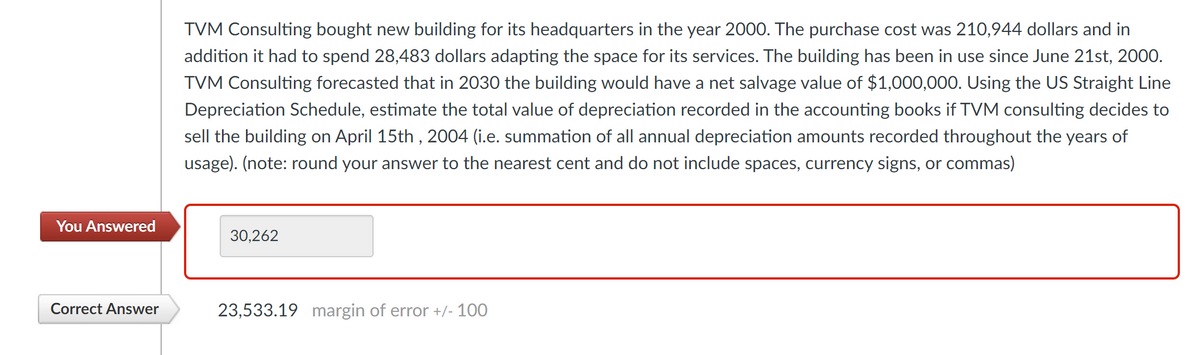

TVM Consulting bought new building for its headquarters in the year 2000. The purchase cost was 210,944 dollars and in addition it had to spend 28,483 dollars adapting the space for its services. The building has been in use since June 21st, 2000. TVM Consulting forecasted that in 2030 the building would have a net salvage value of $1,000,000. Using the US Straight Line Depreciation Schedule, estimate the total value of depreciation recorded in the accounting books if TVM consulting decides to sell the building on April 15th , 2004 (i.e. summation of all annual depreciation amounts recorded throughout the years of usage). (note: round your answer to the nearest cent and do not include spaces, currency signs, or commas)

TVM Consulting bought new building for its headquarters in the year 2000. The purchase cost was 210,944 dollars and in addition it had to spend 28,483 dollars adapting the space for its services. The building has been in use since June 21st, 2000. TVM Consulting forecasted that in 2030 the building would have a net salvage value of $1,000,000. Using the US Straight Line Depreciation Schedule, estimate the total value of depreciation recorded in the accounting books if TVM consulting decides to sell the building on April 15th , 2004 (i.e. summation of all annual depreciation amounts recorded throughout the years of usage). (note: round your answer to the nearest cent and do not include spaces, currency signs, or commas)

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 15PB: Urquhart Global purchases a building to house its administrative offices for $500,000. The best...

Related questions

Concept explainers

Depreciation Methods

The word "depreciation" is defined as an accounting method wherein the cost of tangible assets is spread over its useful life and it usually denotes how much of the assets value has been used up. The depreciation is usually considered as an operating expense. The main reason behind depreciation includes wear and tear of the assets, obsolescence etc.

Depreciation Accounting

In terms of accounting, with the passage of time the value of a fixed asset (like machinery, plants, furniture etc.) goes down over a specific period of time is known as depreciation. Now, the question comes in your mind, why the value of the fixed asset reduces over time.

Topic Video

Question

Transcribed Image Text:TVM Consulting bought new building for its headquarters in the year 2000. The purchase cost was 210,944 dollars and in

addition it had to spend 28,483 dollars adapting the space for its services. The building has been in use since June 21st, 2000.

TVM Consulting forecasted that in 2030 the building would have a net salvage value of $1,000,000. Using the US Straight Line

Depreciation Schedule, estimate the total value of depreciation recorded in the accounting books if TVM consulting decides to

sell the building on April 15th , 2004 (i.e. summation of all annual depreciation amounts recorded throughout the years of

usage). (note: round your answer to the nearest cent and do not include spaces, currency signs, or commas)

You Answered

30,262

Correct Answer

23,533.19 margin of error +/- 100

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT