uep=29592031 ou are a loan officer at the West Elm Savings and Loan. Mr. and Mrs. Brady are in your office to apply for a mortgage loan on a house they want to buy. The house has a market value of $160,000. Your bank quires of the market value as a down payment. 5 a) What is the amount (in $) of the down payment? $ b) What is the amount (in $) of the mortgage for which the Bradys are applying? $ c) Your bank offers the Bradys a 30 year mortgage with a rate of 5%. At that rate, the monthly payments for principal and interest on the loan will be $5.37 for every $1,000 financed. What is the amount (in $) of the principal and interest portion of the Bradys' monthly payment? $ d) What is the total amount (in $) of interest that will be paid over the life of the loan? $ e) Your bank also requires that the monthly mortgage payments include property tax and homeowners insurance payments. If the property tax is $1,710 per year and the property insurance is $1,458 per year, what is the total monthly payment (in $) for PITI (principal, interest, taxes, and insurance)? $ [f) To qualify for the loan, bank rules state that mortgage payments cannot exceed. of the combined monthly income of the family. If the Bradys earn $3,750 per month, will they qualify for this loan? O Yes, they will qualify. O No, they will not qualify. g) What monthly income (in $) would be required to qualify for this size mortgage payment? $

uep=29592031 ou are a loan officer at the West Elm Savings and Loan. Mr. and Mrs. Brady are in your office to apply for a mortgage loan on a house they want to buy. The house has a market value of $160,000. Your bank quires of the market value as a down payment. 5 a) What is the amount (in $) of the down payment? $ b) What is the amount (in $) of the mortgage for which the Bradys are applying? $ c) Your bank offers the Bradys a 30 year mortgage with a rate of 5%. At that rate, the monthly payments for principal and interest on the loan will be $5.37 for every $1,000 financed. What is the amount (in $) of the principal and interest portion of the Bradys' monthly payment? $ d) What is the total amount (in $) of interest that will be paid over the life of the loan? $ e) Your bank also requires that the monthly mortgage payments include property tax and homeowners insurance payments. If the property tax is $1,710 per year and the property insurance is $1,458 per year, what is the total monthly payment (in $) for PITI (principal, interest, taxes, and insurance)? $ [f) To qualify for the loan, bank rules state that mortgage payments cannot exceed. of the combined monthly income of the family. If the Bradys earn $3,750 per month, will they qualify for this loan? O Yes, they will qualify. O No, they will not qualify. g) What monthly income (in $) would be required to qualify for this size mortgage payment? $

Algebra and Trigonometry (MindTap Course List)

4th Edition

ISBN:9781305071742

Author:James Stewart, Lothar Redlin, Saleem Watson

Publisher:James Stewart, Lothar Redlin, Saleem Watson

Chapter13: Sequences And Series

Section13.4: Mathematics Of Finance

Problem 16E

Related questions

Question

100%

Transcribed Image Text:=29392031

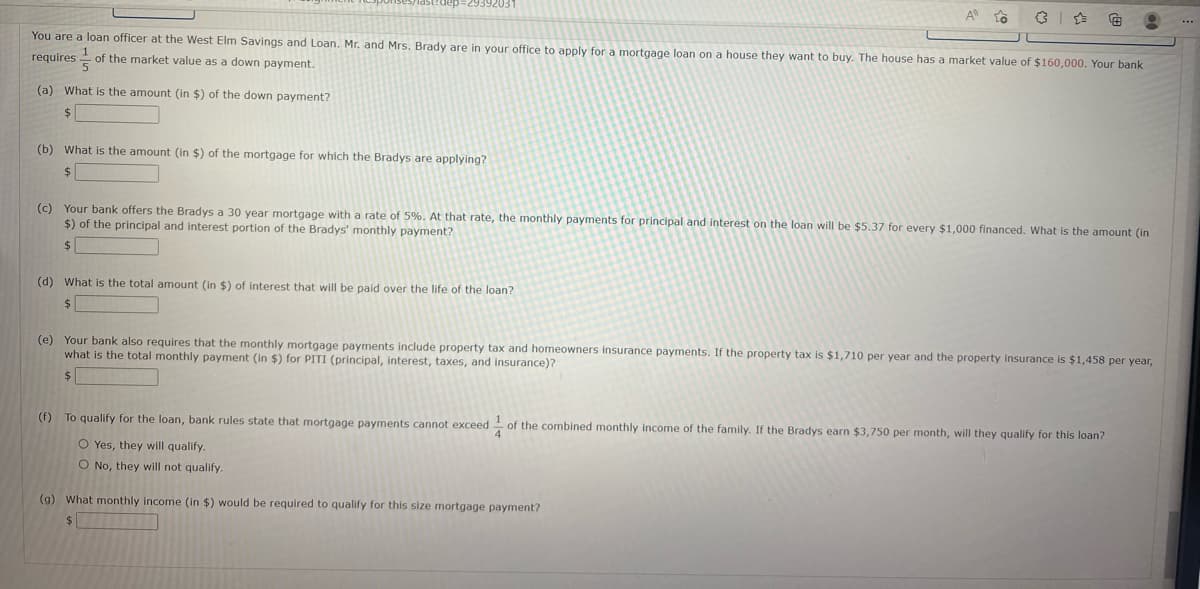

(a) What is the amount (in $) of the down payment?

$

(b) What is the amount (in $) of the mortgage for which the Bradys are applying?

$

You are a loan officer at the West Elm Savings and Loan. Mr. and Mrs. Brady are in your office to apply for a mortgage loan on a house they want to buy. The house has a market value of $160,000. Your bank

requires ¹

of the market value as a down payment.

A to

(d) What is the total amount (in $) of interest that will be paid over the life of the loan?

$

G

(c) Your bank offers the Bradys a 30 year mortgage with a rate of 5%. At that rate, the monthly payments for principal and interest on the loan will be $5.37 for every $1,000 financed. What is the amount (in

$) of the principal and interest portion of the Bradys' monthly payment?

$

#

(g) What monthly income (in $) would be required to qualify for this size mortgage payment?

$

(e) Your bank also requires that the monthly mortgage payments include property tax and homeowners insurance payments. If the property tax is $1,710 per year and the property insurance is $1,458 per year,

what is the total monthly payment (in $) for PITI (principal, interest, taxes, and insurance)?

$

(f) To qualify for the loan, bank rules state that mortgage payments cannot exceed ¹ of the combined monthly income of the family. If the Bradys earn $3,750 per month, will they qualify for this loan?

O Yes, they will qualify.

O No, they will not qualify.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 5 images

Recommended textbooks for you

Algebra and Trigonometry (MindTap Course List)

Algebra

ISBN:

9781305071742

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning

College Algebra

Algebra

ISBN:

9781305115545

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning

Algebra and Trigonometry (MindTap Course List)

Algebra

ISBN:

9781305071742

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning

College Algebra

Algebra

ISBN:

9781305115545

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning