True or False: The following statement accurately describes how firms make decisions related to issuing new common stock. Taking flotation costs into account will reduce the cost of new common stock. O False: Flotation costs are additional costs associated with raising new common stock. O True: Taking flotation costs into account will reduce the cost of new common stock, because you will multiply the cost of new common stock by 1 minus the flotation cost-similar to how the after-tax cost of debt is calculated. Alpha Moose Transporters is considering investing in a one-year project that requires an initial investment of $475,000. To do so, it will have to issue new common stock and will incur a flotation cost of 2.00%. At the end of the year, the project is expected to produce a cash inflow of $595,000. The rate of return that Alpha Moose expects to earn on its project (net of its flotation costs) is (rounded to two decimal places). Sunny Day Manufacturing Company has a current stock price of $33.35 per share, and is expected to pay a per-share dividend of $2.45 at the end of the year. The company's earnings' and dividends' growth rate are expected to grow at the constant rate of 8.70% into the foreseeable future. If Sunny Day expects to incur flotation costs of 6.50% of the value of its newly-raised equity funds, then the flotation-adjusted (net) cost of its new common. stock (rounded to two decimal places) should be Alpha Moose Transporters Co.'s addition to earnings for this year is expected to be $857,000. Its target capital structure consists of 50% debt, 5% preferred, and 45% equity. Determine Alpha Moose Transporters's retained earnings breakpoint: $1,904,444 O $2,094,888 O $1,809,222 O $1,999,666

True or False: The following statement accurately describes how firms make decisions related to issuing new common stock. Taking flotation costs into account will reduce the cost of new common stock. O False: Flotation costs are additional costs associated with raising new common stock. O True: Taking flotation costs into account will reduce the cost of new common stock, because you will multiply the cost of new common stock by 1 minus the flotation cost-similar to how the after-tax cost of debt is calculated. Alpha Moose Transporters is considering investing in a one-year project that requires an initial investment of $475,000. To do so, it will have to issue new common stock and will incur a flotation cost of 2.00%. At the end of the year, the project is expected to produce a cash inflow of $595,000. The rate of return that Alpha Moose expects to earn on its project (net of its flotation costs) is (rounded to two decimal places). Sunny Day Manufacturing Company has a current stock price of $33.35 per share, and is expected to pay a per-share dividend of $2.45 at the end of the year. The company's earnings' and dividends' growth rate are expected to grow at the constant rate of 8.70% into the foreseeable future. If Sunny Day expects to incur flotation costs of 6.50% of the value of its newly-raised equity funds, then the flotation-adjusted (net) cost of its new common. stock (rounded to two decimal places) should be Alpha Moose Transporters Co.'s addition to earnings for this year is expected to be $857,000. Its target capital structure consists of 50% debt, 5% preferred, and 45% equity. Determine Alpha Moose Transporters's retained earnings breakpoint: $1,904,444 O $2,094,888 O $1,809,222 O $1,999,666

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter11: Determining The Cost Of Capital

Section: Chapter Questions

Problem 14MC

Related questions

Question

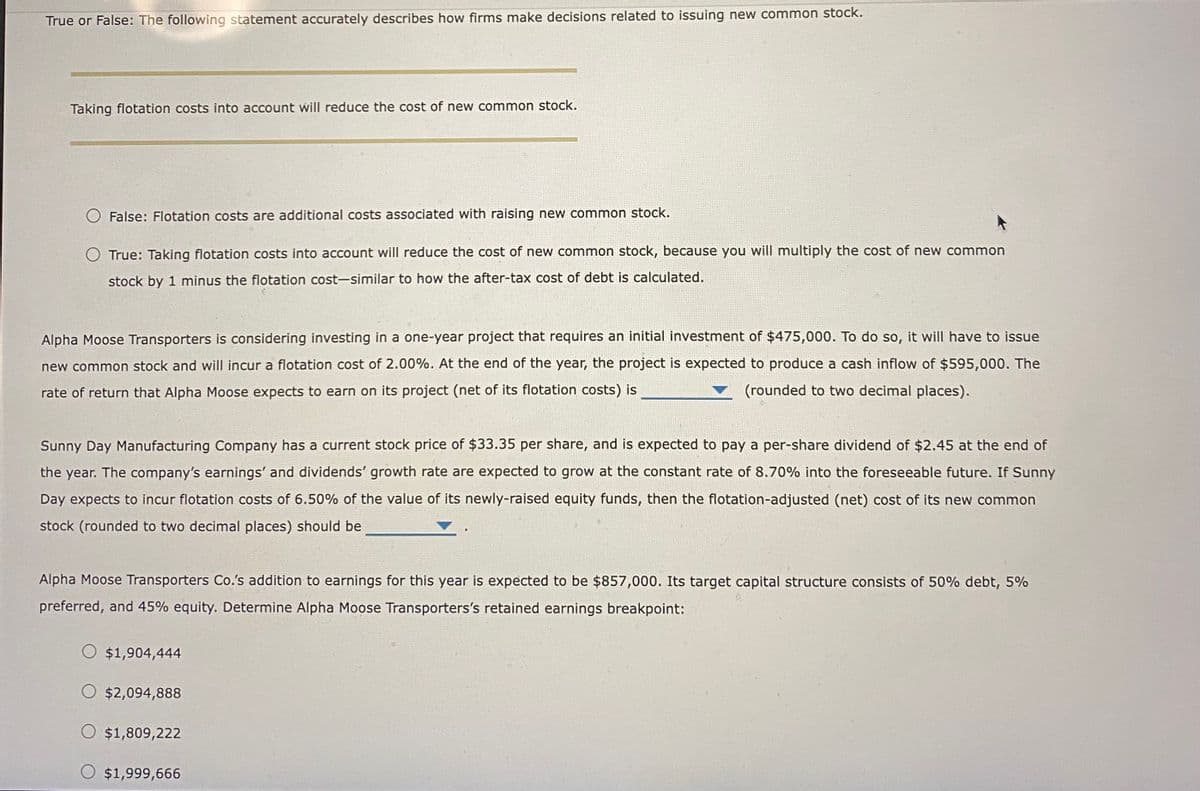

Transcribed Image Text:True or False: The following statement accurately describes how firms make decisions related to issuing new common stock.

Taking flotation costs into account will reduce the cost of new common stock.

O False: Flotation costs are additional costs associated with raising new common stock.

O True: Taking flotation costs into account will reduce the cost of new common stock, because you will multiply the cost of new common

stock by 1 minus the flotation cost-similar to how the after-tax cost of debt is calculated.

Alpha Moose Transporters is considering investing in a one-year project that requires an initial investment of $475,000. To do so, it will have to issue

new common stock and will incur a flotation cost of 2.00%. At the end of the year, the project is expected to produce a cash inflow of $595,000. The

rate of return that Alpha Moose expects to earn on its project (net of its flotation costs) is

(rounded to two decimal places).

Sunny Day Manufacturing Company has a current stock price of $33.35 per share, and is expected to pay a per-share dividend of $2.45 at the end of

the year. The company's earnings' and dividends' growth rate are expected to grow at the constant rate of 8.70% into the foreseeable future. If Sunny

Day expects to incur flotation costs of 6.50% of the value of its newly-raised equity funds, then the flotation-adjusted (net) cost of its new common

stock (rounded to two decimal places) should be

Alpha Moose Transporters Co.'s addition to earnings for this year is expected to be $857,000. Its target capital structure consists of 50% debt, 5%

preferred, and 45% equity. Determine Alpha Moose Transporters's retained earnings breakpoint:

O $1,904,444

O $2,094,888

$1,809,222

O $1,999,666

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning