URRENT RATIO 2.8 2.5 2.0 CID TEST RATIO 0.7 0.9 1.2 CCOUNTS RECEIVABLE TURNOVER 8.6 9.5 10.4 VVENTORY TURNOVER 5.0 5.7 6.8 130.0 2.50 $ 5%| 40% 118.0 2.50 $ ALES TREND 100.0 DIVIDENDS PAID PER SHARE 2.50 IVIDENDS YIELD RATIO 4% 3% IVIDEND PAYOUT RATIO 50% 60% ETURN ON TOTAL ASSETS ETURN ON COMMON STOCKHOLDERS' EQUITY 13.0% 11.8% 10.4% 16.2% 14.5% 9.0% %24

URRENT RATIO 2.8 2.5 2.0 CID TEST RATIO 0.7 0.9 1.2 CCOUNTS RECEIVABLE TURNOVER 8.6 9.5 10.4 VVENTORY TURNOVER 5.0 5.7 6.8 130.0 2.50 $ 5%| 40% 118.0 2.50 $ ALES TREND 100.0 DIVIDENDS PAID PER SHARE 2.50 IVIDENDS YIELD RATIO 4% 3% IVIDEND PAYOUT RATIO 50% 60% ETURN ON TOTAL ASSETS ETURN ON COMMON STOCKHOLDERS' EQUITY 13.0% 11.8% 10.4% 16.2% 14.5% 9.0% %24

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 3MC: Prince Corporations accounts provided the following information at December 31, 2019: What should be...

Related questions

Question

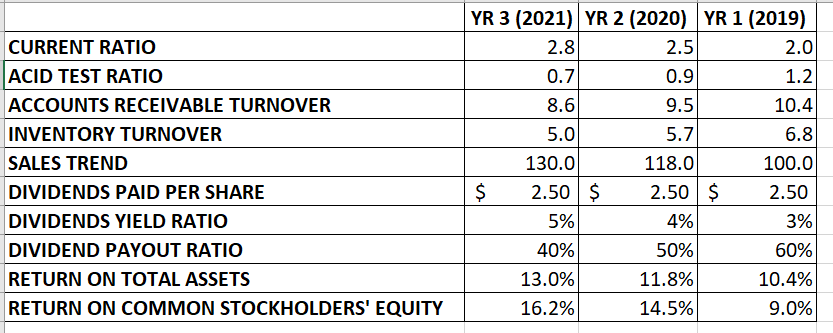

Based on the balance sheet, Is the market price of the company’s stock going up or down? iS IT WORTH TO INVEST IN? EXPLAIN

Transcribed Image Text:YR 3 (2021) YR 2 (2020) YR 1 (2019)

CURRENT RATIO

2.8

2.5

2.0

ACID TEST RATIO

0.7

0.9

1.2

ACCOUNTS RECEIVABLE TURNOVER

8.6

9.5

10.4

INVENTORY TURNOVER

5.0

5.7

6.8

SALES TREND

130.0

118.0

100.0

2.50 $

2.50 $

4%

DIVIDENDS PAID PER SHARE

$

2.50

DIVIDENDS YIELD RATIO

5%

3%

DIVIDEND PAYOUT RATIO

40%

50%

60%

RETURN ON TOTAL ASSETS

13.0%

11.8%

10.4%

RETURN ON COMMON STOCKHOLDERS' EQUITY

16.2%

14.5%

9.0%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning