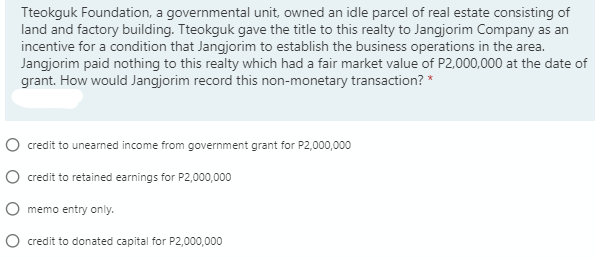

Tteokguk Foundation, a governmental unit, owned an idle parcel of real estate consisting of land and factory building. Tteokguk gave the title to this realty to Jangjorim Company as an incentive for a condition that Jangjorim to establish the business operations in the area. Jangjorim paid nothing to this realty which had a fair market value of P2,000,000 at the date of grant. How would Jangjorim record this non-monetary transaction? * O credit to unearned income from government grant for P2,000,000 O credit to retained earnings for P2,000,000 O memo entry only. O credit to donated capital for P2,000,000

Tteokguk Foundation, a governmental unit, owned an idle parcel of real estate consisting of land and factory building. Tteokguk gave the title to this realty to Jangjorim Company as an incentive for a condition that Jangjorim to establish the business operations in the area. Jangjorim paid nothing to this realty which had a fair market value of P2,000,000 at the date of grant. How would Jangjorim record this non-monetary transaction? * O credit to unearned income from government grant for P2,000,000 O credit to retained earnings for P2,000,000 O memo entry only. O credit to donated capital for P2,000,000

Chapter12: Nonrecognition Transactions

Section: Chapter Questions

Problem 21P

Related questions

Question

Question 48

Choose the correct answer from the choices.

Transcribed Image Text:Tteokguk Foundation, a governmental unit, owned an idle parcel of real estate consisting of

land and factory building. Tteokguk gave the title to this realty to Jangjorim Company as an

incentive for a condition that Jangjorim to establish the business operations in the area.

Jangjorim paid nothing to this realty which had a fair market value of P2,000,000 at the date of

grant. How would Jangjorim record this non-monetary transaction? *

O credit to unearned income from government grant for P2,000,000

O credit to retained earnings for P2,000,000

O memo entry only.

O credit to donated capital for P2,000,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you