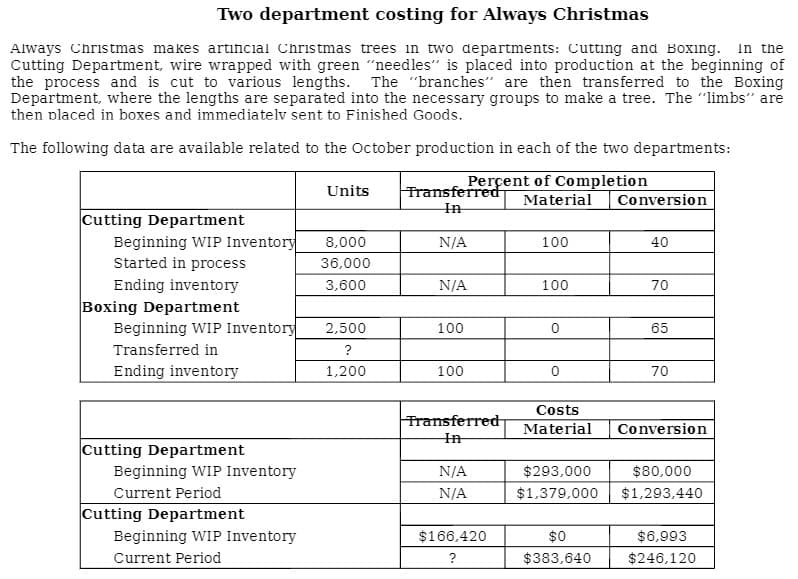

Two department costing for Always Christmas Always Christmas makes artincial Christmas trees in two departments: Cutting and Boxing. In the Cutting Department, wire wrapped with green "needles" is placed into production at the beginning of the process and is cut to various lengths. The "branches" are then transferred to the Boxing Department, where the lengths are separated into the necessary groups to make a tree. The limbs" are then placed in boxes and immediatelv sent to Finished Goods. The following data are available related to the October production in each of the two departments: Perçent of Completion Material Units Transferred Conversion In Cutting Department Beginning WIP Inventory Started in process 8,000 N/A 100 40 36,000 Ending inventory Boxing Department Beginning WIP Inventory 3,600 N/A 100 70 2,500 100 65 Transferred in ? Ending inventory 1,200 100 70 Costs Transferred Material Conversion in Cutting Department Beginning WIP Inventory N/A $293,000 $80,000 Current Period N/A $1,379,000 $1,293,440 Cutting Department Beginning WIP Inventory $166,420 $0 $6,993 Current Period ? $383,640 $246,120

Two department costing for Always Christmas Always Christmas makes artincial Christmas trees in two departments: Cutting and Boxing. In the Cutting Department, wire wrapped with green "needles" is placed into production at the beginning of the process and is cut to various lengths. The "branches" are then transferred to the Boxing Department, where the lengths are separated into the necessary groups to make a tree. The limbs" are then placed in boxes and immediatelv sent to Finished Goods. The following data are available related to the October production in each of the two departments: Perçent of Completion Material Units Transferred Conversion In Cutting Department Beginning WIP Inventory Started in process 8,000 N/A 100 40 36,000 Ending inventory Boxing Department Beginning WIP Inventory 3,600 N/A 100 70 2,500 100 65 Transferred in ? Ending inventory 1,200 100 70 Costs Transferred Material Conversion in Cutting Department Beginning WIP Inventory N/A $293,000 $80,000 Current Period N/A $1,379,000 $1,293,440 Cutting Department Beginning WIP Inventory $166,420 $0 $6,993 Current Period ? $383,640 $246,120

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter4: Activity-based Costing

Section: Chapter Questions

Problem 5E: Handy Leather, Inc., produces three sizes of sports gloves: small, medium, and large. A glove...

Related questions

Question

100%

Instructions: Using formulas/functions wherever possible, complete the following on the Input Tab.

1. Prepare a cost of production report for the Cutting Department assuming a FIFO method.

2. Using the data developed from (1), prepare a cost of production report for the Boxing Department assuming a FIFO method.

Transcribed Image Text:Two department costing for Always Christmas

Always Christmas makes artincial Christmas trees in two departments: Cutting and Boxing. In the

Cutting Department, wire wrapped with green "needles" is placed into production at the beginning of

the process and is cut to various lengths. The "branches" are then transferred to the Boxing

Department, where the lengths are separated into the necessary groups to make a tree. The limbs" are

then placed in boxes and immediatelv sent to Finished Goods.

The following data are available related to the October production in each of the two departments:

Perçent of Completion

Material

Units

Transferred

Conversion

In

Cutting Department

Beginning WIP Inventory

Started in process

8,000

N/A

100

40

36,000

Ending inventory

Boxing Department

Beginning WIP Inventory

3,600

N/A

100

70

2,500

100

65

Transferred in

?

Ending inventory

1,200

100

70

Costs

Transferred

Material

Conversion

in

Cutting Department

Beginning WIP Inventory

N/A

$293,000

$80,000

Current Period

N/A

$1,379,000

$1,293,440

Cutting Department

Beginning WIP Inventory

$166,420

$0

$6,993

Current Period

?

$383,640

$246,120

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,