udent question Time to preview question: 00:09:37 Hauswirth Corporation sold (or exchanged) a warehouse in year 0. Hauswirth bought the warehouse several years ago for $102,000, and it has claimed $33,800 of depreciation expense against the building. Note: Loss amounts should be indicated by a minus sign. Leave no answer blank. Enter zero if applicable. Round your final answers to the nearest whole dollar amount. Required: Assuming that Hauswirth receives $80,500 in cash for the warehouse, compute the amount and character of Hauswirth's recognized gain or loss on the sale. Assuming that Hauswirth exchanges the warehouse in a like-kind exchange for some land with a fair market value of $80,500, compute Hauswirth's realized gain or loss, recognized gain or loss, deferred gain or loss, and basis in the new land. Assuming that Hauswirth receives $27,500 in cash in year 0 and a $88,500 note receivable that is payable in year 1, compute the amount and character of Hauswirth's gain or loss in year 0 and in year 1.

tudent question

Hauswirth Corporation sold (or exchanged) a warehouse in year 0. Hauswirth bought the warehouse several years ago for $102,000, and it has claimed $33,800 of

Note: Loss amounts should be indicated by a minus sign. Leave no answer blank. Enter zero if applicable. Round your final answers to the nearest whole dollar amount.

Required:

Assuming that Hauswirth receives $80,500 in cash for the warehouse, compute the amount and character of Hauswirth's recognized gain or loss on the sale.

Assuming that Hauswirth exchanges the warehouse in a like-kind exchange for some land with a fair market value of $80,500, compute Hauswirth's realized gain or loss, recognized gain or loss, deferred gain or loss, and basis in the new land.

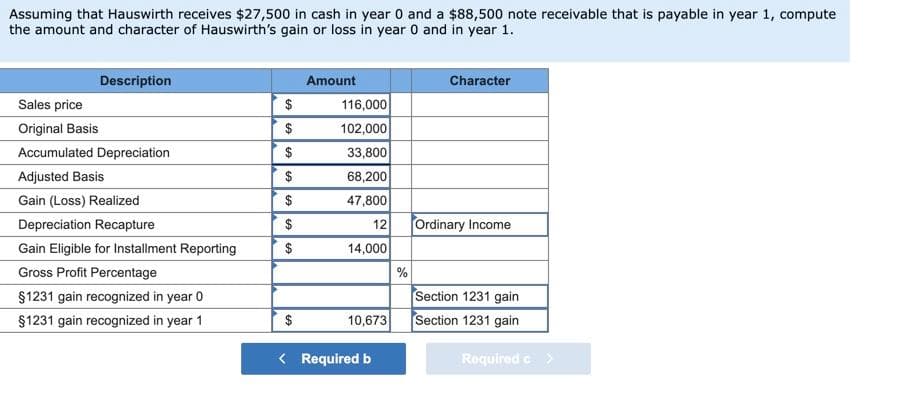

Assuming that Hauswirth receives $27,500 in cash in year 0 and a $88,500 note receivable that is payable in year 1, compute the amount and character of Hauswirth's gain or loss in year 0 and in year 1.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps