant & equip. 1,660.0 Total common equity $1,200.0Total assets $4.000.0 Total liabilities & equity $4.000.0lNCOME STATEMENTNet sales $6,000.0Operating costs 5,599.8Depreciation 100.2EBIT $ 300.0Less: Interest 96 .0EBT $ 204 .0Less: Taxes 81.6Net income $ 122.4OTHER DATAAnnual Principal and Lease Payments 0.00Shares outstanding (millions) 60 .00Common dividends (millions) $42.8Interest rate on NIP and long-term bonds 6.0 %Federal plus state income tax rate 40%Year-end stock price $30 .60 Question 5 What is the firm's EBITDA coverage? Group of answer choices 3.51 3.69 3.88 4.17 Question 6 What is the firms DSO (Days Sales Outstanding)? Group of answer choices 51.30 days 52.80 days 53.50…21. Kinsella Corporation's statement of financial position showed the following amounts: current liabilities, $75,000; total liabilities, $100,000; total assets, $200,000. What is the total long-term debt to total equity ratio? a.0.375 b.0.125 c.0.75 d.0.25

- Delta GMBH’s ROE is 8.9 percent. Sales are $2,956,000.00. Total debt ratio is 0.3743. Total debt is $964,000.00. Determine the return on assets (ROA).Category Prior Year Current Year Accounts payable ??? ??? Accounts receivable 320,715 397,400 Accruals 40,500 33,750 Additional paid in capital 500,000 541,650 Cash 17,500 47,500 Common Stock 94,000 105,000 COGS 328,500 431,139.00 Current portion long-term debt 33,750 35,000 Depreciation expense 54,000 54,349.00 Interest expense 40,500 41,741.00 Inventories 279,000 288,000 Long-term debt 337,728.00 398,725.00 Net fixed assets 946,535 999,000 Notes payable 148,500 162,000 Operating expenses (excl. depr.) 126,000 162,280.00 Retained earnings 306,000 342,000 Sales 639,000 847,106.00 Taxes 24,750 48,618.00 What is the current year's return on assets (ROA)? (Round to 4 decimal places.)Particulars As on 31.3.2019(Rupees. In Lacs)As on 31.3.2020(Rupees. In Lacs)Investment in FinancialAssets- 100Equity Share Capital 150 160Long term Loans taken 100 200Dividend paid - 26Dividend received - 10Interest received - 15 Calculate the debt-equity ratio & comment