ump-Sum Liquidation hree university students, Cho, Kenney, and Martinez, operated a successful business, re raduating and wish to sell the business before beginning their respective careers. They Cash Receivables Loan receivable-Cho Rental equipment, net $6,000 Accounts payable 25,000 Loan payable-Kenney 15,000 | Capital-Cho 140,000 $60,000 10,000 27,000 Capital-Kenney 28,000 Capital-Martinez 61,000 Total assets $186,000 Total liabilities and capital $186,000 mother student group, organized as a corporation, wants to buy the business. Their offe aid and the partnership is liquidated. nquired

ump-Sum Liquidation hree university students, Cho, Kenney, and Martinez, operated a successful business, re raduating and wish to sell the business before beginning their respective careers. They Cash Receivables Loan receivable-Cho Rental equipment, net $6,000 Accounts payable 25,000 Loan payable-Kenney 15,000 | Capital-Cho 140,000 $60,000 10,000 27,000 Capital-Kenney 28,000 Capital-Martinez 61,000 Total assets $186,000 Total liabilities and capital $186,000 mother student group, organized as a corporation, wants to buy the business. Their offe aid and the partnership is liquidated. nquired

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter8: Property Transactions: Capital Gains And Losses, Section 1231 And Recapture Provisions

Section: Chapter Questions

Problem 18P

Related questions

Question

Transcribed Image Text:Lump-Sum Liquidation

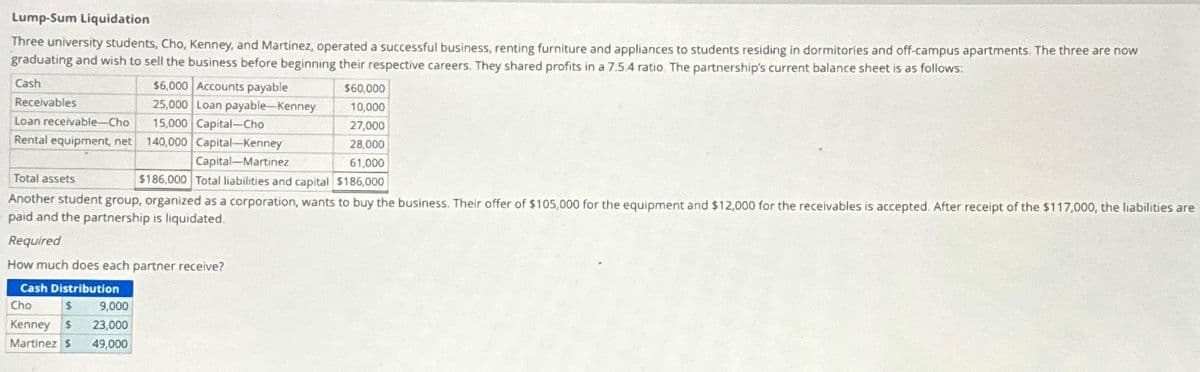

Three university students, Cho, Kenney, and Martinez, operated a successful business, renting furniture and appliances to students residing in dormitories and off-campus apartments. The three are now

graduating and wish to sell the business before beginning their respective careers. They shared profits in a 7.5.4 ratio The partnership's current balance sheet is as follows:

Cash

$6,000 Accounts payable

$60,000

10,000

25,000 Loan payable-Kenney

15,000 Capital—Cho

27,000

28,000

140,000 Capital-Kenney

Capital-Martinez

61,000

Total assets

$186,000 Total liabilities and capital $186,000

Another student group, organized as a corporation, wants to buy the business. Their offer of $105,000 for the equipment and $12,000 for the receivables is accepted. After receipt of the $117,000, the liabilities are

paid and the partnership is liquidated.

Required

How much does each partner receive?

Cash Distribution

Cho

$

9,000

Kenney $ 23,000

Martinez $ 49,000

Receivables

Loan receivable-Cho

Rental equipment, net

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning