UH Jahuary 1, 2020 High Ltd. Purchased 70% of the shares of Low Ltd for $2,100,000 and on the same day, Low Ltd. purchased 65% of the shares of Middle Ltd for $1,950,000. Any fair value increment/de crement was fully allocated to land. At January 1, 2020 High Ltd. 5,000,000 Low Ltd. Middle Ltd. $ 500,000 1,750,000 $ 2,250,000 Shares $ 4,200.000 3,500 000 $ 7,700,000 Retained Eamings 10,000 000 $ 15,000,000 Net Income (cost basis) Dividends paid $4 2,500,000 350,000 $ 1,000,000 200,000 $4 800,000 100,000 There were no intercompany transactions. Instructions Enter all numbers without dollar signs. Round numbers to the nearest whole dollar do not enter any de cimals in your number. Use commas properly If the amount is zero, enter 0, do not leave any answers blank. For example, a properly formatted number is 125,250 Numbers incorrectly formatted wi th not result in any marks. Based on the consolidated statement of High Ltd at December 31.2020 under the entity method determine the following The non-controlling interest in Middle Ltd.

UH Jahuary 1, 2020 High Ltd. Purchased 70% of the shares of Low Ltd for $2,100,000 and on the same day, Low Ltd. purchased 65% of the shares of Middle Ltd for $1,950,000. Any fair value increment/de crement was fully allocated to land. At January 1, 2020 High Ltd. 5,000,000 Low Ltd. Middle Ltd. $ 500,000 1,750,000 $ 2,250,000 Shares $ 4,200.000 3,500 000 $ 7,700,000 Retained Eamings 10,000 000 $ 15,000,000 Net Income (cost basis) Dividends paid $4 2,500,000 350,000 $ 1,000,000 200,000 $4 800,000 100,000 There were no intercompany transactions. Instructions Enter all numbers without dollar signs. Round numbers to the nearest whole dollar do not enter any de cimals in your number. Use commas properly If the amount is zero, enter 0, do not leave any answers blank. For example, a properly formatted number is 125,250 Numbers incorrectly formatted wi th not result in any marks. Based on the consolidated statement of High Ltd at December 31.2020 under the entity method determine the following The non-controlling interest in Middle Ltd.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA2: Investments

Section: Chapter Questions

Problem 23E

Related questions

Question

100%

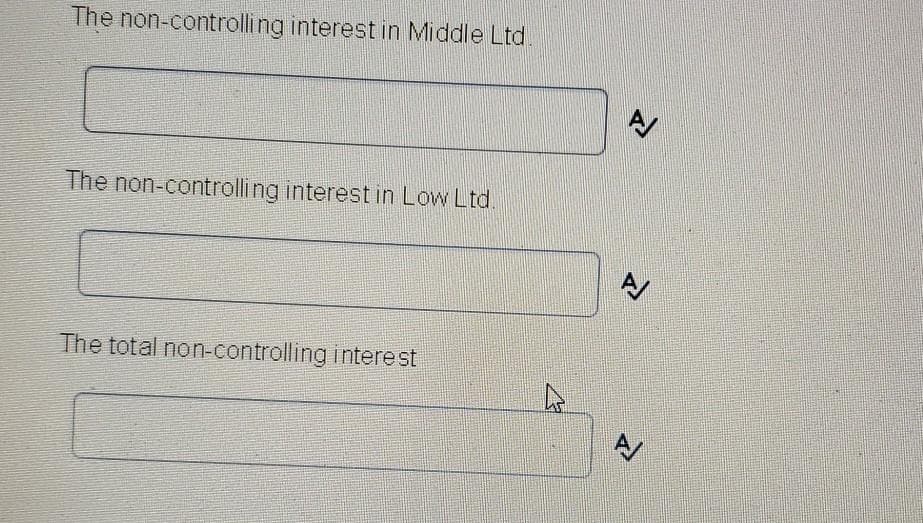

Transcribed Image Text:The non-controlling interest in Middle Ltd.

A

The non-controlling interest in Low Ltd

The total non-controlling interest

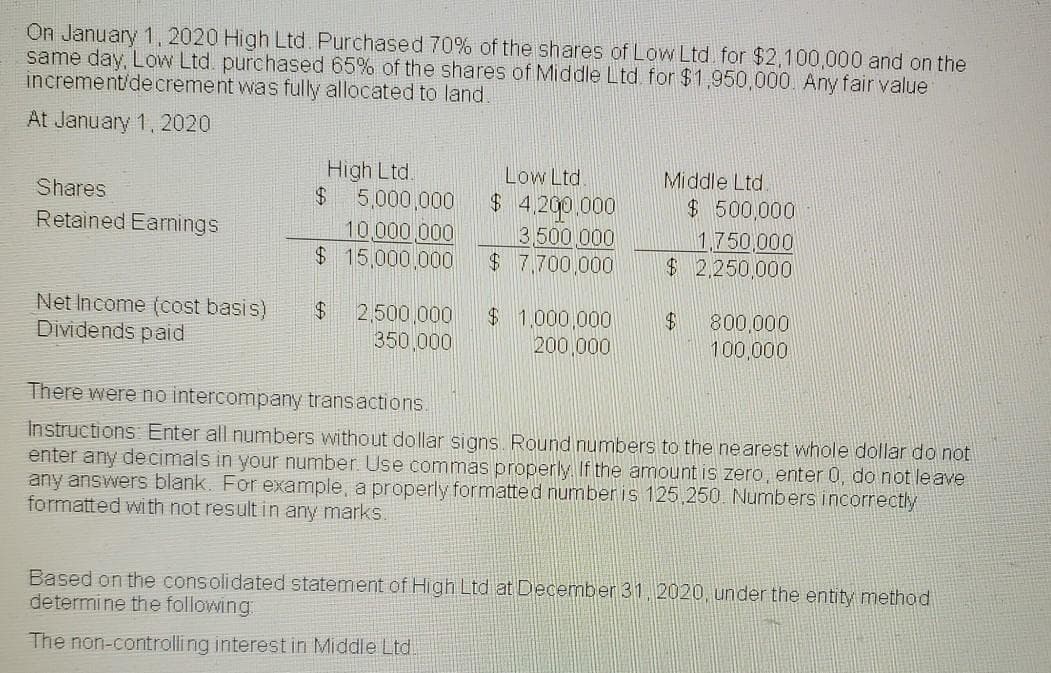

Transcribed Image Text:On January 1,2020 High Ltd. Purchased 70% of the shares of Low Ltd for $2,100,000 and on the

same day, Low Ltd. purchased 65% of the shares of Middle Ltd for $1,950,000. Any fair value

increment/decrement was fully allocated to land.

At January 1, 2020

High Ltd.

24

Low Ltd.

Middle Ltd.

$ 4,200.000

3,500 000

$ 7,700,000

Shares

$ 500,000

5,000,000

10,000 000

$15,000,000

Retained Eamings

1,750,000

$ 2,250,000

Net Income (cost basis)

Dividends paid

2,500,000

350,000

$ 1,000,000

200,000

800,000

100,000

There were no intercompany transactions.

Instructions Enter all numbers without dollar signs. Round numbers to the nearest whole dollar do not

enter any decimals in your number. Use commas properly If the amount is zero, enter 0, do not leave

any answers blank. For example, a properly formatted number is 125.250 Numbers incorrectly

formatted wi th not result in any marks.

Based on the consolidated statement of High Ltd at December 31,2020, under the entity method

determine the following:

The non-controlli ng interest in Middle Ltd!

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning