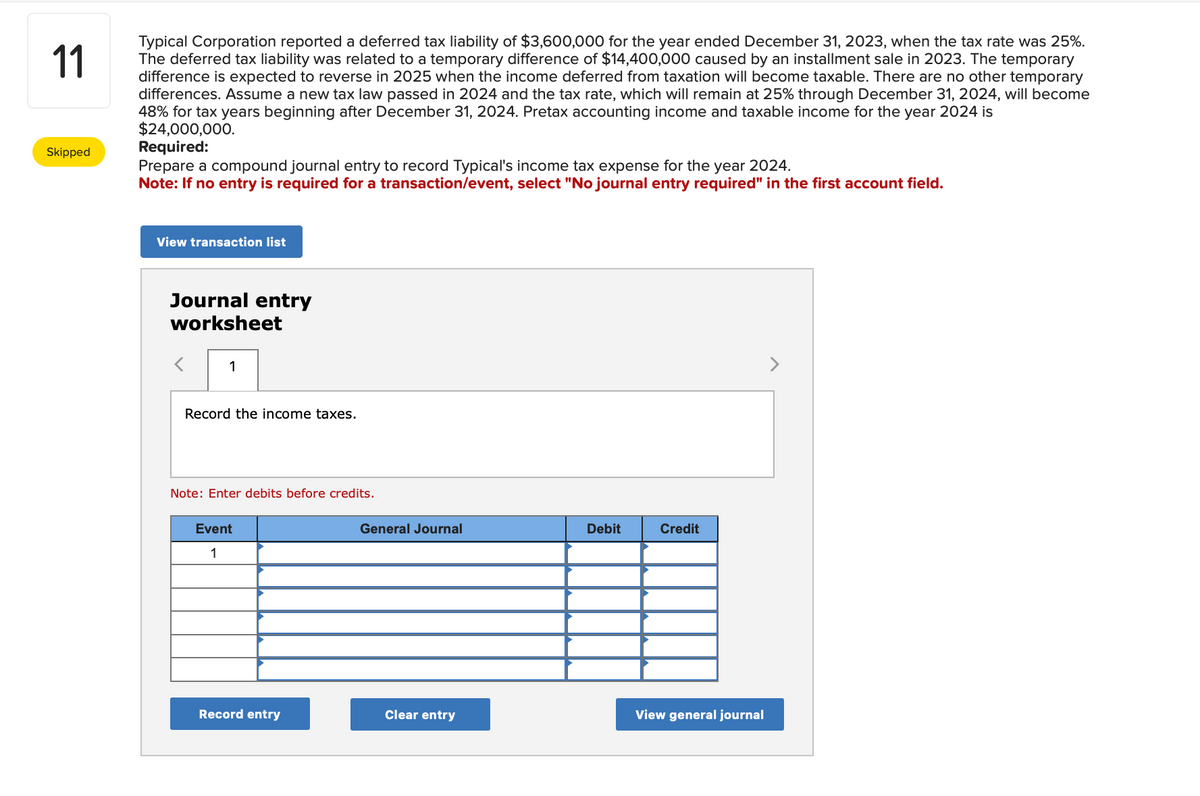

Typical Corporation reported a deferred tax liability of $3,600,000 for the year ended December 31, 2023, when the tax rate was 25%. The deferred tax liability was related to a temporary difference of $14,400,000 caused by an installment sale in 2023. The temporary difference is expected to reverse in 2025 when the income deferred from taxation will become taxable. There are no other temporary differences. Assume a new tax law passed in 2024 and the tax rate, which will remain at 25% through December 31, 2024, will become 48% for tax years beginning after December 31, 2024. Pretax accounting income and taxable income for the year 2024 is $24,000,000. Required: Prepare a compound journal entry to record Typical's income tax expense for the year 2024. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.

Typical Corporation reported a deferred tax liability of $3,600,000 for the year ended December 31, 2023, when the tax rate was 25%. The deferred tax liability was related to a temporary difference of $14,400,000 caused by an installment sale in 2023. The temporary difference is expected to reverse in 2025 when the income deferred from taxation will become taxable. There are no other temporary differences. Assume a new tax law passed in 2024 and the tax rate, which will remain at 25% through December 31, 2024, will become 48% for tax years beginning after December 31, 2024. Pretax accounting income and taxable income for the year 2024 is $24,000,000. Required: Prepare a compound journal entry to record Typical's income tax expense for the year 2024. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter18: Accounting For Income Taxes

Section: Chapter Questions

Problem 13P

Related questions

Question

Transcribed Image Text:11

Typical Corporation reported a deferred tax liability of $3,600,000 for the year ended December 31, 2023, when the tax rate was 25%.

The deferred tax liability was related to a temporary difference of $14,400,000 caused by an installment sale in 2023. The temporary

difference is expected to reverse in 2025 when the income deferred from taxation will become taxable. There are no other temporary

differences. Assume a new tax law passed in 2024 and the tax rate, which will remain at 25% through December 31, 2024, will become

48% for tax years beginning after December 31, 2024. Pretax accounting income and taxable income for the year 2024 is

$24,000,000.

Skipped

Required:

Prepare a compound journal entry to record Typical's income tax expense for the year 2024.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.

View transaction list

Journal entry

worksheet

1

Record the income taxes.

Note: Enter debits before credits.

Event

1

Record entry

General Journal

Clear entry

Debit

Credit

View general journal

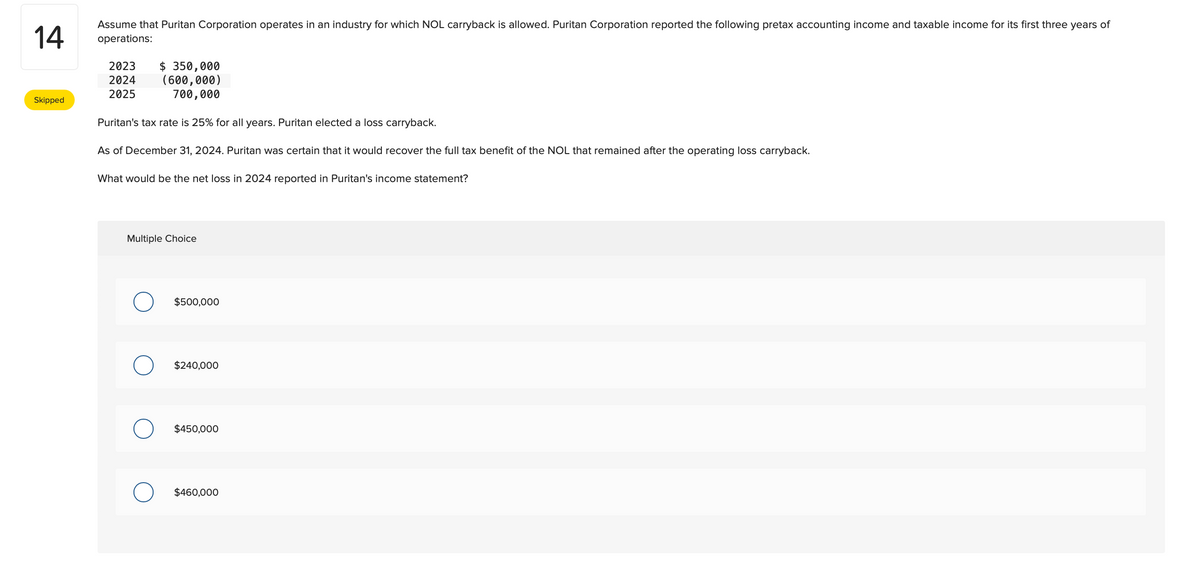

Transcribed Image Text:14

Skipped

Assume that Puritan Corporation operates in an industry for which NOL carryback is allowed. Puritan Corporation reported the following pretax accounting income and taxable income for its first three years of

operations:

$ 350,000

(600,000)

700,000

Puritan's tax rate is 25% for all years. Puritan elected a loss carryback.

As of December 31, 2024. Puritan was certain that it would recover the full tax benefit of the NOL that remained after the operating loss carryback.

What would be the net loss in 2024 reported in Puritan's income statement?

2023

2024

2025

Multiple Choice

O

O

$500,000

$240,000

$450,000

$460,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning