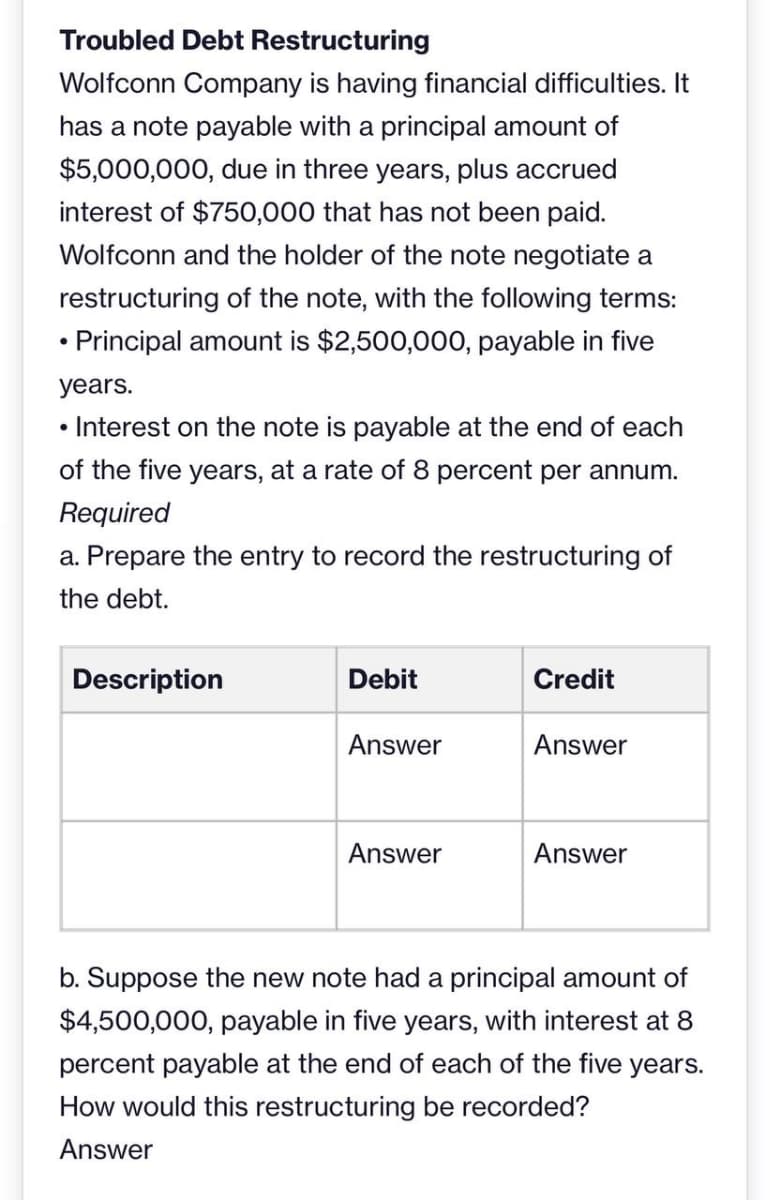

Troubled Debt Restructuring Wolfconn Company is having financial difficulties. It has a note payable with a principal amount of $5,000,000, due in three years, plus accrued interest of $750,000 that has not been paid. Wolfconn and the holder of the note negotiate a restructuring of the note, with the following terms: • Principal amount is $2,500,000, payable in five years. • Interest on the note is payable at the end of each of the five years, at a rate of 8 percent per annum. Required a. Prepare the entry to record the restructuring of the debt. Description Debit Answer Answer Credit Answer Answer b. Suppose the new note had a principal amount of $4,500,000, payable in five years, with interest at 8 percent payable at the end of each of the five years. How would this restructuring be recorded? Answer

Troubled Debt Restructuring Wolfconn Company is having financial difficulties. It has a note payable with a principal amount of $5,000,000, due in three years, plus accrued interest of $750,000 that has not been paid. Wolfconn and the holder of the note negotiate a restructuring of the note, with the following terms: • Principal amount is $2,500,000, payable in five years. • Interest on the note is payable at the end of each of the five years, at a rate of 8 percent per annum. Required a. Prepare the entry to record the restructuring of the debt. Description Debit Answer Answer Credit Answer Answer b. Suppose the new note had a principal amount of $4,500,000, payable in five years, with interest at 8 percent payable at the end of each of the five years. How would this restructuring be recorded? Answer

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter7: Financial Activities

Section: Chapter Questions

Problem 7QE

Related questions

Question

Transcribed Image Text:Troubled Debt Restructuring

Wolfconn Company is having financial difficulties. It

has a note payable with a principal amount of

$5,000,000, due in three years, plus accrued

interest of $750,000 that has not been paid.

Wolfconn and the holder of the note negotiate a

restructuring of the note, with the following terms:

• Principal amount is $2,500,000, payable in five

years.

• Interest on the note is payable at the end of each

of the five years, at a rate of 8 percent per annum.

Required

a. Prepare the entry to record the restructuring of

the debt.

Description

Debit

Answer

Answer

Credit

Answer

Answer

b. Suppose the new note had a principal amount of

$4,500,000, payable in five years, with interest at 8

percent payable at the end of each of the five years.

How would this restructuring be recorded?

Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT