us at the +x 5 ble at the The functions in Exercises 21-26 are defined for all x except for one value of x. If possible, define f(x) at the exceptional point in a way that makes f(x) continuous for all .x. x²7x+10 21. f(x) = x-5 x²+x-12 x+4 x3 - 5x2 +4 x² x² +25 X-5+X5 (6 + x)² - 36 X √9+x-√9 26. f(x) = x 0 X 27. Computing Income Tax The tax that you pay to the federal government is a percentage of your taxable income, which is what remains of your gross income after you subtract your 22. f(x) = 23. f(x) = 24. f(x) = x5 25. f(x)= x = -4 **0 **0

us at the +x 5 ble at the The functions in Exercises 21-26 are defined for all x except for one value of x. If possible, define f(x) at the exceptional point in a way that makes f(x) continuous for all .x. x²7x+10 21. f(x) = x-5 x²+x-12 x+4 x3 - 5x2 +4 x² x² +25 X-5+X5 (6 + x)² - 36 X √9+x-√9 26. f(x) = x 0 X 27. Computing Income Tax The tax that you pay to the federal government is a percentage of your taxable income, which is what remains of your gross income after you subtract your 22. f(x) = 23. f(x) = 24. f(x) = x5 25. f(x)= x = -4 **0 **0

Algebra & Trigonometry with Analytic Geometry

13th Edition

ISBN:9781133382119

Author:Swokowski

Publisher:Swokowski

Chapter3: Functions And Graphs

Section3.4: Definition Of Function

Problem 16E

Related questions

Question

21,23 and 29 please

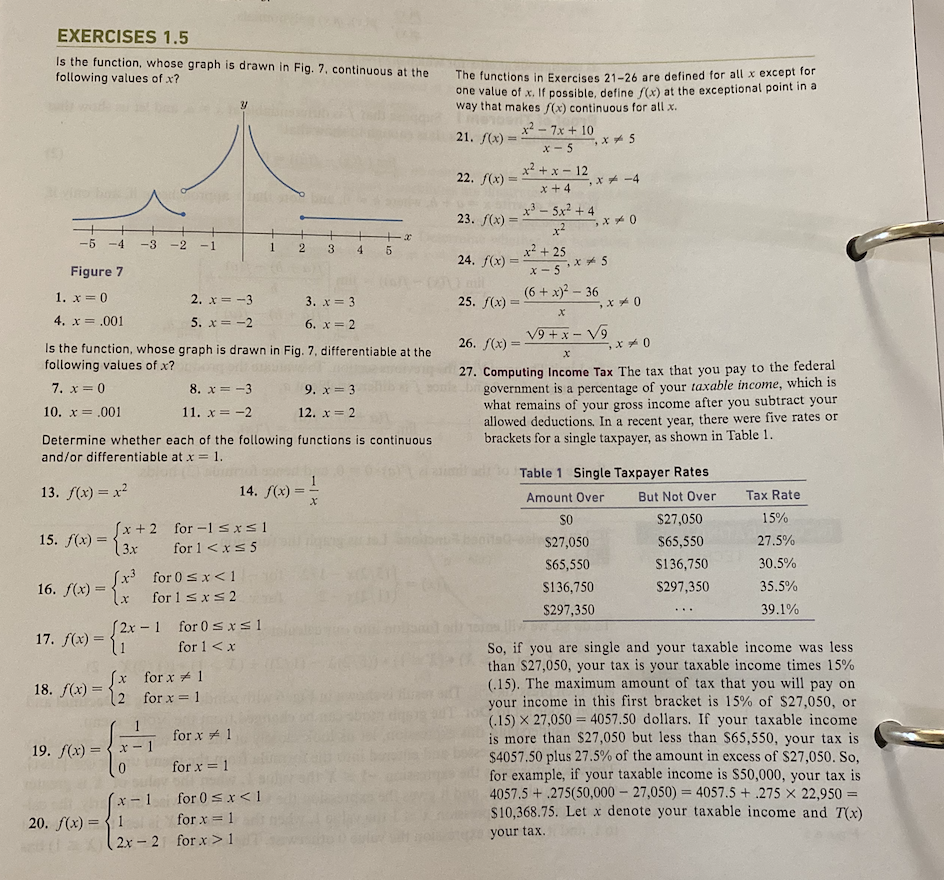

Transcribed Image Text:EXERCISES 1.5

Is the function, whose graph is drawn in Fig. 7, continuous at the

following values of x?

-5 -4 -3 -2

Figure 7

1. x = 0

4. x = .001

15. f(x) =

16. f(x) =

[x³

18. f(x) =

^

Is the function, whose graph is drawn in Fig. 7, differentiable at the

following values of x?

7. x = 0

10. x = .001

17. f(x) = {1

ƒ(x) = { 2

(x+2 for-1 ≤x≤1

(3x

for 1 < x≤ 5

Determine whether each of the following functions is continuous

and/or differentiable at x = 1.

13. f(x) = x²

19. f(x)=x

2. x=-3

5. x = -2

[2x-1 for 0≤x≤1

for 1 < x

20. f(x) = 1

8. x = -3

11. x = -2

for 0≤x<1

for 1 ≤ x ≤ 2

x-1

for x 1

for x = 1

(2x-2

1

2

14. f(x)=

=

for x

1

for x = 1

for 0 ≤ x < 1

for x = 1

for x>1

3 4

3. x = 3

6. x = 2

9. x = 3

12. x = 2

+x

5

X

The functions in Exercises 21-26 are defined for all x except for

one value of x. If possible, define f(x) at the exceptional point in a

way that makes f(x) continuous for all x.

21. f(x)=

=

22. f(x)=

23. f(x)

24. f(x)=

-

25. f(x) =

x²7x+10

x-5

x5

x²+x-12

x +4

x3 - 5x2 +4

x²

x² +25

X-5x5

-,x-4

(6 + x)² - 36

x0

x0

X

26. f(x) =

√9+x-√9

x0

X

27. Computing Income Tax The tax that you pay to the federal

government is a percentage of your taxable income, which is

what remains of your gross income after you subtract your

allowed deductions. In a recent year, there were five rates or

brackets for a single taxpayer, as shown in Table 1.

Table 1 Single Taxpayer Rates

But Not Over

Amount Over

SO

$27,050

$27,050

$65,550

$65,550

$136,750

$136,750

$297,350

$297,350

Tax Rate

15%

27.5%

30.5%

35.5%

39.1%

So, if you are single and your taxable income was less

than $27,050, your tax is your taxable income times 15%

(.15). The maximum amount of tax that you will pay on

your income in this first bracket is 15% of $27,050, or

(15) X 27,050 4057.50 dollars. If your taxable income

is more than $27,050 but less than $65,550, your tax is

$4057.50 plus 27.5% of the amount in excess of $27,050. So,

for example, if your taxable income is $50,000, your tax is

4057.5+275(50,000 -27,050) = 4057.5+275 x 22,950 =

$10,368.75. Let x denote your taxable income and 7(x)

your tax.

Transcribed Image Text:(a) Find a formula for 7(x) if x is not over $136,750.

(b) Plot the graph of 7(x) for 0≤x≤ 136,750.

(c) Find the maximum amount of tax that you will pay on

the portion of your income in the second tax bracket..

Express this amount as a difference between two values

of 7(x).

28. Refer to Exercise 27.

(a) Find a formula for 7(x) for all taxable income x.

(b) Plot 7(x).

(c) Determine the maximum amount of tax that you will pay

on the portion of your income in the fourth tax bracket.

29. Revenue from Sales The owner of a photocopy store charges

7 cents per copy for the first 100 copies and 4 cents per copy

for each copy exceeding 100. In addition, there is a setup fee

of $2.50 for each photocopying job.

(a) Determine R(x), the revenue from selling x copies.

(b) If it costs the store owner 3 cents per copy, what is the

profit from selling x copies? (Recall that profit is revenue

minus cost.)

30. Do Exercise 29 if it costs 10 cents per copy for the first 50

copies and 5 cents per copy for each copy exceeding 50, and

there is no setup fee.

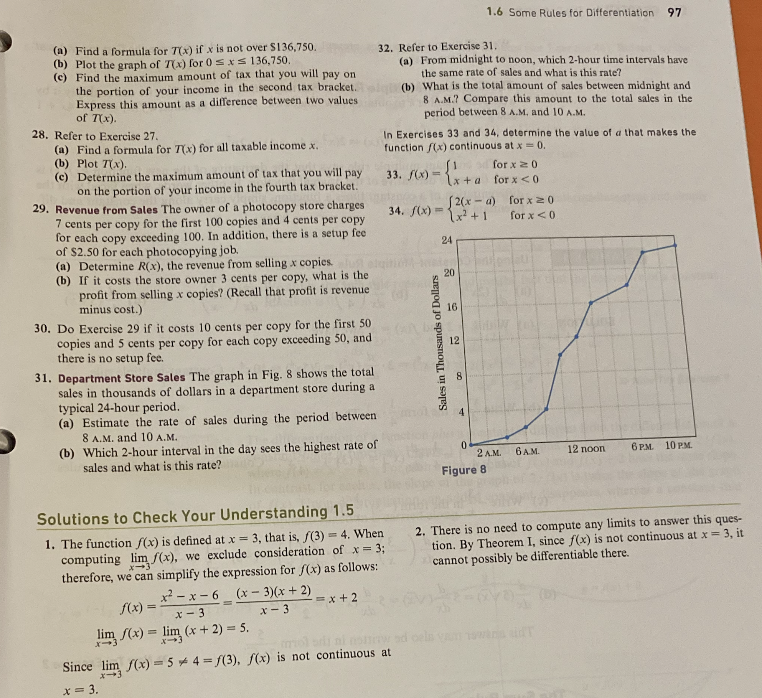

31. Department Store Sales The graph in Fig. 8 shows the total

sales in thousands of dollars in a department store during a

typical 24-hour period.

(a) Estimate the rate of sales during the period between

8 A.M. and 10 A.

(b) Which 2-hour interval in the day sees the highest rate of

sales and what is this rate?

Solutions to Check Your Understanding 1.5

1. The function f(x) is defined at x = 3, that is, f(3) = 4. When

computing lim f(x), we exclude consideration of x = 3;

therefore, we can simplify the expression for f(x) as follows:

x-3

(x-3)(x + 2)

x-3

x²-x-6

f(x)

x-3

lim /(x) = lim (x + 2) = 5.

=

32. Refer to Exercise 31.

(a) From midnight to noon, which 2-hour time intervals have

the same rate of sales and what is this rate?

=x+2

(b) What is the total amount of sales between midnight and

8 A.M.? Compare this amount to the total sales in the

period between 8 A.M. and 10 A.M.

In Exercises 33 and 34, determine the value of a that makes the

function f(x) continuous at x = 0.

[1 for x ≥ 0

33. f(x)=x+a for x < 0

Since lim f(x) = 5*4=f(3), f(x) is not continuous at

x-

x = 3.

[2(x-a)

34. f(x)=x²+1

Sales in Thousands of Dollars

24

20

16

1.6 Some Rules for Differentiation 97

12

8

4

0

2 A.M.

Figure 8

for x 20

for x < 0

6 A.M.

12 noon

6 PM. 10 PM.

2. There is no need to compute any limits to answer this ques-

tion. By Theorem I, since f(x) is not continuous at x = 3, it

cannot possibly be differentiable there.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Algebra & Trigonometry with Analytic Geometry

Algebra

ISBN:

9781133382119

Author:

Swokowski

Publisher:

Cengage

College Algebra

Algebra

ISBN:

9781305115545

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning

Algebra & Trigonometry with Analytic Geometry

Algebra

ISBN:

9781133382119

Author:

Swokowski

Publisher:

Cengage

College Algebra

Algebra

ISBN:

9781305115545

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning