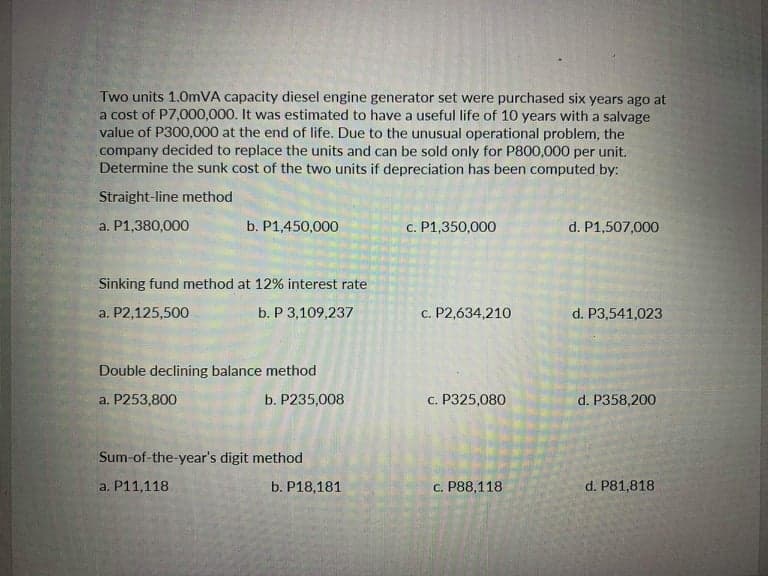

Two units 1.0mVA capacity diesel engine generator set were purchased six years ago at a cost of P7,000,000. It was estimated to have a useful life of 10 years with a salvage value of P300,000 at the end of life. Due to the unusual operational problem, the company decided to replace the units and can be sold only for P800,000 per unit. Determine the sunk cost of the two units if depreciation has been computed by: Straight-line method a. P1,380,000 b. P1,450,000 c. P1,350,000 d. P1,507,000

Two units 1.0mVA capacity diesel engine generator set were purchased six years ago at a cost of P7,000,000. It was estimated to have a useful life of 10 years with a salvage value of P300,000 at the end of life. Due to the unusual operational problem, the company decided to replace the units and can be sold only for P800,000 per unit. Determine the sunk cost of the two units if depreciation has been computed by: Straight-line method a. P1,380,000 b. P1,450,000 c. P1,350,000 d. P1,507,000

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter10: Long-lived Tangible And Intangible Assets

Section: Chapter Questions

Problem 21E

Related questions

Question

Transcribed Image Text:Two units 1.0mVA capacity diesel engine generator set were purchased six years ago at

a cost of P7,000,000. It was estimated to have a useful life of 10 years with a salvage

value of P300,000 at the end of life. Due to the unusual operational problem, the

company decided to replace the units and can be sold only for P800,000 per unit.

Determine the sunk cost of the two units if depreciation has been computed by:

Straight-line method

a. P1,380,000

b. P1,450,000

c. P1,350,000

d. P1,507,000

Sinking fund method at 12% interest rate

a. P2,125,500

b. P 3,109,237

c. P2,634,210

d. P3,541,023

Double declining balance method

a. P253,800

b. P235,008

с. Р325,080

d. P358,200

Sum-of-the-year's digit method

a. P11,118

b. P18,181

с. Р88,118

d. P81,818

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 5 images

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College